Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong, China and India rallied more than 1%; Korea, Taiwan and Japan also did well. Indonesia dropped 0.85%. Europe is currently up across-the-board. Russia is up 1.5%; France, Germany, Italy, Spain and London are also doing very well. Futures here in the States point towards a relatively big gap up for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver up.

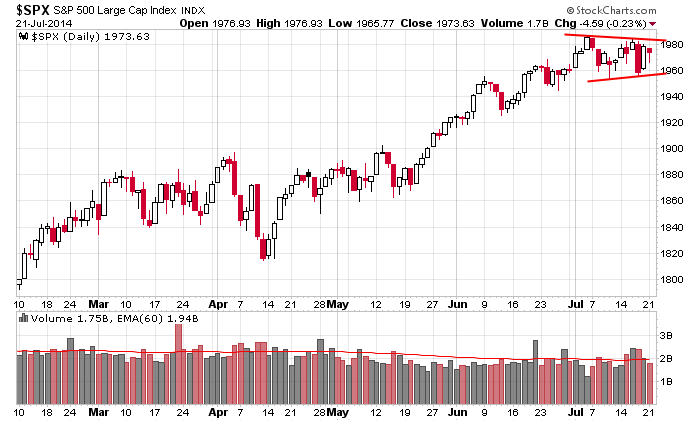

Yesterday had the potential to be a key day. What was the market’s true color…last Thursday’s big sell-off or Friday’s big rally? Heading into this week neither the bulls nor bears were in total control, so given options expiration being behind us and a new week beginning, either buyers or sellers could have taken over. But not enough happened yesterday to give us a definitive answer. The market was weak early and strong late, and although most of the indexes loss ground for the day, the losses weren’t great enough for me to believe the bears were in control. This shifts the day’s potential importance to today, where again, either the buyers or sellers could step up and take control.

Yesterday the bears started with the advantage because the market gapped down. Today the bulls will start with the advantage because of a big gap up. Can they hold the gains and build on them? We’ll see. As I’ve said several times the last few days, if this were a stock, it might be on the Long List.

Don’t think too hard. The market could just move up and down in a range the rest of the summer. More after the open.

Stock headlines from barchart.com…

There are 17 of the S&P 500 companies that have reported earnings this morning and 12 of those companies beat earnings. Notable companies that beat earnings this morning are: Du Pont (DD -0.02%) (1.17 vs 1.168), Verizon (VZ -0.10%) (0.91 vs 0.90), United Technologies (UTX -0.52%) 1.84 vs 1.70), Comcast (CMCSA -1.32%) (0.75 vs 0.72), Harley-Davidson (HOG -0.33%) (1.62 vs 1.46), Ingersoll-Rand (IR -0.56%) (1.13 vs 1.10), State Street (STT -0.21%) (1.39 vs 1.26), Lockheed Martin (LMT +0.30%) (2.76 vs 2.66), and Coca-Cola (KO -0.07%) (0.64 vs 0.63). Companies with disappointing earnings included Rockwell Collins (COL +0.83%) (1.15 vs 1.17), Kimberly-Clark (KMB -0.87%) (1.49 vs 1.497), Travelers (TRV -0.08%) (1.93 vs 2.07), and Altria (MO -0.38%) (0.65 vs 0.656).

Amazon (AMZN +0.31%) is down -1.5% this morning after a downgrade to Neutral from Buy by Citigroup.

CIT Group (CIT +0.48%) will acquire OneWest Bank for $3.4 billion in cash and stock.

Herbalife (HLF -11.21%) volatility is high ahead of today’s presentation by Bill Ackman, again arguing the company is a fraudulent pyramid scheme.

Valspar (VAL -0.50%) was upgraded to a Conviction Buy from Neutral by Goldman.

Texas Instruments (TXN +0.72%) late yesterday reported Q2 EPS of 62 cents, above the consensus of 59 cents.

Netflix (NFLX +1.75%) rallied slightly late yesterday after reporting Q2 EPS of $1.15, close to the consensus.

Chipotle (CMG -0.42%) rallied 10% in after-hours trading after its earnings report.

Johnson & Johnson (JNJ -0.52%) rallied 1% in after-hours trading yesterday after announcing a $5 billion share repurchase program.

Rambus (RMBS +0.73%) fell more than 3% in after-hours trading yesterday after releasing earnings.

Crocs (CROX -0.13%) late yesterday reported Q2 EPS of 36 cents, above the consensus of 31 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 Consumer Price Index

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

10:00 Existing Home Sales

10:00 Richmond Fed Mfg.

Notable earnings before today’s open: ABG, AMTD, AOS, ARMH, ATI, BTU, CIT, CMCSA, CNC, COL, CS, CSL, DD, DFRG, DPZ, EDU, EXAS, FMER, GCI, HOG, HUB.B, IR, KMB, KO, LMT, LPT, LXK, MCD, MJN, MO, MOSY, NEOG, OMC, PII, PLD, RESI, RF, SAH, SBNY, SILC, SNV, STT, TRV, UTX, VZ, WAT, WRLD

Notable earnings after today’s close: AAPL, ACC, ACE, BRCM, CBST, CVA, DFS, EA, EXP, FBC, FNB, FTI, FULT, HA, HTS, IEX, IRBT, ISRG, JNPR, LLTC, MANH, MSFT, NBR, QDEL, RHI, TSS, UIS, VASC, VMW, XLNX, XOOM, ZIXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 22)”

Leave a Reply

You must be logged in to post a comment.

They’re up to their old tricks. A little activity in the morning followed by a yawner of an afternoon, then they zoom to target overnight. They hit what equates to SPX 1982-83 overnight, and have stayed up there for now, so we’ll have a gap up.

Where it goes from there: my bet is after the exuberance is over, they’ll head down. They can hold it higher — all day if they want to — but one thing you can say about “da boyz” and that is they are repetitive. Eventually they return to the mean. Might be today, might not. Those big down days are when they’re returning to the mean. As long as we bounce like we have since Friday morning.

The higher level of support is 1977/78 down to 1975/76 (the levels aren’t exact because the delta between futures and SPX has changed by a full point over the last week.)

The next level: 1973/74 down to 1971/72.

Bonds are slightly bearish. BKX is bullish.

Futures high was +9.75, now +9.25 at 920

adv 2225/dec 652 trin at 1.52 hmmmmmmmm

short some dia puts…its lagging…

BKX is solid bullish, bonds bullish too. Agree on TRIN. Despite the bullish readings, I “feel” like you do it’s lagging. There is one open target about 2 points above the high. Am thinking while we’re here and since we’re this close, they tag it. Never know. They might pause to reload and go higher.

10am high is holding.

It is, for now. I’ve got to leave for the rest of the day. I’d be surprised if they don’t tag the target (1 point higher than the 11 EST high) before the end of the day. Might take that long, too. See u tomorrow.

Jim, that high at 11 am was exactly 1 point shy of the target.