Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. India rallied 1.4%; Australia, New Zealand and Singapore also did well. Hong Kong, China and Korea dropped. Europe is currently mixed. Spain is leading the way with a 1.1% gain; Austria, Amsterdam, London, Germany and France are also doing well. Futures here in the States point towards an up open for the cash market (prior to the release of the employment numbers).

The dollar is up slightly. Oil is up, copper is down. Gold is flat, silver is down.

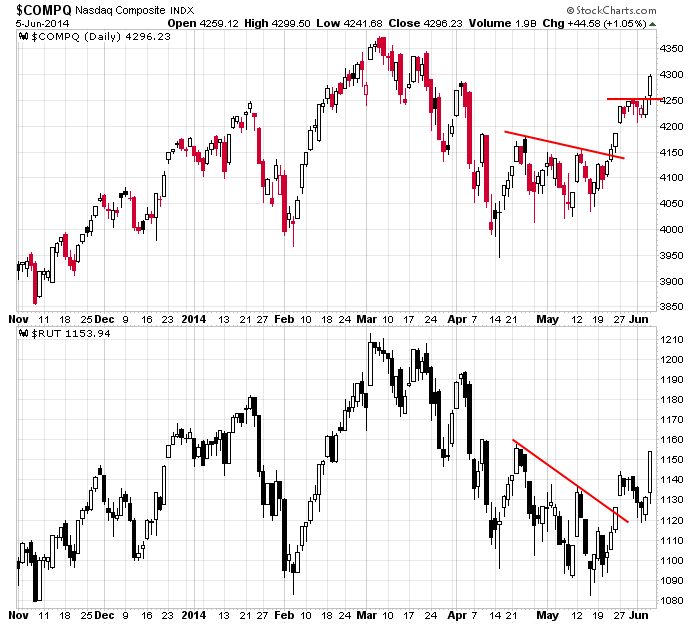

The market exploded yesterday…well, it exploded relative to the slow, low volume, low volatility movement we’ve had recently. The Nas and Russell led the way, and the S&P hit a new all-time high for the 7th time in 8 days. My bias remains to the upside.

Here are the employment numbers…

unemployment rate: 6.3% (was 6.3% last month)

nonfarm payrolls: +217K

private payrolls:

average workweek: unchanged 34.5 hours

hourly wages: up 0.2% cent to $24.38

labor participation rate drops to 62.8% (unchanged)

On the news the S&P futures moved up a couple points…not a big reaction.

There has been lots of technical improvement. Unless something unexpected happens, the trend should continue. Don’t fight it. We’ve had lots of great trades lately. More after the open.

Stock headlines from barchart.com…

Herman Miller (MLHR +2.36%) was upgraded to ‘Buy’ from ‘Neutral’ at Longbow.

Joy Global (JOY +6.66%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Humana (HUM -0.71%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Peabody (BTU +1.97%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

NBC News reported that The Beastie Boys won a $1.7 million verdict in a copyright dispute with Monster Beverage (MNST -0.12%) .

Men’s Wearhouse (MW -0.54%) reported Q1 adjusted EPS of 69 cents, better than consensus of 67 cents.

Muirfield Capital reported an 8.8% passive stake in DFC Global (DLLR +0.64%) .

Vail Resorts (MTN +1.14%) reported Q3 EPS of $3.18, stronger than consensus of $2.92.

VeriFone (PAY -0.09%) rose over 4% in after-hours trading after it reported Q2 adjusted EPS of 37 cents, higher than consensus of 33 cents.

Cooper Companies (COO +0.03%) reported Q2 non-GAAP EPS of $1.64, better than consensus of $1.60.

Gap (GPS +0.10%) reported May net sales up 4% y/y to $1.27 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Non-farm payrolls

3:00 PM Consumer Credit

Notable earnings before today’s open: JOSB

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 6)”

Leave a Reply

You must be logged in to post a comment.

BLS has spoken. Reaction was IMHO muted.

They keep driving it higher, tho. Ok, fine. Here are the levels to watch today.

Support: 1941 (after an expected gap up at the open) down thru 1939. If broken, several levels below:

1934, 1930, 1926.

I’m having a hard time seeing any resistance other than the high that the futures created after the 830 reports which equates to SPX 1945-46, and that is above Thurs’ record high. In other words, if the futures hold til the bell, we will open in uncharted territory.

I don’t know when, but what goes up must come down. In the meantime, we play what we see.

Futures were + all night, peaked at +5.25 at 830, fell off a bit, now +4.00 at 9 am.