Good morning. Happy Wednesday.

The Asian/Pacific market leaned to the downside. China and Indonesia moved up; Japan, India, Taiwan and New Zealand moved down. Europe is currently mixed. Russia, Greece and Italy are up; Austria and Prague are down. Futures here in the States point towards an up open for the cash market.

Get reports like this sent directly to you…join our email list.

The dollar is up slightly. Oil is up, copper down. Gold and silver are down.

After two consecutive up days – albeit on declining volume – the market turned around yesterday and almost gave back all the gains. Rallies get sold, dips get bought. The indexes are signing different songs, and the indicators show small signs of improvement but are pointing down overall.

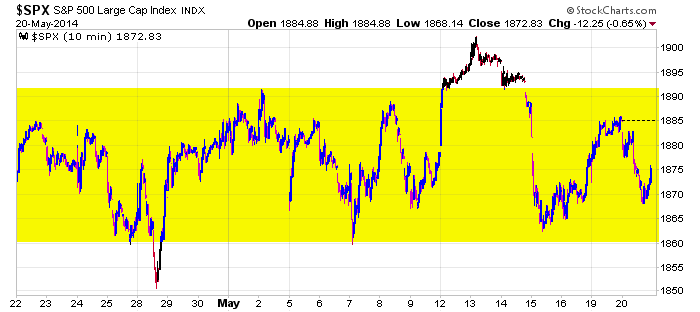

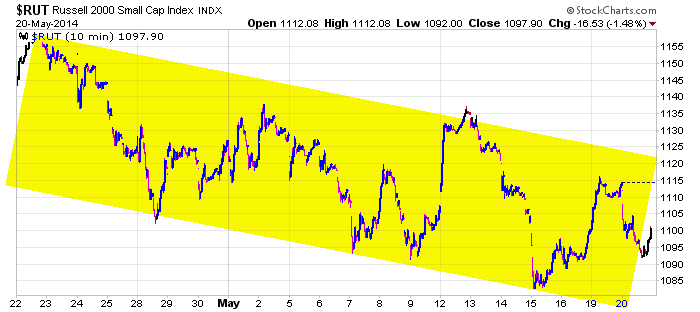

The battle between the large and small caps continues – a winner has yet to be determined. Here are the SPX and RUT charts going back one month. In both cases most of the price movement has taken place within a range – but the RUT’s range slants down. This has been the market’s issue. Even though the large caps hit a new all-time high last week, the small caps lagged by a wide margin. Until this divergence resolves itself, the upside potential will be kept in check.

From a swing trading standpoint – those of us who wish to hold for a couple weeks or possibly longer – our best course of action is to lay low. That doesn’t mean we don’t trade; it just means smaller positions are in order and expectations for big moves are brought down.

Preserve capital. Don’t force trades.

Stock headlines from barchart.com…

Tiffany (TIF -2.78%) reported Q1 EPS of 97 cents, well above consensus of 78 cents.

Raymond James (RJF -1.88%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Citigroup raised its price target for ConocoPhillips (COP +0.14%) shares to $100 from $85 and keeps a ‘Buy’ rating on the stock.

Booz Allen (BAH -0.57%) reported Q4 adjusted EPS of 33 cents, higher than consensus of 31 cents.

TJX (TJX -7.62%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Hormel Foods (HRL -1.10%) reported Q2 EPS of 52 cents, below consensus of 56 cents.

Lowe’s (LOW -0.07%) reported Q1 EPS of 58 cents, weaker than consensus of 60 cents.

Pratt & Whitney (UTX -1.67%) says it has 5,500 orders in backlog for geared turbofan engines.

Dycom (DY -3.18%) reported Q3 EPS of 23 cents, better than consensus of 22 cents.

Salesforce.com (CRM -0.64%) reported Q1 adjusted EPS of 11 cents, higher than consensus of 10 cents.

Analog Devices (ADI unch) rose 1% in after-hours trading after it reported Q2 EPS of 59 cents, higher than consensus of 56 cents.

Amgen (AMGN +0.12%) announced that The New England Journal of Medicine published results from a Phase 1 study that showed ‘positive’ data for asthma treatment with Amgen’s 157 drug.

Intuit (INTU -0.30%) slipped nearly 4% in after-hours trading after it reported Q3 EPS of $3.53, better than consensus of $3.50, but then lowered guidance on Q4 EPS to 6 cents-8 cents, below consensus of 12 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Fed’s Williams: “Job gains and Economic Conditions”

10:30 EIA Petroleum Inventories

11:30 Janet Yellen speech

12:50 PM Fed’s George: “U.S. Economy and Banking”

1:30 PM Fed’s Kocherlakota Speech

2:00 PM FOMC minutes

Notable earnings before today’s open:AEO, BAH, EV, HRL, LITB, LOW, MMYT, NM, PETM, QIWI, TGT, TIF, TSL

Notable earnings after today’s close: ANW, BRS, EGHT, GA, LB, NTAP, RENN, SINA, SMTC, SNPS, VVTV, WSM, WSTL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers