Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan rallied almost 2%, India 1.4%, South Korea 0.9% and New Zealand 0.7%. Europe is currently mixed. Germany is up 0.7% and Russia 1.4%. Prague is down 1%, and Greece and Italy are down 0.6%. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

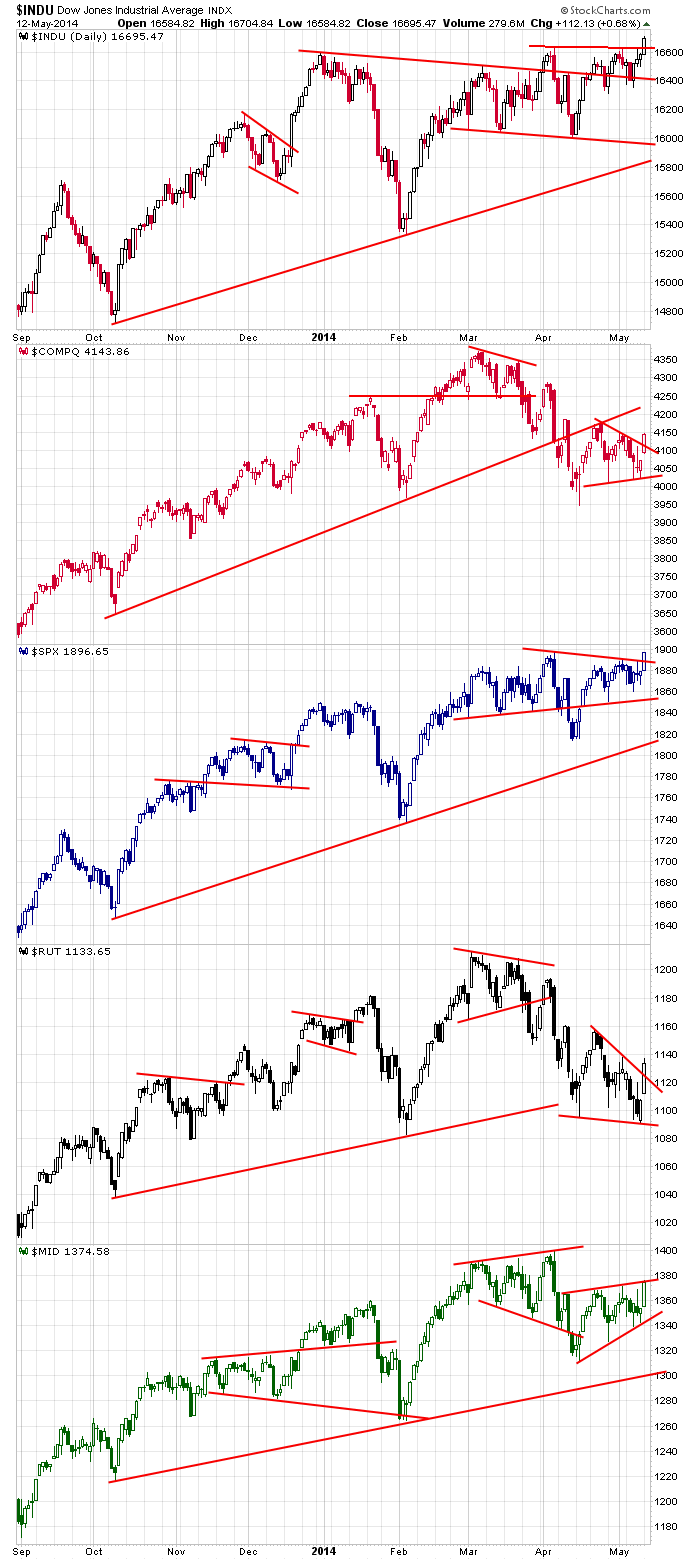

Big move up for the market yesterday…and it was the Nas and Russell 2000 which led the way. The Dow and OEX are at new highs…the SPX is not far behind. The mid caps are at their highest level since early April. Overall it was a great day…the best up day since the April bottom, and I think it will continue.

Even if the market’s hidden agenda is to move down, it should follow through enough to lure in more bulls and cause the bears to panic and cover their shorts. Then it’ll move down.

But if this is the beginning of a real move, a move that takes the S&P up to 2000, I’ll want to see the breadth indicators continue to improve and our comparison charts (small caps vs large caps, growth stocks vs. value stocks, Nasdaq vs. NYSE) turn around. Otherwise I doubt a rally has legs.

Here are the daily charts. Every rally begins with a single up. That’s what we got yesterday. Can the bulls continue to apply pressure?

Stock headlines from barchart.com…

Coca-Cola (KO -0.12%) increased its stake in Keurig Green Mountain Coffee Roasters (GMCR +2.07%) to 16%.

Brookdale Senior Living (BKD +0.36%) was added to short-term ‘Buy’ list at Deutsche Bank.

UBS kept its ‘Buy’ ratinng on McDonald’s (MCD -0.07%) and raised its prices target on the stock to $120 from $107.

CST Brands (CST +1.62%) reported Q1 EPS of 14 cents, below consensus of 19 cents.

QIAGEN (QGEN +0.81%) was upgraded to ‘Neutral’ from ‘Underweight’ at HSBC.

Concho Resources (CXO -3.38%) was downgraded to ‘Hold’ from ‘Buy’ at Wunderlich.

Elbit Systems (ESLT +2.71%) reported Q1 EPS of $1.22, higher than consensus of $1.0.7

DirectTV (DTV -0.97%) rose over 8% in after-hours trading after Bloomberg reported that AT&T (T +0.36%) is in talks to buy DirecTV for approximately $100 per share.

Babcock & Wilcox (BWC +0.49%) reported Q1 adjusted EPS of 42 cents, right on consensus, but reported Q1 revenue of $662 million, below consensus of $704.81 million.

Convergys (CVG +1.95%) reported Q1 adjusted EPS of 32 cents, higher than consensus of 29 cents.

McKesson (MCK +1.89%) advanced over 2% higher in after-hours trading after it reported Q4 EPS of $2.55, better than consensus of $2.40.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:30 Retail Sales

8:30 Import/Export Prices

8:55 Redbook Chain Store Sales

10:00 Business Inventories

Notable earnings before today’s open: CST, DCIX, ECA, IDRA, INSY, REN, RICE, WIX

Notable earnings after today’s close: CNAT, FOSL, NTWK, PETX, PLAB, SYNC, TTWO, URS, YUME

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 13)”

Leave a Reply

You must be logged in to post a comment.

New closing high for SPX Monday.

Today could easily pullback to several levels of support, then bounce.

Anything lower than 1881-1875 would make me look closer.

Targets are all above 1900, and as I said April 24, “I actually have one 1936.”

Futures were +4 (high of the night) at 7 am. Have fallen off to +1 at 8:55.

Earth has been sold to Mars,to pay off earths giant debt

nas 100,rut,dax and all tech’s should rally as the marians are a race of robots,

and no doubt will buy out all the tech companies

however the marians beleive humans are a inferior race and secretly intend to pull out the atmospher to earth

this is the begining of the end but will take 10 years to reach zero usd for equities

cheif robotic bear

no put/call ratio report for option expiring week? Looks like Market(s) will remain at inflated level through weekend to cause max pain and then recede to lower levels. Thoughts?

I forgot to do it Monday, and at this point, it’s too late. Options expire in two days. Next month.