Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. China, Indonesia and Korea rallied more than 1%; Hong Kong, Malaysia and Taiwan also did well. Japan dropped 0.85%. Europe currently leans to the upside. Greece and Switzerland are leading; otherwise gains are small, and there are no big losers. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is up, copper is down. Gold is up, silver is down.

The indexes posted across-the-board gains yesterday. Gains were mostly small, but it was nice to see the small caps continue to lead.

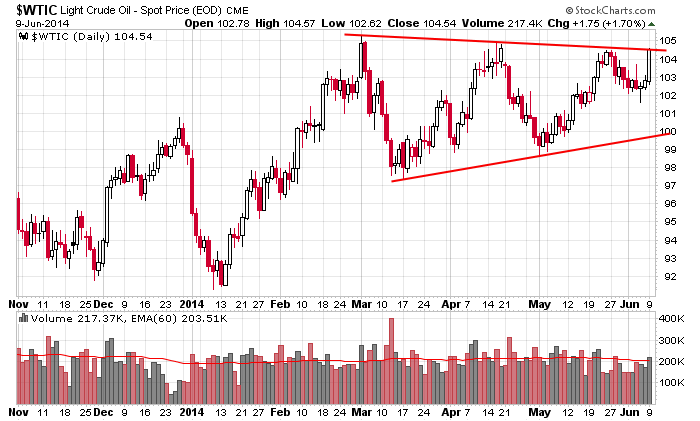

The most noteworthy action came from oil, which is now sitting at the top of a large symmetrical triangle pattern. Oil has been our #1 group the last month – in fact there were a few times where most of the set ups on the Long List were oil & gas companies – and if oil breaks out from this pattern, we’re going to continue getting a lot of plays from the group.

Let’s see…

The S&P is up 13 of 16 days and has made a new all-time high 9 of the last 10 days.

The financials have moved up 14 of 16 days.

Tech is up 17 of 23 days.

Semis are up 13 straight.

Some pretty consistent buying. Overall I continue to like the market and think it will be higher in a month or two than it is right now, but in the near term, the extent of the recent moves tells me the risk/reward for new set ups isn’t nearly as good as it was a month ago. Don’t get careless with your entries…manage positions wisely. More after the open.

Stock headlines from barchart.com…

Tyson Foods (TSN -6.53%) was downgraded to ‘Underperform’ from ‘Neutral’ at Credit Suisse.

SAIC (SAIC -1.22%) reported Q1 EPS of 69 cents, higher than consensus of 66 cents.

Colgate-Palmolive (CL +0.62%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital.

Twitter (TWTR +3.42%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Wells Fargo.

ConocoPhillips (COP +0.01%) was initiated with a ‘Buy’ at Deutsche Bank with a price target of $94.

Union Pacific (UNP -49.40%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

Urban Outfitters (URBN +0.81%) said Q2 comparative sales to date are ‘approximately flat.’

HD Supply (HDS +0.84%) reported Q1 adjusted EPS of 20 cents, better than consensus of 18 cents.

Las Vegas Sands (LVS -2.16%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Netflix (NFLX -1.64%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Evercore.

Chico’s FAS (CHS -0.19%) jumped over 10% in after-hours trading after the Financial Times reported that the company is considering a sale to PE firms and going private.

eBay (EBAY -0.24%) fell 2% in after-hours trading after it announced that PayPal President David Marcus is leaving the company on June 27 to lead Facebook’s (FB +0.61%) messaging products.

Pep Boys ({=PBY reported Q1 EPS of 3 cents, well below consensus of 6 cents.

BlackRock reported a 11.3% passive stake in Washington Prime Group (WPG -0.05%) and a 10.1% passive stake in Quotient (QTNT +1.86%) .

PL Capital reported a 7.1% stake in Banc of California (BANC +1.15%) .

According to Reuters, International Game Technology (IGT +14.39%) hired Morgan Stanley to explore a sale and has attracted interest from rival gaming companies as well as private equity firms.

Casey’s General Stores (CASY +3.34%) reported Q4 EPS of 59 cents, better than consensus of 53 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Wholesale Trade

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $28B, 3-Year Note Auction

Notable earnings before today’s open: CBK, FRAN, HDS, RSH, SAIC

Notable earnings after today’s close: ULTA, UNFI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 10)”

Leave a Reply

You must be logged in to post a comment.

Sorry couldn’t post Mon. Medical situation, now settled.

The energizer bunny market keeps on going. Sooner or later there will be a pullback, and

we’ve kinda/sorta had one overnight.

There is a level of support at 1945-46 which extends down to 1942.50-1943.50.

If 1943.50 breaks, we are looking at a move down of about 20 SPX points.

If 1943.50 and that layer of support holds, they’ll be targeting 1960.

At this point you have to have in the back of your mind that “they’re” targeting 2000

as a nice round number.

Resistance will be at 1947-48, then 1951 thru 1953.

Futures were negative all night, as low as -5.50, now -3.5o just after 9 am.