Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China, Hong Kong and Taiwan moved up; Australia and Japan moved down. Europe is currently mostly up. Belgium, Italy, Greece, Spain and Czech Republic are leading the way. Futures here in the States point towards an up open for the cash market.

Be alerted of new content. Join our email list here.

The dollar is flat. Oil is down, copper flat. Gold and silver are down.

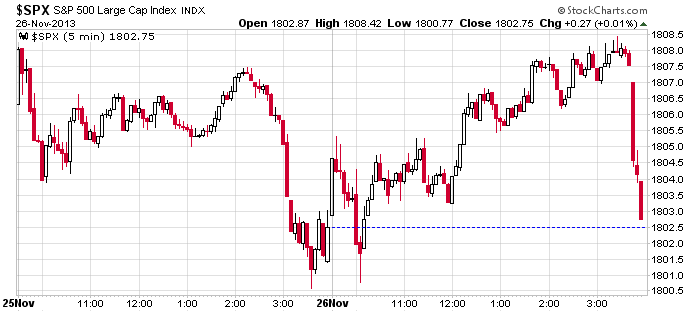

Here’s an intraday S&P 500 chart from the last two days. You can see the nearly-vertical drop coming after slow grinding up moves. Read what you want into it. Somebody wanted out badly each day, and instead of selling throughout the day, they dumped everything at once.

Today of course is the day before Thanksgiving. Not only is the market closed tomorrow, Friday is a half day. I’d be very surprised if anything noteworthy happened today. Many market participants won’t show up for work until next Monday, so volume and volatility are likely to be on the lighter side.

There’s no sense forcing things right now. Long term the market looks great. In the near term this are less clear. How you play things right now is entirely dependent on your style. If you’re short term, be careful chasing over-bought stocks higher. The risk/reward isn’t there for many set ups. If you back up, see the big picture and play the bigger moves, the long side is the only side to be.

There are lots of reasons to believe the uptrend will continue into the new year.

Stock headlines from barchart.com…

UBS (UBS +0.38%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

Gap (GPS +0.37%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

FBR Capital kept its ‘Outperform” rating on Expedia (EXPE +1.53%) and raised its price target on the stock to $70 from $65.

Intel (INTC -0.42%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

DigiTimes reporrs that Apple (AAPL +1.84%) has increased its orders of iPad mini with Retina in November to 4 million units and that orders for the iPad mini with Retina haave already surpassed those for the first-generation iPad mini.

Zurich Insurance (ZURVY +0.53%) was upgraded to ‘Buy’ from ‘Hold’ at Societe Generale.

GW Pharmaceuticals (GWPH +1.39%) jumped 9% in after-hours trading after Piper Jaffray initiated an ‘Overweight’ on the stock with a price target of $73.

Burger King (BKW +0.48%) said it had established a joint venture with Groupe Olivier Bertrand to aggressively develop and expand the Burger King brand presence in France.

SAIC (SAIC -4.96%) announced that it was awarded a prime contract by the U.S. Space and Naval Warfare Systems Center Atlantic worth as much as $890 million if all options are exercised to provide transport, computing and infrastructure support services related to command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance.

Hewlett-Packard (HPQ -0.91%) climbed over 7% in after-hours trading after it reported Q4 EPS of $1.01, higher than consensus of $1.00.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Durable Goods

8:30 Initial Jobless Claims

8:30 Chicago Fed National Activity Index

9:45 Chicago PMI

9:45 Bloomberg Consumer Comfort Index

9:55 Reuters/UofM Consumer Sentiment

10:00 Leading Indicators

10:30 EIA Petroleum Inventories

12:00 PM EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: FRO

Notable earnings after today’s close: RENN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 27)”

Leave a Reply

You must be logged in to post a comment.

“In the long term we are all death”. Keynes.

First Time claims down 2 K, Manufacturing is down 2%

The Fed has got our back, or is it our butt? In any case buy if you got it to spend.

Check this out: Zero Hedge site :

Margin Debt Soars To New Record; Investor Net Worth Hits Record Low

Be thankful you are not a turkey – yet.

Happy Thanksgiving to all.

Today’s numbers are the same as yesterday’s with one addition. There is new resistance above due to the fairly large drop in the last 30 mins of trading that Jason outlined above.

Bulls need to get thru that resistance starting at about 1805 thru 1806.50.

We all expect low volume, but yesterday’s was higher than Monday’s. Maybe due to the NASDAQ’s run and close above 4000 for the first time since 2000. Maybe they’ll be happy with that and go slow today, but be aware that even in low volume, moves can be exaggerated.

At 30 mins to the bell futures are +2.50. High of the night +2.75, low -1.25. Quiet.

Good point that someone want’s out badly.

Really makes you wonder.