Good morning. Happy Thursday.

The Asian/Pacific markets closes mixed with a bullish bias. Europe is currently up across the board. Futures here in the States suggest a small gap up open, but of course things can change between now and the open.

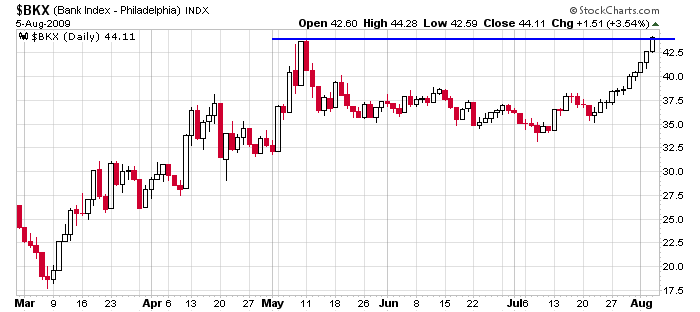

The big story this week has been the banking group and commodities. While the overall market has been largely range bound, the banking group has been up, up and away. Day after day the banks rally; they now sit at a new high … The US dollar has broken down, so most commodities have done well too. Here’s the banking chart.

It would be irresponsible of us to go short right now because the uptrend is super strong, but we must starting planning for an eventual pullback. The SPX moved up 125 points in 3 weeks. This pace cannot last. What will you do if the market pulls back? Hold in anticipation of a mild pullback followed by another leg up? Exit everything and look to re-enter in a few weeks or whenever the next bottom is established? I personally like to take it stock by stock. Anything that has shown signs of being weak (isn’t making new highs with the market) needs to be let go (when the market pulls back), but some stocks are strong and need to be held. They need to be given a chance. The big money is made riding the big trends, and most traders are better off holding than exiting and trying to re-enter. This doesn’t mean give back a large portion of your paper profits. It means if you have a cushion and the stock continues to act well, there’s no reason to initially panic when the market comes down.

As I’ve been saying for many days, the trend is up, but don’t get lazy. A pullback is coming soon.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases