Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. China, Hong Kong and Indonesia did the best. Europe is currently mostly down. Austria, Belgium, Norway, Switzerland, Spain and London are posting the biggest losses. Futures here in the States point towards a flat open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are down.

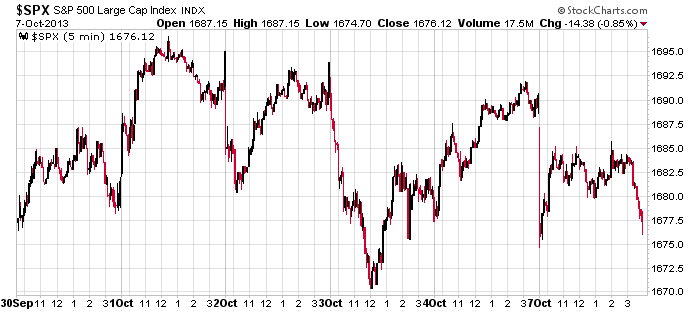

Here’s the S&P over the last six days. Lots of up and down. Lots of gap opens. Several sudden reversals. And in the end the net change is very little.

The government shutdown continues. The longer it lasts, the worse it will be in the near term. But as I’ve said a few times, lower prices in the near term will likely be a blessing in disguise. Trader and investors will have the opportunity to buy stocks at lower prices. The shutdown sucks for those who aren’t getting a paycheck right now, but for everyone else, it will, in my opinion, turn out to be a non-issue.

Even though we have some good long set ups on the Long List, risk is elevated. Unless the stock is a great performer (you often don’t know this until after the fact), you gotta be content with small gains. The chart above tells us we’re not getting much follow through. And when the shutdown ends, there’s no guarantee the market is going to take off. It’s entirely possible we get a knee-jerk pop which then gets sold into. Then after a couple weeks of selling, a bottom is put in place and we get a year-end rally that makes new highs. Be flexible. Be open minded. Be on your toes.

Stock headlines from barchart.com…

Crown Holdings (CCK -0.48%) was downgraded to “Market Perform” from “Outperform” at Wells Fargo.

Wells Fargo downgraded the Packaging industry to “Market Weight” from “Overweight” on expectations consumer demand will be muted over the next 6-12 months.

Piper Jaffray kept its “Overweight” rating on Starbucks (SBUX -0.70%) and raised its price limit on the stock to $85 from $75.

Wells Fargo (WFC -1.65%) was downgraded to “Neutral” from “Outperform” at Macquarie.

J.C. Penney (JCP -1.91%) was downgraded to “Neutral” from “Buy” at Sterne Agee.

Talisman Energy (TLM +4.59%) surged 11% in after-hours trading after billionare investor Carl Icahn reported a 5.97% stake in the company.

Avon Products (AVP -1.19%) and Procter & Gamble (PG -0.49%) were both upgraded to “Outperform” from “Market Perform” at Wells Fargo.

Whole Foods (WFM -0.67%) was initiated with a “Buy” at Jefferies with a price target of $70.

SolarWinds (SWI -2.21%) announced that it has acquired privately held Confio Software for $103 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:30 Trade Balance

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $32B, 3-Year Note Auction

Notable earnings before today’s open: WWW

Notable earnings after today’s close: AA, ADTN, YUM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 8)”

Leave a Reply

You must be logged in to post a comment.

Look at Nat Gas, Some techs in China, IWM QQQ and wait. Own some puts. Looks like we will have to recognize that we pay our bond coupon first and cut the rest out of planning spending. Perish the thought. Lovely in Mexico, but prices are rising. Why?

Ground hog day. Sorta.

We will start the day below the Long at 1678 unless there’s a pop in the futures before the bell. That Long fails if we pass thru 1665.

Lots of overhead resistance which showed its face starting at 10 am and thru 2 pm. The target of that resistance, if reached, kills the long. Target is 1665.

well done Mike

666 to 1666

1000 points in 4.6 years

how long to loose 1000 points

closed my shorts –considering longs

Tks, Aussie.

“They” meaning “the boyz” have another target a few points lower (about 1662) so they might pick that one off before going higher.

I expect a bounce after hitting that tgt. Maybe today, maybe they flounder around here at the lows or even go lower. Can’t tell til they’ve made a marker.

Am sure you’re ready to reload some bulls to sell higher.

instos really like taking out stops -dont they

but i had a good ride on down side and out at my piviots

nas 100 was a good one

dax exhausted down y/day

atm the markets look like false break lows for earnings few weeks,

but am in no hurry to go long

Agreed. Thought we had a chance to bounce about an hour ago, but the buyers left the building. Always good advice “never get too bullish or too bearish” so we’ll just see when they decide to reverse. Interesting move as I’m typing.

i declare the 2 week grand golden bull festival of earnings open

may we have lots of bull ,deception,uforeaha,lies,enthusiasum as the golden bull is fatterned up for sale

The market was due for a sell off.