Good morning. Happy Tuesday.

The Asian/Pacific markets leaned to the upside. Hong Kong, Japan, India and Indonesia did well; Australia led to the downside. Europe is currently mostly down. Spain, Italy, London, Austria and Germany are down the most. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down. Oil is flat, copper down. Gold and silver are up.

The first day of the week did nothing to change the market’s mixed picture. There’s still a lack of clarity, a lack of obvious direction.

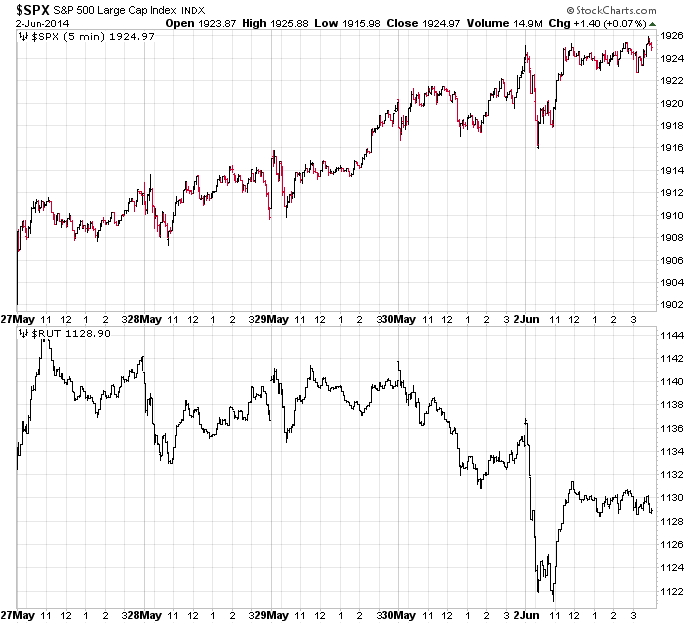

Case in point, the S&P 500 hit a new 5-day high yesterday; the Russell 2000 hit a 5-day low.

The small caps have been lagging for a couple months. Everyone knows this. I haven’t seen a single financial media outlet that hasn’t discussed this divergence at least once. In the old days, this would have been a no-brainer short, but in today’s world where such occurrences are known by all market participants, playing out by the book happens much less frequently. I’ve seen it with technical indicators; I’ve seen it with historical tendencies; I’ve seen it with divergences.

At best the market remains mixed. Its next forceful move is not yet known…there are hints supporting both a rally and drop. In my eyes, the next couple weeks are not clear. Don’t force trades. Preserve capital.

Stock headlines from barchart.com…

Dollar General (DG +0.97%) reported Q1 EPS of 72 cwnts, below consensus of 73 cents.

Clovis (CLVS -6.76%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Broadcom (BRCM +9.32%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Lam Research (LRCX +0.44%) was initiated with a ‘Buy’ at Jefferies with a price target of $75.

Merion Investment reported a 9.0% passive stake in Zale (ZLC unch) .

Lockheed Martin (LMT +0.28%) was awarded a $914.7 million government contract for engineering, manufacturing and development, production and deployment for the Space Fence program.

Steadfast Capital reported a 5.2% passive stake in Tesoro (TSO -0.21%) .

Applied Materials (AMAT +1.63%) was initiated with a ‘Buy’ at Jefferies with a price target of $28.

Kroger (KR -0.48%) was initiated with an ‘Outperform’ at Oppenheimer with a price target of $55.

Quiksilver (ZQK -2.53%) plunged over 30% in after-hours trading after it reported a Q2 adjusted EPS loss of -15 cents, a much wider loss than consensus of -2 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:45 ICSC Retail Store Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Factory Orders

11:00 Global Manufacturing PMI

1:50 PM Fed’s George: Monetary Policy

Notable earnings before today’s open: DG, GIII

Notable earnings after today’s close: ABM, AMBA, ASNA, DATE, FCEL, MFRM, RENT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 3)”

Leave a Reply

You must be logged in to post a comment.

Spring summer 1998 was the last time small caps diverged so badly. The market traded sideways for a while then in September and October we has two MOABOS. I still wish I would have held after the October low as the NASDAQ went up by a factor of four in 18 months.

Buy low sell hi if you cannot sell hi and buy low.