Good morning. Happy Friday.

The Asian/Pacific markets leaned to the upside. Indonesia rallied 1.1%; India, New Zealand, Taiwan, China and Singapore also did well. Europe currently leans to the downside. Austria and Italy are down more than 1%; Belgium and Greece are doing well. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are down. Gold is flat, silver is up.

Within the last two days, the S&P 500 big caps, S&P 400 mid caps, Russell 2000 small caps and Nas all hit new highs – the three former all-time highs, the latter hit its highest level since 2000. We knew new highs were coming…personally I wish we’d get some up and down action (on the daily) instead of the slow steady grind. A big component of what I do relies on relative strength, so a little up and down movement helps separate the truly strong stocks from those that are just coming along for the ride. Oh well. We’ve had many good trades recently and many more to come. If the market keeps grinding higher, one by one our set ups will pop. If it pulls back, good. The strongest stocks will step forward and announce themselves.

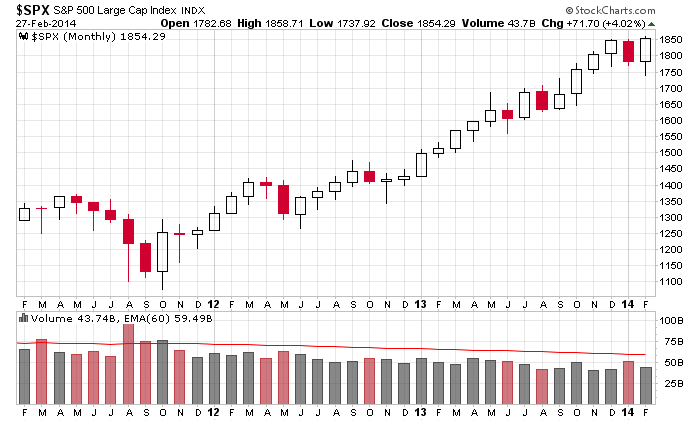

Today is the last day of February. Here’s the monthly chart. The trend is up until it’s not. The most bearish observation you can have is that that market has moved up 17 of 21 months and therefore is in need of a rest. But in my book, that’s complete garbage. That’s not a reason to abandon the long side. Being in a state of denial is very costly.

Stock headlines from barchart.com…

Iron Mountain (IRM -0.42%) reported Q4 EPS of 15 cents, well below consensus of 22 cents.

Pepco Holdings (POM -0.92%) reported Q4 EPS of 24 cents, higher than consensus of 21 cents.

Dominion (D -0.26%) was downgraded to ‘Hold’ from ‘Buy’ at Argus due to valuation.

Crane (CR -0.15%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Southwestern Energy (SWN +1.43%) reported Q4 adjusted EPS of 54 cents, better than consensus of 53 cents.

Universal Health (UHS -0.28%) reported Q4 EPS of $1.24, well ahead of consensus of $1.08.

MasTec (MTZ -0.39%) reported Q4 adjusted EPS of 53 cents, consensus 52 cents.

Gabelli reported an 8.08% stake in Zale (ZLC +0.37%) .

Esterline (ESL +0.87%) reported Q1 adjusted EPS of $1.08, stronger than consensus of $1.05.

Deckers Outdoor (DECK +2.83%) slumped 14% in after-hours trading after it reported Q4 EPS of $4.04, higher than consensus of $3.80, but then lowered guidance on Q1 EPS to a loss of -16 cents, well below consensus of a 10 cent profit.

Monster Beverage (MNST +0.23%) reported Q4 EPS of 44 cents, weaker than consensus of 46 cents.

Salesforce.com (CRM +3.89%) reported Q4 adjusted EPS of 7 cents, better than consensus of 6 cents.

Ross Stores (ROST +0.86%) reported Q4 EPS $1.02, right on consensus, but reported Q4 revenue of $2.74 billion, slightly below consensus of $2.75 billion.

Gap (GPS -0.52%) reported Q4 EPS of 68 cents, higher than consensus of 66 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 GDP Q4

9:45 Chicago PMI

9:55 Reuters/UofM Consumer Sentiment

10:00 Pending Home Sales

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: Notable earnings before Friday’s open: AMAP, AUXL, BSFT, DDD, ENDP, GLOG, HMSY, IRM, ISIS, NCT, NIHD, NRG, NWN, PMC, POM, PRIM, RHP, SJI, TTI, VTG, XLS

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 28)”

Leave a Reply

You must be logged in to post a comment.

Explaining the GDP will call for the best story telling available. Was it the weather, or something else like consumer spending, inventories, regulation, fear of AC Act? 2.4 from 3.2 says we were lied to or things are weaker than we though possible. Reading the whole of the report I suspect the globe economy is slipping since exports show demand is down. Go with caution and buy a few puts.

Futures show determine to end the month with strength, on the other hand…take care.

Last 2 sentences of Jason’s report are great. Denying that the market can move up further (or down further, as the case may be) provides the fuel for those who are driving it in the direction it’s going.

Lots of support here, all pointing higher. Immediate target is 1860, possible today. Next 1868 still valid (see y’day’s post). LT tgt remains 1900.

Some resistance to be felt 1855-1856 and previous Intraday high at 1858.50. Would expect a pullback when/if we hit 1860.

Futures overnight: up to +1.75 then -5 Now, -1.50at 9:05.

I got a sell signal yesterday at the close. I am out on any strength right now until the next buy signal.

I sure would not short this market.

Ukraine is the reason to short this market NOW!