Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Japan rallied almost 3%, Indonesia and South Korea more than 1% and India, Taiwan and Hong Kong also did well. China dropped 1.2%. Europe is currently mostly up, but there are no 1% movers. Belgium and Greece are down. Norway, Russia and the Czech Republic are up. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down slightly.

It’s options expiration…a meaningless day in my view. Any traders/investors who needed to square off positions or roll them to forward months has likely done so. Perhaps there may be a little volatility today, but overall OE doesn’t matter.

Where it could come into play is next week. There is a tendency for stocks to rally into options expiration and then sell off after. It doesn’t happen all the time, but it happens enough to keep it in mind next week.

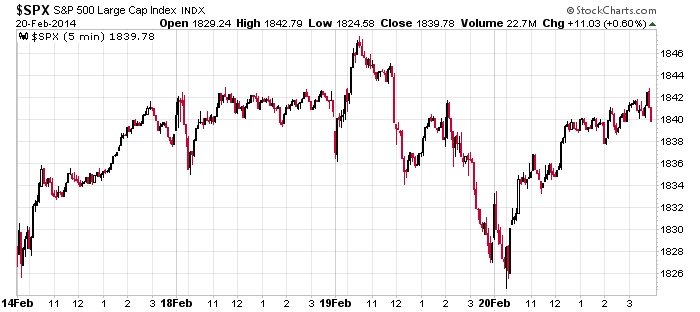

Here’s the 4-day, 5-min SPX chart for this week. The index has been very trendy (trend up Mon and Fri, trend down Thurs), but there’s been very little net change relative to last Friday’s close.

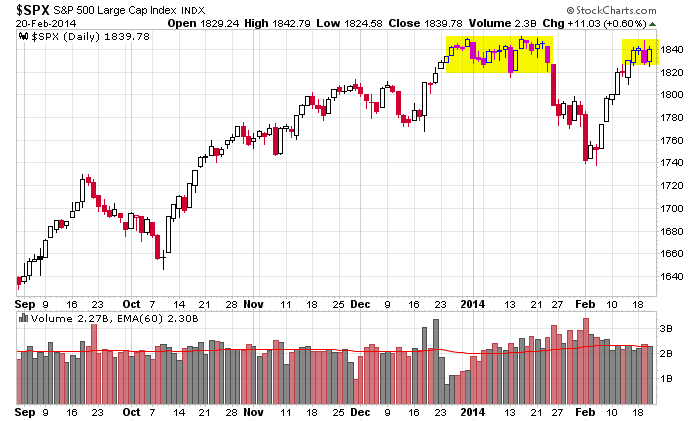

And here’s the daily…consolidation mode all week. This is bullish considering the run up the previous two weeks.

I’m hoping for a further rest. I like the market; I see many good set ups. But I’d like to see it consolidate further, and I want to see what it does early next week (after options expire).

Stock headlines from barchart.com…

Signet Jewelers (SIG +0.61%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee.

FBR Capital raised its price target for priceline.com (PCLN +0.73%) to $1,500 from $1,300 and keeps an ‘Outperform’ rating on the stock.

Donaldson (DCI +1.43%) reported Q2 adjusted EPS of 39 cents, higher than consensus of 36 cents.

Kindred Healthcare (KND -0.31%) reported Q4 adjusted EPS of 15 cents, better than consensus of 13 cents.

MRC Global (MRC +2.00%) reported Q4 adjusted EPS of 32 cents, well below consensus of 41 cents.

Pilgrim’s Pride (PPC +2.34%) reported Q4 EPS of 55 cents, higher than consensus of 47 cents.

Express Scripts (ESRX +0.97%) reported Q4 EPS of $1.12, right on consensus, but reported Q4 revenue of $25.78 billion, sronger than consensus of $25.37 billion.

Mohawk (MHK +1.32%) reported Q4 EPS ex-items of $1.79, better than consensus of $1.75.

Total (TOT +0.84%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

Marvell (MRVL +2.28%) reported Q4 EPS of 29 cents, higher than consensus of 25 cents.

Nordstrom (JWN +0.95%) reported Q4 EPS of $1.37, higher than consensus of $1.34.

Groupon (GRPN +2.59%) rallied 14% in after-hours trading after it reported Q4 EPS of 4 cents, double consensus of 2 cents, but then erased its advance and tumbled 12% after it said it expects a -2 cent to a -4 cent loss in Q1, weaker than consensus of a 6 cent gain.

Priceline.com (PCLN +0.73%) rose over 2% in after-hours trading after it reported Q4 EPS of $8.85, well above consensus of $8.29.

Hewlett-Packard (HPQ +2.51%) reported Q1 adjusted EPS of 90 cents, better than consensus of 84 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Existing Home Sales

1:10 PM Fed’s Bullard: U.S. Economic Outlook and Monetary Policy

1:45 PM Fed’s Fisher: Economic Outlook

Notable earnings before today’s open: AEE, B, BCC, CHTR, DCI, DISH, ECL, EGO, PNW, RUTH, SATS, STRA, STRZA, TFX, LBY

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 21)”

Leave a Reply

You must be logged in to post a comment.

Flying in a cloud. OpEx proves nothing except who runs the markets. Slightly strange currency situation in Euro 137.14. Why are they looking for love in all the wrong places? Europe is reluctant to fix its banks. Mexico GDP disappoints, less than expected. Overall I hold the indexes and remain in put options.

Sorry for the length, lots of things to report today.

OPEX. The antics started yesterday. Remember that the SPX options closed at the cash bell yesterday — settlement will be determined by the opening print today. OEX and DJI’s options have until today’s close to play out.

Interestingly and a bit unusual, they front ran my support level of 1818-19 yesterday. (All numbers herein are SPX.) Not forecasting this, but am observing that when they front run, they sometimes return to hit it right on the money which means it is possible in the future we could revisit that level before going on to highs. At this point, just keep that in mind, and if we head down, watch for a bounce there.

Today: there are a couple of levels of support. [The only resistance is at the previous high.]

The highest support is at 1840 down thru 1838. If that holds, tgt is 1849.

If that one breaks, another level exists @ 1833. If 1830 is broken, then I’d expect a move down to 1818-19 as discussed above. If the support @ 1840-38 holds, target is 1850-52. See yesterday’s report for expectations if the level of support at 1818 (lower level at 1811-10) is broken.

Remember, it’s OPEX and as Jason and Whidbey said, there are forces asserting their control to make options expire worthlessly for the retail (us) crowd, and Da “boyz” will do what’s necessary to make themselves money. Enjoy the show.

Overnight futures range: -1 to +7 in that order. Now: +5.00 (as I wrote this, futures rose from +2 to +5, the games have begun.)

only the open and close matters opts ex day for the futures and the rest is usually flat

but as today is the highs for the next 10 years we may get some volitility

looking for spx cash at 1850 for the high

Making us a little nervous? Ten years? But why not?