Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan and China dropped; Singapore moved up. Europe is currently mixed. London, France, Italy, Belgium, Norway and Stockholm are doing well; Russia, Greece and Amsterdam are down more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

The market was slow yesterday. The Nas was a noticeable laggard while the other indexes formed inside days on light-ish volume…nothing for the bulls to be concernedabout coming off six straight up days.

After the close, FB released favorable earnings; the stock is up 5.2% premarket this morning. AAPL also announced good earnings along with a dividend hike, a commitment to increase their buyback program and a 7-for-1 stock split. The stock is up 8.5% premarket.

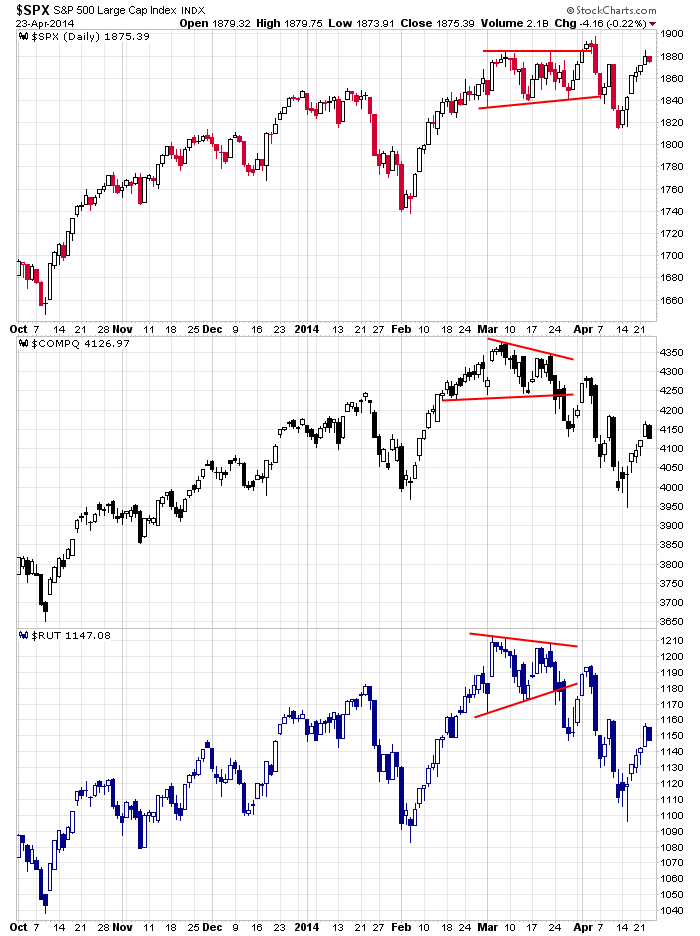

The market has improved a bunch the last week. Indicators have improved, key stocks have moved up and the Dow and SPX are back near their highs. The battle is right here (see below). The Nas and Russell small caps are lagging. While the S&P has rallied all the way back to a previous resistance level, the Nas and RUT continue to make lower highs and lower lows. The market’s movement over the next few weeks will be determined by the Nas and small caps. If they can move up, take out the most recent high from within the downtrend and then hold the gains, the market will be free to continue up. But if the Nas and small caps lag, the SPX isn’t going anywhere. Simple as that. The battle is right here. This is where the intermediate term will be determined.

Stock headlines from barchart.com…

Aetna (AET +0.29%) reported Q1 EPS of $1.98, well above consensus of $1.55.

Time Warner Cable (TWC +1.04%) reported Q1 EPS of $1.78, higher than consensus of $1.67.

Texas Instruments (TXN unch) reported Q1 EPS with items of 44 cents, higher than consensus of 41 cents.

Lam Research (LRCX unch) reported Q3 adjusted EPS of $1.26, better than consensus of $1.17.

Apple (AAPL -1.31%) jumped over 7% in after-hours trading after it reported Q2 EPS of $11.62, well above consensus of $10.18, and announced a 7-for-1 stock split.

Cheesecake Factory (CAKE -2.50%) reported Q1 adjusted EPS of 43 cents, below consensus of 49 cents, and then lowered guidance on fiscal 2014 EPS to $2.24-$2.33, below consensus of $2.36.

Flowserve (FLS -0.74%) reported Q1 EPS of 78 cents, better than consensus of 75 cents.

E-Trade (ETFC unch) reported Q1 EPS of 33 cents, higher than consensus of 23 cents.

Assurant (AIZ +0.36%) reported Q1 adjusted EPS of $1.68, stronger than consensus of $1.54.

Safeway (SWY -0.21%) reported Q1 EPS of 6 cents, well below consensus of 18 cents.

Chicago Bridge & Iron (CBI -0.88%) reported Q1 adjusted EPS of 87 cents, weaker than consensus of $1.10.

LSI Corporation (LSI +0.09%) reported Q1 EPS of 17 cents, better than consensus of 15 cents.

United Stationers (USTR +0.34%) reported Q1 adjusted EPS of 56 cents, weaker than consensus of 57 cents.

Stryker (SYK -0.44%) reported Q1 adjusted EPS of $1.06, below consensus of $1.08.

Facebook (FB -2.65%) rose over 5% in pre-market trading after it reported Q1 EPS of 34 cents, well above consensus of 24 cents.

Qualcomm (QCOM unch) reported Q2 adjusted EPS of $1.31, better than consensus of $1.22, and raised guidance on fiscal 2014 adjusted EPS view to $5.05-$5.25 from $5.00-$5.20.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Durable Goods

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAL, ABC, AET, ALXN, AMAG, ASPS, AVT, AZN, BC, BHE, BKU, BMS, BTU, CAB, CAJ, CAM, CAT, CCE, CELG, CFX, CLFD, CLI, CMS, CNMD, COG, COR, CRR, CRS, CSH, CWEI, DFT, DGX, DHI, DLPH, DLX, DNKN, DO, DST, EQM, EQT, ETR, FAF, FCX, FNFG, GM, GMT, GPK, GTI, HOT, HP, HSY, IMAX, IVC, JBLU, KKR, LAD, LLY, LSTR, LTM, LUV, MDP, MHO, MJN, MMM, MO, NBL, NDAQ, NLSN, NTCT, NUE, NVS, NYT, ODFL, ORI, OSTK, PAG, PENN, PHM, POT, PTEN, RCL, RS, RTIX, RTN, RYL, SCG, SFE, SIAL, SILC, SIRI, SONS, SQNS, STC, SWK, TKR, TROW, TWC, TWI, UA, UAL, UFS, UPS, USG, UTEK, VDSI, VIVO, VLY, VZ, WCC, WM, WYN, YNDX, ZMH

Notable earnings after today’s close: ABAX, AFOP, ALTR, AMCC, AMZN, AWAY, BAS, BGG, BIDU, BLDR, BRCM, CAMP, CB, CENX, CERN, CINF, CLF, CLMS, CRUS, CUDA, CYN, DECK, DGII, DV, ECHO, EMN, EW, FBP, FET, FICO, FII, FSL, GIMO, HBI, HWAY, INAP, INFA, ITRI, KLAC, LEG, LSCC, LVS, MAS, MKTO, MLNX, MSCC, MSFT, MTSN, MXIM, NEM, NR, NTGR, OLN, OTEX, P, PEB, PFG, PKI, QLIK, RGA, RGC, RSG, SBUX, SHOR, SIVB, SPN, SPWR, SRCL, SWFT, SYNA, TCO, UHS, V, VR, VRSN, WFT, WOOF, WRE, WRI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers