Good morning. Happy Tuesday. It’s like a national holiday here in Costa Rica as the country gets ready for another World Cup game.

The Asian/Pacific markets did well. India and Korea led the way followed by China, Hong Kong, Indonesia and Malaysia. Europe is currently mixed. Prague and Greece are down more than 1%; Russia is up 1.5%. Futures here in the States point towards a flat open for the cash market.

Quick write-up today because my internet is down.

A quick review of a couple divergent charts posted over the weekend…

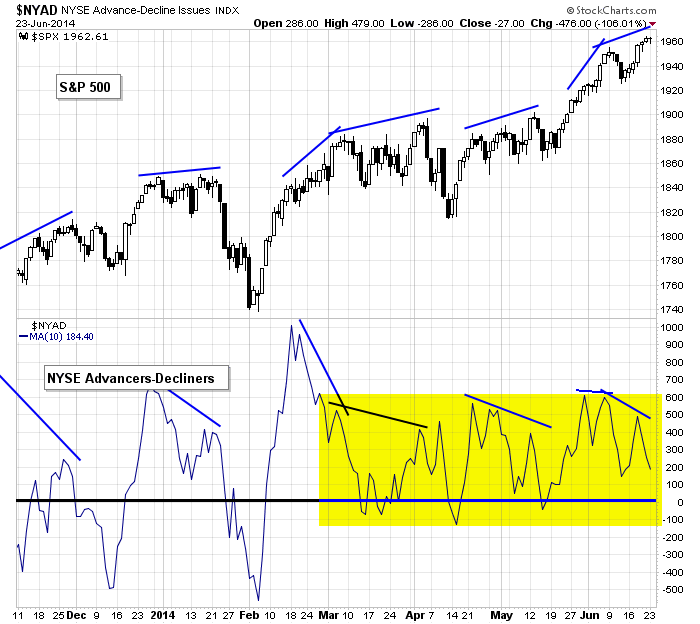

The S&P hit a new high while the 10-day of the NYSE AD line failed to match the movement…

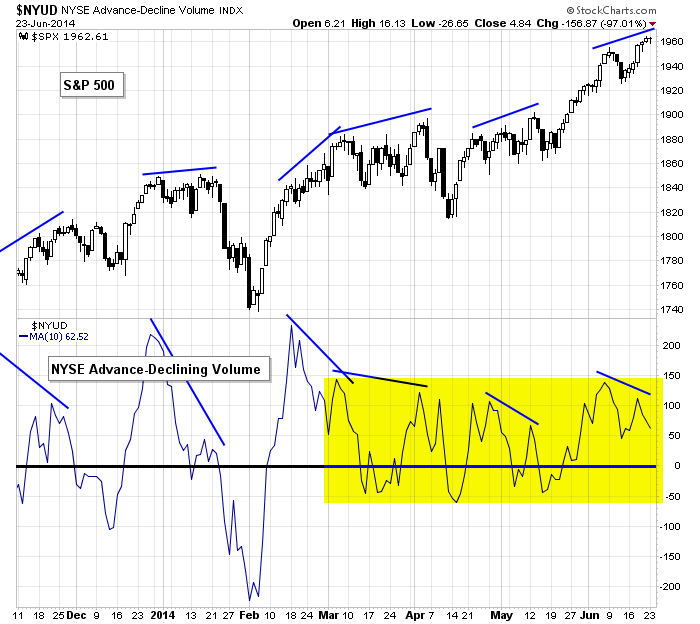

Same thing for the S&P vs. the 10-day of the NYSE AD volume line…

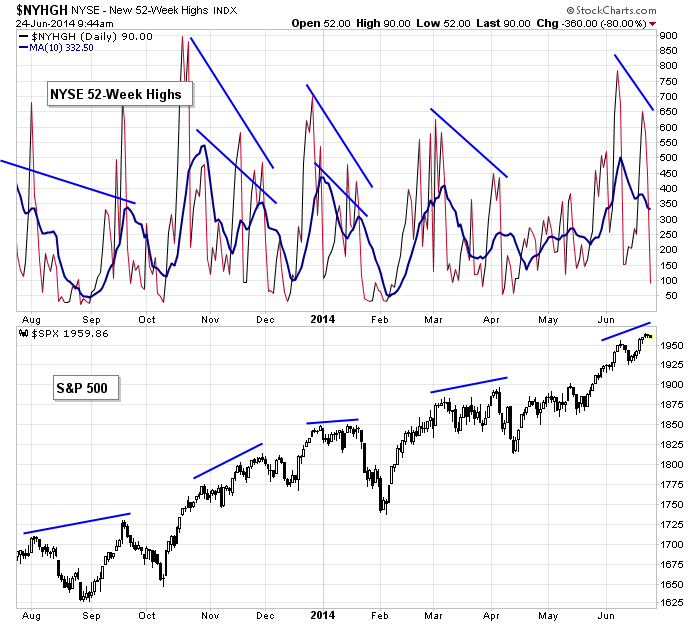

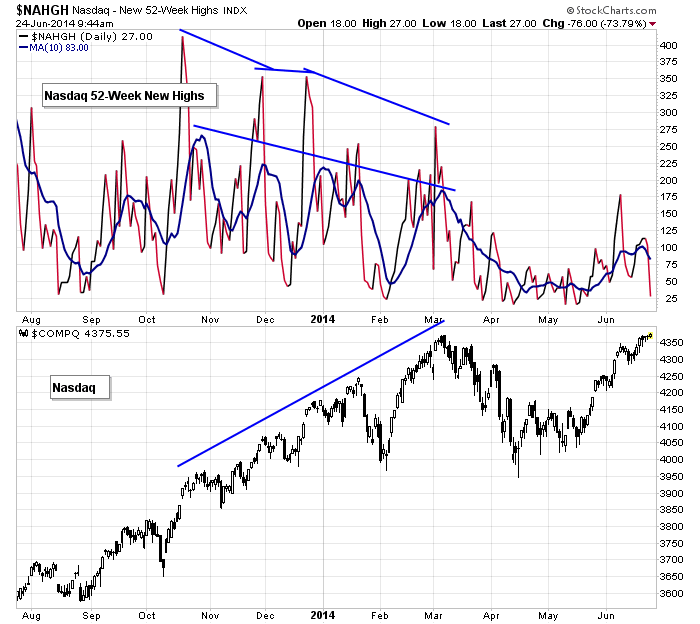

And both the NYSE new highs and NASDAQ new highs also put in lower highs…

Long term I like the market. Short term (next two weeks) I’m looking for a stall or minor drop. More after the open.

Stock headlines from barchart.com…

Walgreen (WAG -1.09%) reported Q3 EPS of 91 cents, below consensus of 94 cents.

IDEXX (IDXX +0.52%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord.

O’Reilly Automotive (ORLY -0.77%) was initiated with an ‘Overweight’ at Morgan Stanley with a price target of $175.

Dr Pepper Snapple (DPS -1.18%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

ITG (ITG -3.05%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

National Retail Properties (NNN -0.85%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Wells Fargo downgraded IntercontinentalExchange (ICE +1.71%) to ‘Market Perform’ from ‘Outperform.’

Aviva (AV -0.23%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Cray (CRAY -0.39%) announced that it has been awarded a $54 million contract to provide the Korea Meteorological Administration with supercomputers.

Dean Foods (DF -0.17%) fell over 7% in after-hours trading after Dow Jones reported that the company received subpoenas from federal authorities in an insider trading probe involving activist investor Carl Icahn.

SAB Capital Advisors reported a 9.4% passive stake in Famous Dave’s (DAVE -2.80%) .

Priceline reported a 5.1% stake in OpenTable (OPEN +0.35%) .

Micron (MU -1.85%) reported Q3 EPS of 79 cents, well above consensus of 70 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:05 Fed’s Plosser: Monetary Policy and Economic Outlook

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

10:00 New Home Sales

1:00 PM Results of $30B, 2-Year Note Auction

Notable earnings before today’s open: CCL, WAG

Notable earnings after today’s close: APOG

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 24)”

Leave a Reply

You must be logged in to post a comment.

Great analysis. Agree 100%.

I use different methods but love when the answer is the same.

Just now getting to post for today. Will post what I prepared at 9 am, then add an afternoon update below it.

Es De, thanks for your kind words. Took Monday off, kind of a yawner. Market had to retrace last week’s gains.

Today, resistance from 1961-1963. If we can’t get thru 1963, target below is 1951.50.

Overnight, they’ve bounced it at a support level: 1955 which extends lower to 1952. As long as that holds, target is 1969+.

Futures were negative all night, low of -6.

AFTERNOON UPDATE

We went straight up and broke the resistance in a big way this morning. However, we came straight back down to where we started. Technically, we shouldn’t have gone below 1960-61.

Now testing the support level at 1955 to 1952. Keep an eye on that level in the last 2.5 hours today.