Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan and India led to the downside. Hong Kong, China, New Zealand and Taiwan did well to the upside. Europe is currently mostly up. Germany, Spain, Italy, Norway and Russia are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are down.

Yesterday the S&P dropped 25+ points off its high and then rallied furiously back. It was a great reversal that was matched by many tech stocks which have lagged lately.

One of the problems with the market lately has been the performance of the Nas relative to the NYSE…and the performance of growth stocks relative to value stocks. If tech stocks can bounce, the market will do the same. Along with the small caps, this has been my #1 indicator. I’ve said numerous times the market will go as the Nas goes. If the Nas could move up, the rest of the market would do the same. If not, the rest of the market would have very limited upside.

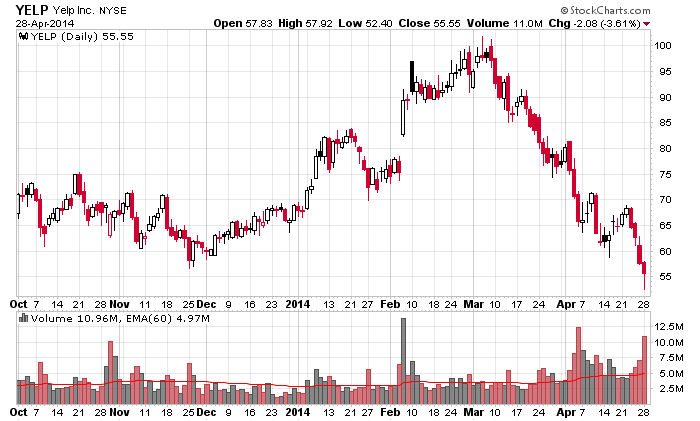

Here’s YELP. The stock has almost got cut in half. Yesterday’s close was well off its low, so maybe, just maybe, this will turn out to be a local bottom. We’ll see.

There’s an FOMC meeting tomorrow, and then we get the latest employment numbers Friday. Oh and several hundred earnings reports too. This is not a time to take big chances. More after the open.

Stock headlines from barchart.com…

Bristol-Myers Squibb (BMY -0.28%) reported Q1 EPS of 46 cents, higher than consensus of 43 cents.

Merck & Co. (MRK -0.98%) reported Q1 EPS of 88 cents, stronger than consensus of 79 cents.

Archer-Daniels Midland (ADM -0.09%) reported Q1 EPS of 55 cents, well below consensus of 74 cents.

General Dynamics (GD -1.49%) was awarded a $17.6 billion contract from the U.S. Navy for the construction of 10 additional Virginia-class submarines.

Owens & Minor (OMI +1.37%) reported Q1 adjusted EPS of 44 cents, weaker than consensus of 46 cents.

Hartford Financial (HIG -1.46%) reported Q1 EPS of $1.18, well above consensus of 93 cents.

Tiger Global reported a 9.5% passive stake in Zillow (Z -1.85%) .

PartnerRe (PRE -0.06%) reported Q1 operating EPS of $3.36, much better than consensus of $2.56.

Herbalife (HLF +1.76%) climbed nearly 3% in after-hours trading after it reported Q1 adjusted EPS of $1.50, well above consensus of $1.29, and then raised guidance on fiscal 2014 EPS view to $6.10-$6.30 from $5.85-$6.05.

Kaman (KAMN -0.73%) reported Q1 EPS of 42 cents, higher than consensus of 41 cents.

Charles Baker reported a 5.6% stake in ZipRealty (ZIPR -1.79%) .

Ameriprise (AMP -0.02%) reported Q1 EPS of $2.01, much better than consensus of $1.88.

CoreLogic (CLGX -0.25%) reported Q1 adjusted EPS of 17 cents, higher than consensus of 16 cents.

Buffalo Wild Wings (BWLD -2.29%) rose 5% in after-hours trading after it reported Q1 EPS of $1.49, well above consensus of $1.34, and then raised guidance on fiscal 2014 net earnings growth rate to 25% from 20%.

Plum Creek Timber (PCL +0.35%) reported Q1 EPS of 17 cents, higher than consensus of 15 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

1:00 PM Results of $15B, 2-Year FRN Note Auction

Notable earnings before today’s open: ABB, AGCO, AIXG, ALR, AMG, ARRY, AXE, BMY, BP, BSX, CARB, CCJ, CHKP, CIT, CMI, CNX, COH, CPLA, CRY, DBD, DDD, DORM, ESV, ETN, FDP, FLWS, FRX, GAS, GEO, GLT, GT, GTLS, HCA, HCBK, HRS, HUN, HW, IPGP, IRWD, KLIC, LG, LKQ, LRN, LYB, MGI, MGLN, MGM, MHFI, MLM, MRK, NMM, NOK, OSK, PCAR, PES, PH, POR, RESI, ROK, OTC:RTRX, RYN, S, SAVE, SCOR, SLAB, ST, TRW, UBSI, UDR, UTHR, VAC, VLO, WAT, WDR, WRLD, WWW, XYL

Notable earnings after today’s close: ACE, ACHC, ACMP, AEC, AEGN, AFL, ANIK, ARI, AUY, AXS, AZPN, BGFV, BOOM, BXP, CALX, CAP, CEB, CEMP, CHE, CHRW, CLD, CMRE, CNQR, COLM, CRAY, DLB, DNB, DWA, EBAY, EEFT, EIX, EPR, ESRX, EZPW, FARO, FEIC, FISV, GMED, GNW, GPRE, HURN, IPHI, LOGM, MAC, MAR, MEOH, MWA, NANO, NATI, NCR, NDLS, NFX, NUVA, OHI, OI, PNRA, PRXL, REXX, RFMD, RNG, RNR, RPXC, RVBD, SIMG, SKT, SLCA, SM, STR, STX, SWI, TE, THG, TMH, TRLA, TRN, TTS, TWTR, ULTI, USNA, VNR, VPRT, VRSK, WSH, X, XCO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 29)”

Leave a Reply

You must be logged in to post a comment.

Looks like they accomplished all of my possible scenarios in one day.

They closed the day with a rally off a level that I thought was a low possibility of hitting. Interesting.

From here, I do expect a pullback after a gap up open.

That should come down to SPX 1869 ~. Possible bounce from there.

But if 1868 breaks, then likely they’ll take it to 1864.

If so, they need to bounce at or above 1860.

If ANY of those levels are held, we should go to 1880.

If NONE of those levels are held, it’s likely they’re taking it down to yesterday’s low or even lower to 1848-9.

If 1839 is broken, then we’ve got a new ball game.

Some days are straightforward, today is not one of them.

Futures went to +6.75 overnight, at 8:50 am: +4.75