Good morning. Happy Friday.

The Asian/Pacific markets, finally fully open since Monday, closed mostly up. China rallied 1.4%; India, Malaysia, Singapore and Taiwan also did well. Europe, also fully open, is also mostly up. Greece is up 4.3%. Austria, France, Germany, Italy, Norway, Stockholm, Switzerland and London are also doing very well. Futures here in the States are flat.

The dollar is down a bunch. Oil is up, copper down. Gold and silver are down.

Odd week for me. It feels like a Monday because I just got back in town, but it’s Friday.

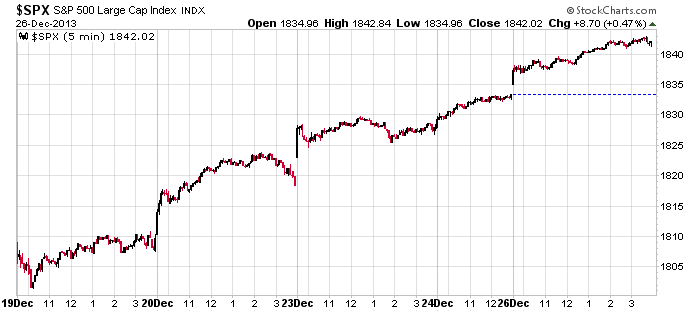

The market has seen steady buying interest the last week…there have been no noticeable pullbacks…just steady buying. Here’s the 5-min SPX chart.

Including the Fed day, the S&P is up about 75 points in just six days. Heck, the average hedge fund manager isn’t doing much better for the entire year. Can we have a moment of silence for all the traders who will be losing their jobs soon. lol

At the risk of beating a dead horse, I’m long, I’ve been long for a long time. I see no reason to fight the trend. I see no reason to see what isn’t there. If the movement doesn’t make sense, it doesn’t make sense to others, so it’s likely to continue until more people become believers.

Right now there’s a real possibility we have a full-blown hysterical buying frenzy. There are so many investors/traders sitting on the sidelines desperately hoping for a pullback that hasn’t happened. One by one they will throw all caution to the wind and buy at any cost because they can’t stand to see the market continue up without them. Buying will beget more buying which will beget more buying.

I don’t know what the odds of such an occurrence is, but it’s certainly on the table for the next couple weeks. Keep it in mind. Be ready just in case it happens.

Stock headlines from barchart.com…

GM (GM +1.57%) and its China joint venture partner SAIC Motor Corp. will recall close to 1.5 million vehicles in China due to potential safety issues.

Twitter (TWTR +4.79%) was downgraded to ‘Underperform’ from ‘Neutral’ at Macquarie.

Netflix (NFLX -0.39%) yesterday suffered outage issues that affected streaming for users in the U.S., Canada and Latin America.

Textron (TXT +0.56%) will acquire Beechcraft for $1.4 billion in cash.

General Dynamics (GD +1.14%) was awarded a $171.96 million government contract modification to a previously awarded contract for USS Carter Hall fiscal 2014 extended dry-docking planned maintenance availability.

Boeing (BA +1.05%) was awarded a $617.68 million government contract modification for the remanufacture of twenty-two CH-47F helicopters, six new CH-47F helicopters, and long lead funding for remanufacturing thirteen CH-47F helicopters.

Adage Capital reported a 5.07% passive stake in HeartWare (HTWR +0.29%) .

ANI Pharmaceuticals (ANIP +2.33%) announced that it has acquired 31 previously marketed generic drug products from Teva Pharmaceuticals (TEVA -0.15%) for $12.5 million in cash and a percentage of future gross profits from product sales.

Gabelli reported a 5.37% stake in Lawson Products (LAWS +1.22%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

Notable earnings before today’s open: none

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 27)”

Leave a Reply

You must be logged in to post a comment.

And someone in Kansas might want to sell a 2 lot in January in order to delay their capital gains taxes into 2014. Just a slight possibility. Probably not though. The world is risk-free…