Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 3%; Australia also did well. India and Malaysia dropped. Europe is currently up across-the-board. Italy is up more than 2%; Germany, France, Spain and Greece are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

The market turned around in a big way yesterday. Early weakness got sold into relatively hard. All the indexes dropped and either matched their previous days’ low or went lower. Then buyers stepped in and bought at a steady pace for the remainder of the day. When the closing bell rang, all the indexes were up and at their highs. The Nas and small caps lagged, but at least they closed well off their lows.

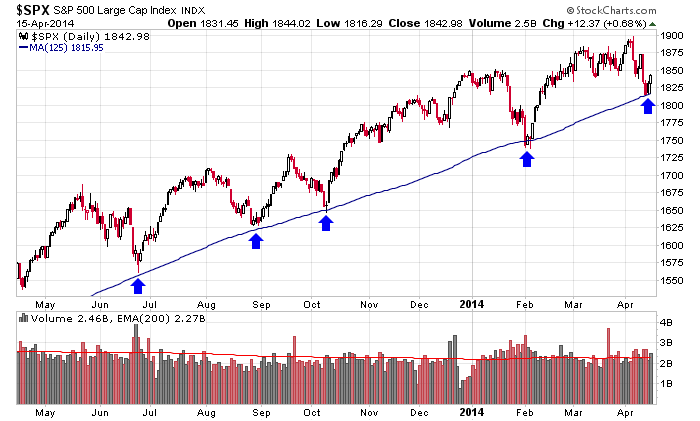

I posted this chart in late January and early February to remind everyone that as bad as things had gotten, the bulls deserved the benefit of the doubt because the trend had been up for so long and every mini correction had been bought. I’m posting the chart again now for the same reason. The market has suffered a lot of technical deterioration lately – much more than previous corrections – but it seems like most traders have turned bearish lately, and we all know what happens when too many traders get stacked on one side of the market.

In the near term I like the upside. In the intermediate term I still like the downside, but of course I’m open to changing my mind if the market tells me to. I will not dig my heels in and defend a position.

Stock headlines from barchart.com…

Bank of America (BAC +2.44%) reported Q1 EPS of 34 cents, higher than consensus of 27 cents.

United Natural Foods (UNFI -0.92%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

NetApp (NTAP +0.54%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Genuine Parts (GPC +0.38%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

Grainger (GWW +0.74%) reported Q1 EPS of $3.07, stronger than consensus of $2.96.

UnitedHealth (UNH +0.42%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

PNC Financial Services Group (PNC +0.69%) reported Q1 EPS of $1.71, better than consensus of $1.65.

Billionare investor Carl Icahn boosted his stake in Navistar (NAV +1.35%) to 17.64% from 16.55%.

Linear Technology (LLTC +1.14%) reported Q3 adjusted EPS of 55 cents, better than consensus of 48 cents.

Casey’s General Stores (CASY -0.68%) reported March prepared food and fountain Same-Store-Sales were up 12.7% y/y.

Yahoo (YHOO +2.30%) jumped 8% in after-hours trading after it reported Q1 EPS of 38 cents, stronger than consensus of 37 cents, and reported Alibaba Q4 net income $1.36 billion vs $650 million for prior year.

CSX (CSX -0.32%) reported Q1 EPS of 40 cents, higher than consensus of 37 cents.

Intel (INTC +0.79%) rose over 1% in after-hours trading after it reported Q1 EPS of 38 cents, better than consensus of 37 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Housing Starts

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

12:15 PM Janet Yellen speech

1:25 PM Fed’s Fisher: Economic Outllok

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: ABT, ASML, BAC, CS, FRC, GWW, HBAN, PNC, STJ, USB

Notable earnings after today’s close: AF, ALB, AXP, BGS, BMI, CCK, COF, EFII, EPB, EWBC, GOOG, HBHC, IBM, KMI, KMP, KSU, NE, NSR, PBCT, PLXS, RLI, SLM, SNDK, STLD, TPLM, URI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 16)”

Leave a Reply

You must be logged in to post a comment.

Jason

Well said “and we all know what happens when too many traders get stacked on one side of the market.”

notice to the bulls ftom Jason –above

think about getting another profesion–intermediatly

more tech stocks reporting after hours

even though this bounce may even produce higher highs,broadening pattern

the jaws of death will get you

become a bear for the next 10 years and have fun

instos still in charge and trading derivitives whilst runing stops

in other words

dont be just a long only trader

better still be a high frequency day trading snipper and trade both sides