Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mixed. China dropped 2%, Indonesia almost 1%. Australia rallied 1%, Singapore 0.8%. Europe currently leans to the upside. Greece is down 1.3%, but no other index is up or down more than 0.5%. Futures here in the States suggest an up open for the cash market.

The dollar is down. Oil is down, copper up. Gold and silver are up.

Yesterday the market traded quietly and closed with small-to-moderate losses. I’m calling it a victory for the bulls. The market’s tendency is to reverse the post-FOMC move, and since the indexes didn’t give much back, it’s a good performance for the bulls.

I continue to like the market longer term and think 2014 should start off on a good note. I don’t see any glaring warning signs. In the shorter term, however, some of the breadth indicators aren’t yet ready to support a leg up. I’d prefer some sideways movement or another mini move down before the next leg up begins. I don’t always get what I want, so I’m maintaining my long exposure and I’m not going short. I’m just hoping for a little more rest to better set the stage for a lasting rally.

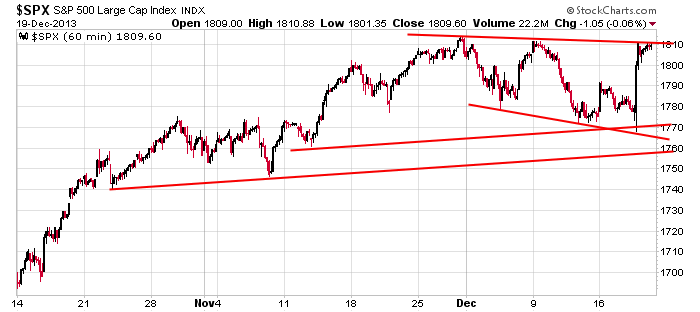

Here’s the 60-minute SPX chart. Consolidation mode continues.

It’s Friday. Then the market is closed next Wednesday (and Tuesday is a half day). The entire week will be dead because Christmas is in the middle of the week. But the market can certainly float in either direction on light volume, so we can still get some movement.

Stock headlines from barchart.com…

3M Company (MMM +0.45%) was upgraded to ‘Neutral’ from ‘Underweight’ at JPMorgan.

CarMax (KMX +1.01%) reported Q3 EPS of 47 cents, below consensus of 48 cents.

Zumiez (ZUMZ -0.68%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

BlackBerry (BBRY +3.14%) slid 7% in pre-market trading after it reported a Q3 adjusted EPS loss of -67 cents, a bigger loss than consensus of -45 cents.

Walgreen (WAG -0.70%) reported Q1 EPS of 79 cents, stronger than consensus of 72 cents.

Standard & Poor’s Ratings Services raised its long-term local currency rating on Mexico to ‘A’ from ‘A-‘ and its long-term foreign currency rating to ‘BBB+’ from ‘BBB.’

Peabody Energy (BTU +2.74%) said it sees fiscal 2013 adjusted EBITDA $60 million-$80 million lower than its prior view.

Jazz Pharmaceuticals (JAZZ +0.86%) will acquire Gentium (GENT -2.28%) for $57 per share.

Cintas (CTAS +0.34%) reported Q2 EPS of 70 cents, stronger than consensus of 68 cents.

Nike (NKE -0.37%) reported Q2 EPS of 59 cents, better than consensus of 58 cents.

AAR Corp. (AIR -0.56%) lowered guidance on fiscal 2014 EPS view to $1.95-$2.00 from $2.00-$2.05, below consensus of $2.05.

TIBCO (TIBX unch) slumped over 13% in after-hours trading after it reported Q4 adjusted EPS of 42 cents, better than consensus of 39 cents, but then cut guidance on Q1 EPS to 17 cents-18 cents, below consensus of 21 cents.

Red Hat (RHT +0.18%) surged over 10% in after-hours trading after it reported Q3 adjusted EPS of 42 cents, higher than consensus of 35 cents, and then raised guidance on fiscal 2013 EPS $1.46-$1.48, well ahead of consensus of $1.38.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 GDP Q3

8:30 Corporate Profits

11:00 Kansas City Fed Mfg Survey

Notable earnings before today’s open: BBRY, FINL, KMX, NAV, WAG

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 20)”

Leave a Reply

You must be logged in to post a comment.

4.1% GDP revision for 3rd Qtr. It maybe a real change but lots of inventory build. That too is hopeful. A rally into the end of the year, then we have debt ceiling. Should be good close to the week. Watching gold, China is buying gold in preference to the USD and US debt.

Friday OPEX, anything can happen. Let the antics begin.

As Jason said, Thurs held near the highs of Wed’s move. Bullish.

BTW, the move on Wed was on much higher than average volume for both SPX and NASDAQ, indicative of solid buying. Once pro traders understood the insignificance of the “taper,” it was buy buy buy.

As for today, same levels as yesterday’s post provided.

TGT remains SPX 1840, 1843 likely.

Futures overnight range: -.75 to +4.75, now +3.25