Good morning. Happy Friday.

A couple of the Asian/Pacific markets were closed today. Of the ones that opened for trading, most closed down. India and Indonesia each dropped 1.9%. Europe is currently mixed. Only Greece and the Czech Republic (down 2% and 1.5%) have moved much from their unchanged levels. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

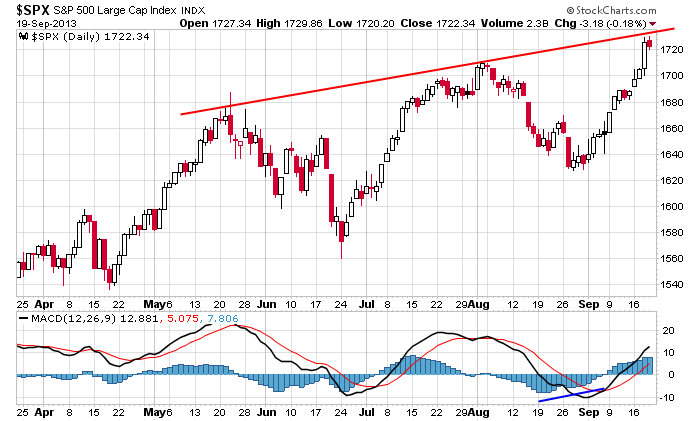

So far it’s been a great week…3 of 4 up days, and thanks to the huge post-FOMC move, the indexes are posting solid gains. You could argue things are getting a little stretched, but what’s that mean? We know overbought can remain overbought for long periods of time. And besides, the S&P would have to go another 50 points just to match the April/May rally and June/July rally.

Today is quad witching…irrelevant unless you have options that expire today.

Then the market has to deal with reshuffling of the Dow. NKE, V and GS are being added. GS and V are very expensive, so they’ll be very influential. But both are sitting at new highs. In order for the Dow to continue up, more new highs will have to be made.

Then we get a break from news until earnings season starts the second week of October and debt ceiling talks ramp up.

My gut says we’ll get some weakness soon…mostly because the wall of worry is gone, and almost everything I’m looking at says up. The S&P has moved up 13 of 16 days. Traders are getting lazy. The bears have blown up again. When all signs read “full speed ahead” we’ll hit a few speed bumps just to keep everyone honest. Perhaps a little pause to digest this week’s gains are in order.

Stock headlines from barchart.com…

Darden Restaurants (DRI -1.02%) reported Q1 EPS of 53 cents, well below consensus of 70 cents.

Facebook (FB +1.66%) was upgraded to “Outperform” from “Market Perform” at Cowen.

MetLife (MET -3.19%) was upgraded to “Conviction Buy” from “Buy” at Goldman.

Pier 1 Imports (PIR -13.86%) was upgraded to “Outperform” from “Neutral” at Credit Suisse.

Ameren (AEE -0.20%) was upgraded to “Overweight” from “Equal Weight” at Barclays.

Volvo (VOLVY +0.75%) was upgraded to “Buy” from “Hold” at Societe Generale.

Gabelli reported a 5.13% stake in Flushing Financial (FFIC -0.92%) .

American Capital Mortgage (MTGE -1.81%) cuts its dividend to 70 cents from 80 cents per share.

Cintas (CTAS -0.27%) reported Q1 EPS of 63 cents, right on consensus, although Q1 revenue of $1.12 billion was slightly better than consensus of $1.1 billion.

TIBCO (TIBX +2.64%) reported Q3 adjusted EPS of 28 cents, better than consensus of 22 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

12:30 PM Fed’s George: “The Federal Reserve and the Economy”

12:55 PM Fed’s Bullard: U.S. Economy and Monetary Policy

Notable earnings before today’s open: DRI

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 20)”

Leave a Reply

You must be logged in to post a comment.

Uncertainty reigns. Congress and the President are having a tiff but the markets could die, and just to unnerve you a little the Philly Fed president said the taper could start on Oct meeting, but is depends….probably on employment rates…then again ….

Be cautious, but it appears that a run to 1780 in SP is possible, and maybe gold up to 1430 or higher. What does it mean? Janet Yellen, and consumer spending falling. Nothing to worry about until you are a trader or investor. The P in P/E is up, but E is going to decline.