Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mixed. Japan dropped 1.4%, Australia 0.6%. India rallied 0.9%, Indonesia 0.8%. Europe is currently mostly down. Italy is up 0.6%; Greece is down 2.1%, France 1.4%, Austria 0.9%, Amsterdam and Norway 0.5%. Futures here in the States point towards a small down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

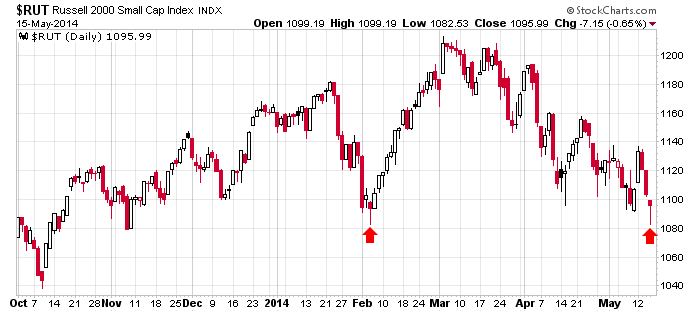

The small caps staged an impressive turnaround yesterday…they still closed down on the day but well off their lows. In the past, such action has led to more buying in the near term – sometimes lasting a couple days, sometimes lasting much longer. Here’s the Russell 2000 daily chart.

Options expire today. It’s been many years since this day has influenced the market. Whatever positions traders have needed to square off or roll to the next month has likely already happened. There are too many other external factors much more powerful than this day, so I wouldn’t expect any weird or noticeably different movement. But this day has had a tendency to act as a turning point, but there isn’t a clear trend heading into today. The SPX hit a new high three days ago and is already 30+ points off its high.

My stance stays the same. In the very near term anything goes. This is always the case. You have to be ready for anything and very flexible to the situation if you trade day to day. Over the intermediate term (next couple months) the path of least resistance is down until the small caps, growth stocks and Nasdaq improve. Can the Dow, SPX and OEX hit a new high again soon? Sure, but there won’t be much follow through unless we see more broad-based strength. More after the open.

Stock headlines from barchart.com…

Torchmark (TMK -0.99%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill.

Kansas City Southern (KSU -1.85%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Bank of the Ozarks (OZRK +0.02%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James.

Prudential (PRU -2.98%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Union Pacific (UNP -0.57%) announced a two-for-one stock split and approved an additional $150 million in capital expenditures that will bring total 2014 capital spending to $4.1 billion.

Verizon (VZ -0.10%) climbed nearly 2% in after-hours trading after Berkshire Hathaway disclosed that it has a 11 million share stake in the company.

Dillard’s (DDS -1.91%) reported Q1 EPS of $2.56, higher than consensus of $2.41.

Nordstrom (JWN -0.63%) rose over 10% in after-hours trading after it reported Q1 EPS of 72 cents, better than consensus of 68 cents.

J.C. Penney (JCP -2.79%) surged over 18% in after-hours trading after it reported a Q1 EPS loss of -$1.16, a smaller loss than consensus of -$1.25.

Autodesk (ADSK -0.52%) jumped over 5% in after-hours trading after it reported Q1 EPS of 32 cents, well above consensus of 21 cents.

Applied Materials (AMAT -1.37%) reported Q2 adjusted EPS of 28 cents, right on consensus.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Housing Starts

9:55 Reuters/UofM Consumer Sentiment

11:50 Fed’s Bullard: U.S. Economic Outlook and Monetary Policy

Notable earnings before today’s open: CMGE, CSIQ, CSTM, TNP

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 16)”

Leave a Reply

You must be logged in to post a comment.

I said on Tues “Anything lower than 1881-1875 would make me look closer.”

We broke that and all support including significant support at 1870. Thursday’s low is a

good indicator of direction: If it holds (and it might today, glimmer of hope for bulls.

If it doesn’t, then we’re

headed down to at least the low 1800s, circa 1810-20.

FYI, if the layer of resistance at 1874 thru 1877 can be broken today, it would be a victory for bulls.

And if that resistance is broken, expect a pullback before a further climb. Usual pattern. If the pullback fails, then you know we’re headed lower.

Never know — when they decide it’s time for “sell in May and go away ” it’s time to get out of the way.

Futures have been subdued all night. +1.25 was the high and -5.25 was the low.

At 9 am, -1.00