Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly up. China rallied 2.7%; Hong Kong, Australia and South Korea also did well. New Zealand lagged. Europe is currently mixed. Russia is down 2%; Amsterdam, Norway, Switzerland and Germany are doing the best. Futures here in the States point towards an up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are up.

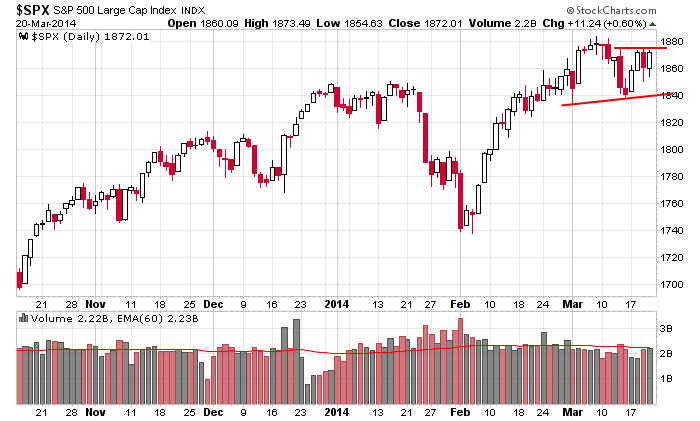

Here’s the daily S&P. The index has moved up 3 of 4 days this week and so far is up 31 points on the week. This does not completely recapture last week’s loss, but it’s close enough. The long term trend remains solidly up. There is no other way to interpret the charts. If you want to be worried about China or Russia, fine. But per the charts, the long side is the right side.

The biggest “event” in the near term is today’s options expiration. The day itself doesn’t carry the meaning it used to (often times we’d get a volatile day with wild swings in both directions, but not any more), but this day each month has been known to act as a turning point. The market would move up into expiration and then sell off after. So regardless of what the charts look like, such a development would see some selling early next week. We’ll see if it plays out. I’m long and will continue to be long. But I am making mental note of what may be in the pipeline.

Stock headlines from barchart.com…

United Technologies (UTX -0.21%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Keurig Green Mountain (GMCR +0.16%) will replace WPX Energy (WPX +1.04%) in S&P 500 as of today’s close.

Herbalife (HLF -3.66%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Boeing (BA +1.22%) and ConAgra (CAG +1.35%) were both downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Walgreens (WAG -0.49%) was downgraded to ‘Sell’ from ‘Hold’ at Cantor.

Darden Restaurants (DRI +0.45%) reported Q3 EPS of 88 cents, right on expectations.

Tiffany & Co. (TIF -1.75%) reported Q4 EPS of $1.47, below consensus of $1.52.

Ann Inc. (ANN -0.48%) rose over 11% in after-hours trading after Golden Gate Capital reported a 9.5% stake in the company.

Luxor Capital Group reported a 5.1% passive stake in Lamar Advertising (LAMR +0.42%) .

CommScope (COMM +0.23%) raised guidance on Q1 adjusted EPS view to 43 cents-47 cents from 36 cents-40 cents, above consensus of 38 cents.

Exelon (EXC +1.00%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Nike (NKE +0.15%) fell over 3% in after-hours trading after it reported Q3 continuing operations EPS of 76 cents, better than consensus of 72 cents, but then said expects forex headwinds to reduce EPS growth in Q4 and into fiscal 2015.

AAR Corp. (AIR +0.62%) reported Q3 EPS of 45 cents, less than consensus of 47 cents, and then lowered guidance on fiscal 2014 EPS view to $1.79-$1.82 from $1.95-$2.00, well below consensus of $1.97.

Zions bank (ZION +3.19%) is the only bank to fall short of minimum capital level in the Fed’s stress test.

Symantec (SYMC +1.60%) fell over 9% in after-hours trading after it announced that it terminated CEO Steve Bennett and appointed Michael Brown as interim CEO effective immediately. Symantec was then downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Atlanta Fed’s Business Inflation Expectations

11:45 Fed’s Bullard:”Nominal GDP”

4:30 PM Fed’s Kocherlakota Speech

6:30 PM Jeremy Stein: Monetary Policy

Notable earnings before today’s open: DRI, TIF

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 21)”

Leave a Reply

You must be logged in to post a comment.

One of our problems is that we do not realize that our government is spending more than the GDP each year. This leads to a problem known as debt binding of an economy. We need to be

worried. check out this link: http://www.zerohedge.com/news/2014-03-20/what-surprise-it-turns-out-they-lied-about-deficit-last-year (not my favorite blog, but this is mathematically correct.

Yesterday Ukraine did a bail-in on deposit accounts in banks in Ukraine. This is the last desperate act of a bankrupt government. We need to know the rules.

OPEX: anything can happen today.

Yesterday went as predicted: broke resistance, pulled back and climbed the rest of the day.

Progressing towards our target of 1909. Near term tgt is 1886.

Market can pull back all the way to 1860 and not threaten the uptrend. Not saying that will happen.

Futures were -4 early evening, then to +6.50 at 5 am. Now are +4.5 at 9 am.

Have a good weekend.

one by one world indexes are rolling over into downtrends

will your index be next

the big ponsi will catch you