Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. India rallied 2.3%, Hong Kong 1.1% and Australia, Indonesia, South Korea and Taiwan also did well. Europe is currently mostly up. France, Norway, Stockholm, Czech Republic and Greece are leading the way. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are down.

The S&P has added its name to the list of indexes hitting all-time highs. It didn’t take long. I felt all along the government shutdown would be a non-issue, and the market would eventually find a bottom and rally to new highs later this year. I didn’t think it would happen so fast. The market was supposed to fall further, and it was supposed to take longer to recapture the losses. We are just days past the midway point in October. The market has already accomplish the year-end goal. Dare I say the market is in idiot mode. Traders and investors can’t climb over each other fast enough to buy.

GOOG is up almost 10% pre market…earnings related…the stock is less than 30 bucks from $1000.

CMG is up almost 8%…also earnings related…new all-time high territory.

For what it’s worth, options expire today.

It’s not yet clear what the economic calendar will look like next week. No question the government has a lot of catching up to do, starting with the missed employment report being released on Tuesday, Oct 22.

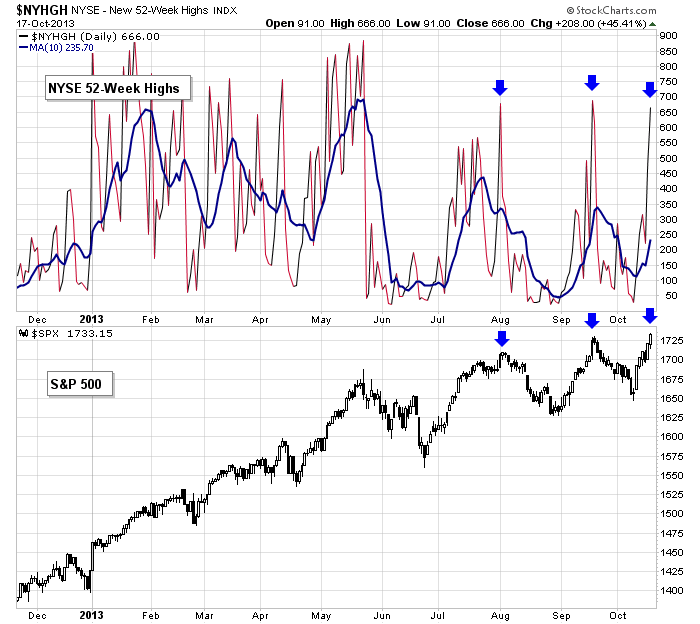

Among the indicators, there are a few warnings. I’ll discuss these in greater detail in my weekly report posted Sunday. Here’s one…the spike in new highs at the NYSE.

I’m only interesting in the long side…but don’t get carried away.

Stock headlines from barchart.com…

Schlumberger (SLB -0.81%) reported Q3 EPS of $1.29, better than consensus of $1.24.

IBM (IBM -6.37%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

General Electric (GE +1.31%) reported Q3 EPS of 36 cents, better than consensus of 35 cents.

Ingersoll-Rand PLC (IR +0.27%) reported Q3 EPS of $1.16, stronger than consensus of $1.10.

Morgan Stanley (MS +1.05%) reported Q3 EPS of 50 cents, better than consensus of 40 cents.

Parker Hannifin (PH +1.12%) reported Q1 EPS of $1.67, well ahead of consensus of $1.47, and then raised guidance on fiscal 2014 EPS to $7.78-$8.38 from $7.35-$8.15, better than consensus of $6.53.

Las Vegas Sands (LVS +2.07%) reported Q3 EPS of 82 cents, higher than consensus of 76 cents.

Intuitive Surgical (ISRG -0.55%) fell 8% in after-hours trading after it reported Q3 EPS of $3.99, well ahead of consensus of $3.40, but said Q3 revenue was $499 million, below consensus of $526 million.

Commercial Metals (CMC +2.69%) sold Howell Metal for $58.5 million to Mueller Industries (MLI +1.06%) .

Capital One (COF -0.14%) reported Q3 EPS of $1.86, better than consensus of $1.80.

Stryker (SYK +1.44%) reported Q2 adjusted EPS of 98 cents, lower than consensus of $1.00.

Chipotle (CMG +0.23%) climbed 8% in after0hours trading after it reported Q3 EPS of $2.66, weaker than consensus of $2.78, but reported Q3 revenue of $826.9 million, better than consensus of $820.28 million.

Google (GOOG -1.03%) rallied 8% in after-hours trading after it reported Q3 EPS of $10.74, well ahead of consensus of $10.34.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

No events scheduled.

Notable earnings before today’s open: BHI, FHN, FNFG, GE, GPC, HON, IPG, IR, KSU, LH, MS, PH, SLB, STI, TXT

Notable earnings after today’s close: CE

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 18)”

Leave a Reply

You must be logged in to post a comment.

Idiot mode for sure. But it’s OPEX, and that combined with being the day after GOOG earnings is always entertaining.

Anyone with a speck of market sense can see y’day’s straight up is not normal. There is a “feel” that we have to retrace. But as Jason has said, trade what you see not what you think you should see.

So with that, here are levels I see. First off, we went higher overnight in the futures, so if this holds until the bell, we start the open higher than yesterday’s close. Morgan Stanley and GE also posted earnings which added to the bullishness.

We could proceed higher from the start to 1740. And they could overshoot that up to 1743-5. Lots of irrational exuberance / panicked shorts.

We could proceed lower either before or after getting into the 1740s. If so, 1725-8 would be likely, and if that holds, projects to 1742-3 target. Breaking 1725-8, there are multiple levels of support below but which one “da boyz” decide to make a stand on, I can’t say. The lowest support, however is around 1700 and below that, bears will get bold again.

Hope this helps someone.

Interesting market, for sure. We have come almost 100 SPX points since the low on Oct 9. That’s a sizzler in anyone’s book.

The Equity run into December (That is the next stand off) has started. This is also the start of the invested season for seasonal investors, lasts to next May. This is a buy and hold winner. Oil looks like down soon, some puts around 90 or lower. The broad market looks OK up to 1767 or 1790 on S&P, the old highs then a correction of some sort. I suspect gold and silver will start a new drive to 1380, then correct, and do it again. Gold does this, but it is not an investment, just a trade. IBM is in trouble my short is doing well. more Numbers at 7AM PST. I think housing is in trouble again, and GDP will be weak into 2014 until after the debt ceiling hassel. Following China, short term bounce seems probable, PGJ has a good position. Thanks Jason for your list, We are clients and we do recommend your picks.

Any thoughts on the flash crash of WMT yesterday @ 3:pm- Perhaps it was $3:01-

Anything else get hit then?

Coincidentally, the low of the flash bottomed at the prior swing low- over 4 point drop and recovery in under 1 minute.-

Looks like an oops…perhaps a single trade that was entered incorrectly. No harm, no foul. I wouldn’t read anything into it.