Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. China, India, Malaysia and South Korea are down the most. Hong Kong is up. Europe is currently mostly up. Gains are not big, but they’re across-the-board. Futures here in the States point towards an up open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are up.

Options expire today (technically tomorrow) – meaningless in my opinion. Traders have already squared off positions or rolled to a new month. I don’t expect any weird movement, but there have been periods in the past where the market would rally into OE and then sell off in the weeks after, so it’ll be something to look out for next week.

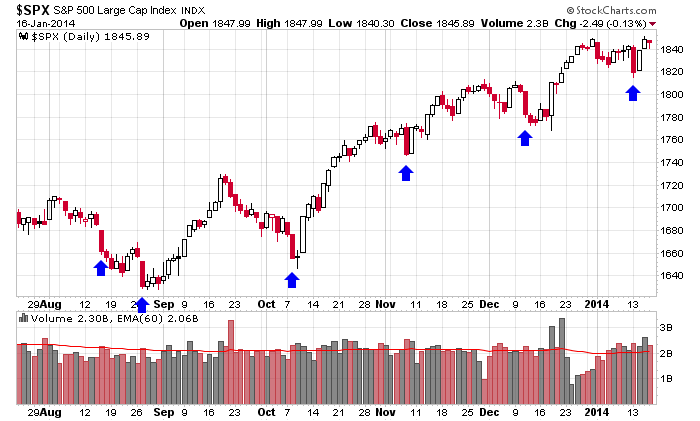

Remember this chart I posted Tuesday morning? I commented not to get too bearish just because the market suffered a big down day because it’s not uncommon for the market to reverse soon-after. It happened again.

There are very few econ reports out next week, but earnings season ramps up. There are several hundred reports, so expect gaps, sudden moves and otherwise herky jerky movement.

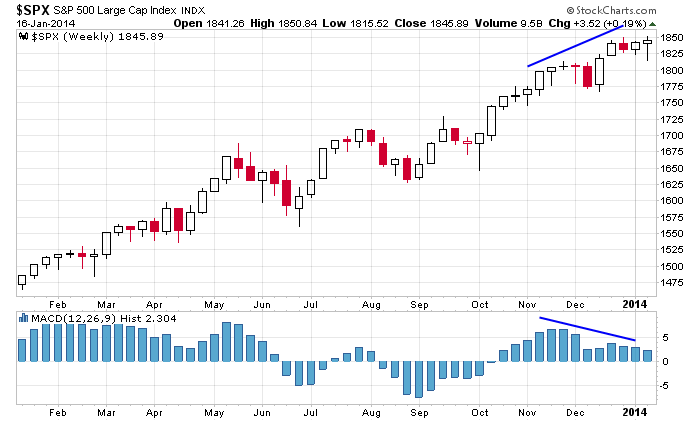

My bias is to the upside, but this chart still lingers. The S&P is still working off a negative divergence.

I’m long…not all in…but I’m long.

Stock headlines from barchart.com…

Morgan Stanley (MS -0.68%) reported Q4 EPS of 49 cents, stronger than consensus of 44 cents.

General Electric (GE -0.51%) reported Q4 EPS of 53 cents, right on consensus.

Comerica (CMA -0.63%) reported Q4 EPS of 77 cents, better than consensus of 74 cents.

Best Buy (BBY -28.59%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS and at Goldman.

SunTrust Banks (STI -1.12%) reported Q4 EPS of 77 cents, higher than consensus of 70 cents.

Schlumberger (SLM -0.37%) reported Q4 EPS of $1.35, better than expectations of $1.32.

Tractor Supply (TSCO -1.16%) will replace Life Technologies (LIFE +0.01%) in the S&P 500 Index as of the close on Jan 23.

Elizabeth Arden (RDEN -1.43%) plunged 20% in after-hours trading after it said it sees Q2 EPS ex-items of $1.05-$1.08, well below consensus of $1.47, and then said it will withdraw its guidance on fiscal 2014 EPS.

Sysco (SYY +0.35%) fell over 2% in after-hours trading after Reuters reported that Florida, Indiana and other U.S. states are reviewing the merger of Sysco and U.S. Foods.

Con-way (CNW -1.31%) fell over 4% in after-hours trading after it said that it sees Q4 EPS approximating 21 cents, well below consensus of 39 cents.

American Express (AXP -0.53%) reported Q4 EPS of $1.21, weaker tthan consensus of $1.25.

Capital One (COF -0.77%) reported Q4 EPS of $1.45, below consensus of $1.54, and then was downgraded to ‘Neutral’ from ‘Positive’ at Susquehanna.

Intel (INTC -0.49%) slipped over 4% in after-hours trading after it reported Q4 EPS of 51 cents, below consensus of 52 cents, and said fiscal 2014 revenue will be flat vs. 2013 at $52.7 billion, below consensus of $53.21 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Housing Starts

9:15 Industrial Production

9:55 Reuters/UofM Consumer Sentiment

10:00 Job Openings and Labor Turnover Survey

Notable earnings before today’s open: BK, CMA, FHN, GE, MS, MTB, SLB, STI, WBS, WIT

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 17)”

Leave a Reply

You must be logged in to post a comment.

Jason

Nice chart work.

The move down Thursday was recovered in the last part of the day, so wasn’t as severe as it looked earlier in the day.

The overnight action in futures implies we could continue some more selling.

They pull all kinds of antics on OPEX day. The SPX index options have expired (the settlement number is determined on the opening print this morning) while the stock options are still in effect til 4 pm, so lots of cross currents at play.

Friday’s resistance: 1844 up thru 1847.

Here’s what I said yesterday, kinda think that still applies:

“After the move up from Monday’s low which was 36 points straight up, normal to do a giveback. Add in the gyrations accompanying OPEX and max pain, we could easily move back down 10 points from where we are at the moment, or to 1832 and as low as 1827.

Tgt still 1865 as long as 1827 not violated.”

Have a good 3 day weekend.

this analysis is always presented in a way where it will never be wrong

c,

If you’re addressing me, let me try to help you.

Go back to Tuesday’s post where I id’d the bottom of the current run (I said it happened Monday afternoon.)

I said this “we have our line to watch: yesterday’s low. If they hold 1815 (today and into the future), it projects a target to 1865.”

Pretty sweet info. Look back at this week’s chart. Not too shabby for free advice.

We are in the middle of that move now. It is not the time for entry.

Have a good day.

The UPS,ADM RDS earnings are down which makes one nervous. Housing starts stumble, but sales to buyers with lower incomes are up. Another bubble? Bonds will rise in price soon. Gold may scatter the investors, but I have a little. It is my dividend investments which are holding on well, up 2% and 4% dividend flows monthly, lots of risk.

I am hoping the Seahawks can hold it all together. About half way to San Diego CA. This is not near the fun it used to be.