Cyber Week Special

Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. Indonesia dropped 0.8%; Japan rallied 0.8%. Otherwise there wasn’t much net movement. Europe is currently mixed, but no market has moved more than 0.5% from its unchanged level. Either everyone is waiting for the US employment numbers or they’re waiting for the World Cup draw. Futures here in the States point towards a moderate gap up open for the cash market. This will of course change the jobs report is released.

The dollar is up. Oil is down, copper up. Gold and silver are up.

The market has fallen five straight days, but the loss is minimal. Very little damage has been done, so it seems like more of a buyers strike than aggressive selling pressure.

Today’s employment numbers are extremely important. As I’ve said several times, Wall St. is obsessed with the Fed, and the Fed is obsessed with the data. Good news could be bad news, and bad news could be good news. Good numbers will give the Fed a green light to start tapering sooner rather than later while bad news allows them to hold off an extra month or two. In the past, the market performed poorly when QE cycles ended, so regardless of earnings or other factors, traders should not ignore the Fed.

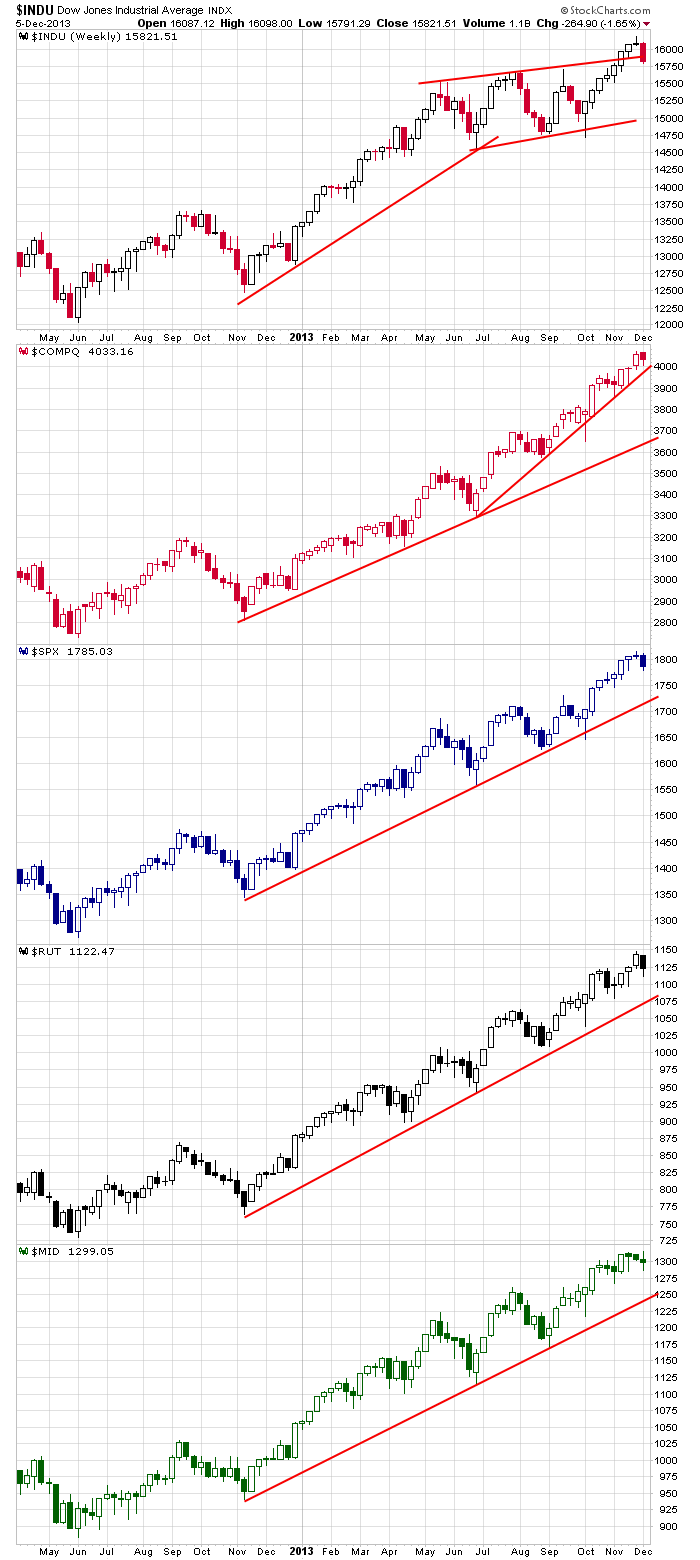

But, so everyone doesn’t freak out, here are the weeklies. Trends don’t be better and more steady than this. Yes, in most cases, there’s room to move down before the support trendlines are hit, but overall, being long is the only place to be.

Here are the numbers…

unemployment rate: 7.0% (was 7.3% last month)

nonfarm payrolls: +203K

private payrolls:

average workweek: up 0.1 hour to 34.5

hourly wages: up 4 cents to $24.15

labor participation rate 13.8% from 13.6%

September gain revised from 163K to 175K.

October gain cut from 204K to 200K

The futures were extremely volatile right after the news. Right now they’re still up but they’re off their highs.

Good news is bad news, bad news is good news. It’s a catch-22. And often the market’s first reaction is the wrong reaction. There’s lots for the market to digest right now.

Stock headlines from barchart.com…

Genesco (GCO -0.53%) reported Q3 EPS of $1.43, better than consensus of $1.38.

Manitowoc (MTW +0.48%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman.

Cubic (CUB +0.26%) lowered guidance on fiscal 2014 EPS to $2.60-$2.75, well below consensus of $3.09.

According to FCC commissioner Ajit Pai, any effort by Comcast (CMCSA +0.41%) to acquire Time Warner Cable (TWC +0.25%) would face significant hurdles in Washington.

Five Below (FIVE -3.94%) slid 6% in after-hours trading after it said it sees fiscal 2013 adjusted EPS of 70 cents-72 cents, below consensus of 73 cents.

Cooper Companies (COO +1.40%) said it sees fiscal 2014 EPS of $6.70-$7.00, on the lower end of consensus at $7.00.

Big Lots (BIG -0.08%) dropped over 3% in after-hours trading after it reported a Q3 adjusted EPS loss of -16 cents, double consensus of an -8 cent loss, and then lowered guidance on fiscal 2013 adjusted EPS to $1.42-$1.65, well below consensus of $2.94.

Ulta Salon (ULTA -4.44%) plunged over 16% in after-hours trading after it reported Q3 adjusted EPS of 72 cents, weaker than consensus of 74 cents.

FedEx Corp (FDX -0.35%) said it will increase shipping rates for FedEx Ground and FedEx Home Delivery by an average of 4.9% effective January 6, 2014.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Nonfarm Payrolls

8:30 Personal Income and Outlays

9:55 Reuters/UofM Consumer Sentiment

3:00 PM Consumer Credit

Notable earnings before today’s open: AEO, BNS, FGP, GCO

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 6)”

Leave a Reply

You must be logged in to post a comment.

WE are not the children of a Fed Reserve god, but we are frighten of the number mill. The numbers were not enough to taper soon, but when it is time, we will blow up like

a cheap fire cracker. Yellen will not act too soon, probably march ’14. The Fiscal freaks are talking like they want a deal but can’t bring themselves to do it.

The numbers were not convincing the a recovery is in progress. The numbers today show more unemployed quit looking. The wages were equivocal and point neither up or down.

Today? I think down after a celebration, except bonds will be hurt. Having fun yet?

As Jason says, volatile reaction to the report. First down, then up, then way down, then way way up, nearly +20. (They actually tagged a long fib to the tick on the second move down, and that’s what’s in play.)

The support level ID’d Wed is validated. All resistance is broken in the moves after the report. Projects a tgt to 1825.

Likely will pop and pull back after the open. If we pull back, watch this layer: 1793-96. A bounce from it, we’re going higher. If that is broken, could drop to Wed’s support level, or lower.

At 9:08, +18

the instos like to take all the scared bulls put innsurance for fri weekly opts ex

they also did a good job running short stops,which makes it hard to have stops or limit orders in the market at open

the exhausted bulls will all now die of obesity as the idiot bears come into clean up the mess