Good morning. Happy Friday.

Today, an hour before the open, the Labor Dept. releases the latest employment data, but I’m typing these comments before the numbers come out because I don’t think the data matters much.

The market often makes a decision ahead of time which way it wants to move, and the numbers are either ignored or embraced – whatever is convenient …

If the market wants to move up, it’ll move up regardless. If the numbers are good, the market may gap up and after a gap fill attempt it’ll be off to the races. If the numbers are poor, the market will gap down, rally to fill the gap, chop around, and then illogically rally.

If the market wants to move down, it’ll move down no matter what. A gap up will get sold while a gap down may initially get bought before the really move begins.

The decision has been made; the numbers don’t matter.

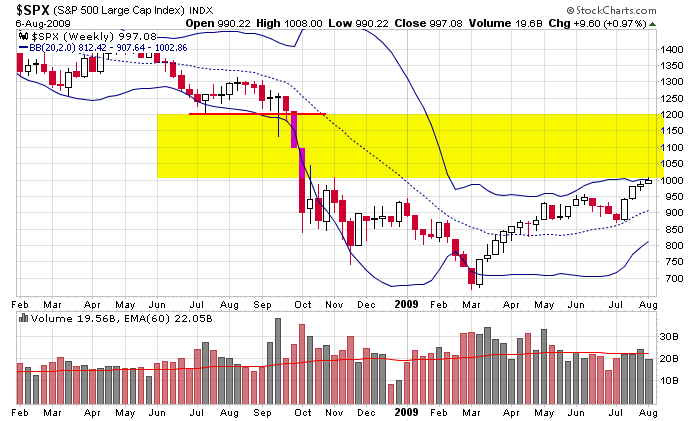

Here’s the weekly SPX. Barring a big sell-off, this’ll be the 4th consecutive up week, but given its proximity to the upper Bollinger Band and the bottom of a very thin area, the risk/reward for new longs isn’t great. An upward surge from here could be a false move. If the market wants to move up, I’d prefer some backing and filling first.

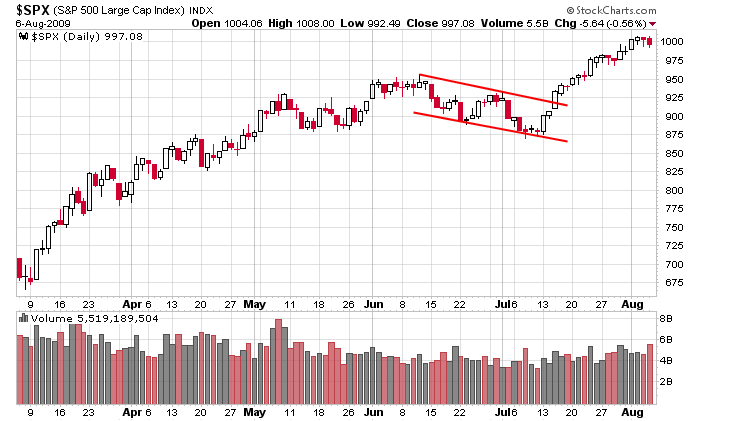

Here’s the daily. You can’t argue with the trend. Going short constitutes guessing a top which I don’t like to do. I’d rather let the price action be my guide rather than constantly guessing when a top will be established.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases