Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China moved up 0.9%, Singapore 0.6%. Taiwan dropped 1.4%, India 0.7%. Europe is suffering big losses. Greece is down 2.2%, Italy 2.1%, Spain and Belgium 1.5%, Austria 1%, Amsterdam 1.2%, Norway 1.1%, Germany 1.3% and France 1.1%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil is down, copper down. Gold and silver are down.

Here’s a repeat of what I stated yesterday…if left alone, without any outside influences, the market’s next move will be down.

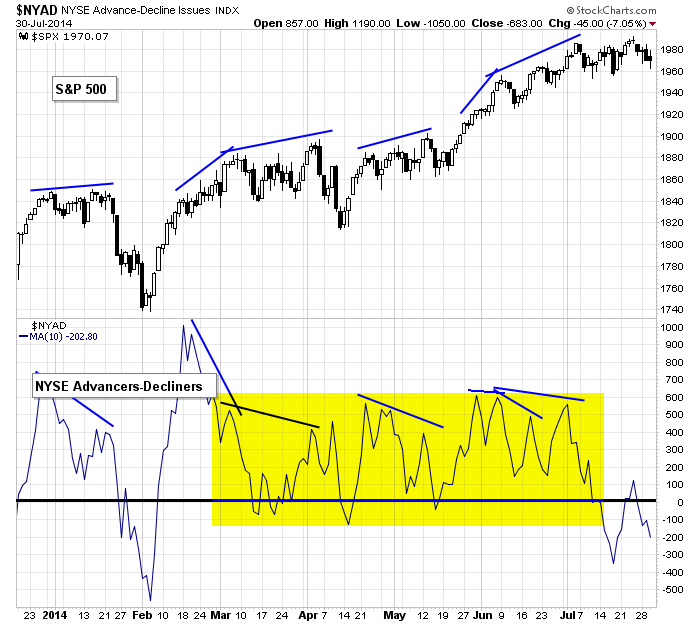

The 10-day of the AD line is back below 0. If it fails to move up soon, the path of least resistance will be down.

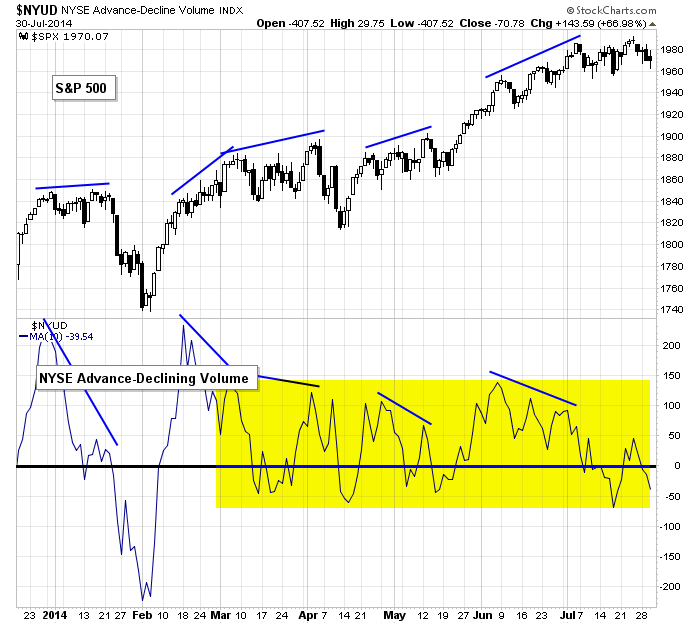

The 10-day of the AD volume line isn’t giving the bulls much room for error. Bounce or else lower prices are coming.

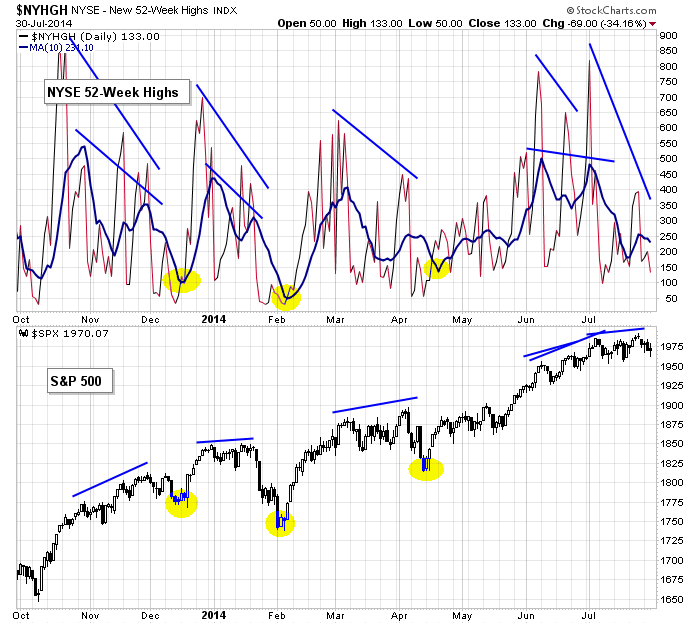

The low print from the new highs isn’t helping the bulls’ case.

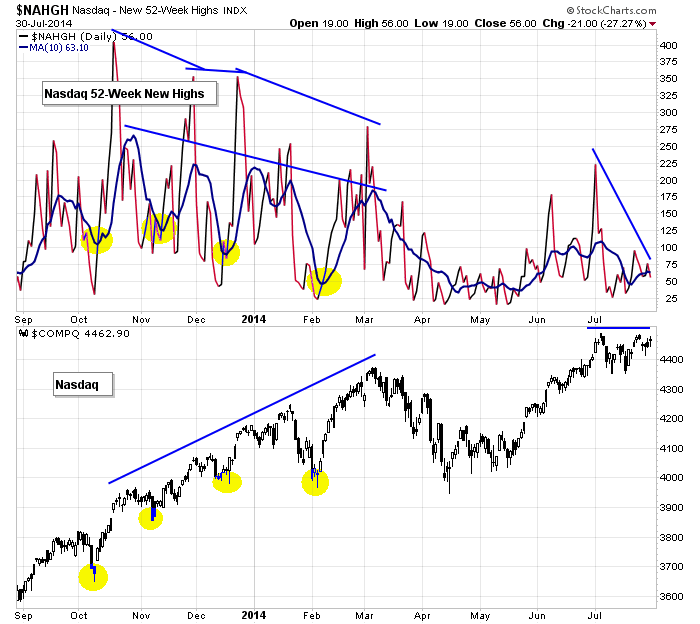

New highs at the Nas are also nowhere to be found.

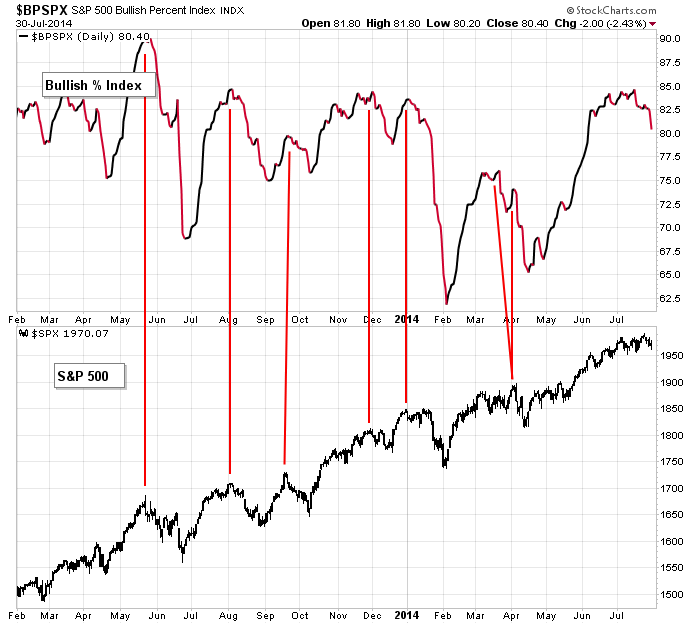

The SPX bullish percent is now trending down.

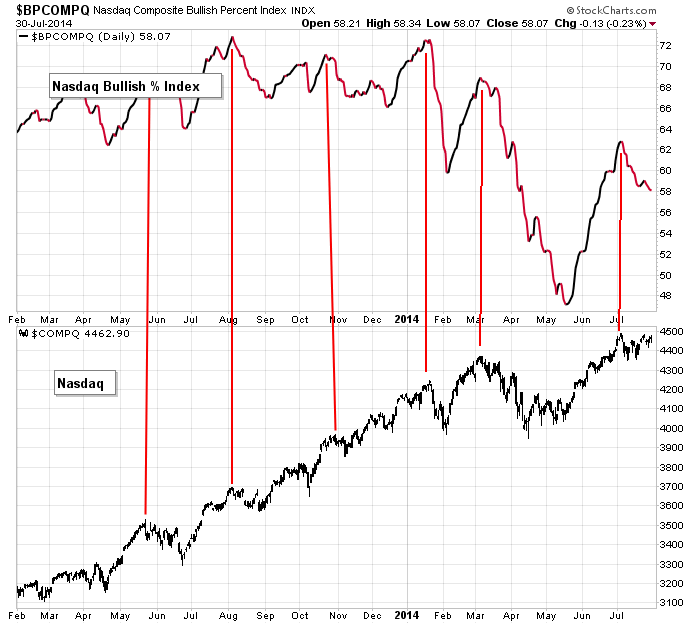

And the Nas bullish percent continues down.

Again, unless good news hits the market, the technicals say down.

Stock headlines from barchart.com…

CME Group (CME +0.44%) reported Q2 EPS of 77 cents, below consensus of 79 cents.

Avon Products (AVP +0.39%) reported Q2 EPS of 20 cents, weaker than consensus of 21 cents.

Con-way (CNW +0.19%) reported Q2 EPS of 91 cents, well above consensus of 75 cents.

Lam Research (LRCX -1.32%) reported Q4 adjusted EPS of $1.25, better than consensus of $1.23.

Western Digital (WDC +0.38%) reported Q4 EPS of $1.85, stronger than consensus of $1.74.

Unum Group (UNM -0.46%) reported Q2 EPS of 94 cents, higher than consensus of 87 cents.

Endurance Specialty (ENH -0.19%) terminated its offer to acquire Aspen Insurance (AHL -0.63%) .

Hologic (HOLX +1.68%) reported Q3 EPS of 37 cents, better than consensus of 34 cents, and then raisd guidance on fiscal 2014 EPS view ex-items to $1.44-$1.45 from $1.37-$1.40, higher than consensus of $1.40.

Allstate (ALL -0.28%) gained nearly 3% in after-hours tradng after it reported Q2 operating EPS of $1.01, well above consensus of 70 cents.

MetLife (MET +0.65%) reported Q2 EPS of $1.39, less than consensus of $1.41.

Kraft Foods (KRFT -0.90%) dropped over 2% in after-hours trading after it reported Q2 EPS of 80 cents, weaker than consensus of 83 cents.

Fortune Brands (FBHS +0.11%) reported Q2 EPS of 55 cents, higher than consensus of 54 cents, although Q2 revenue of $1.14 billion was slightly less than consensus of $1.17 billion.

Whiting Petroleum (WLL -0.13%) rose over 1% in after-hours trading after it reported adjusted Q2 EPS of $1.40, stronger than consensus of $1.28.

AMC Entertainment (AMC -0.31%) reported Q2 EPS of 32 cents, higher than consensus of 29 cents.

Whole Foods Market (WFM +3.80%) fell over 4% in afer-hours trading after it reported Q3 EPS of 41 cents, better than consensus of 39 cents, but then lowered guidance on fiscal 2014 EPS view to $1.52-$1.54 from $1.52-$1.56, at the low end of consensus of $1.53.

Akamai (AKAM +2.93%) reported Q2 EPS of 58 cents, higher than consensus of 55 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup US Payroll to Population

8:30 Employment Cost Index

9:45 Chicago PMI

10:30 EIA Natural Gas Inventory

3:00 PM USDA Ag. Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAWW, ABMD, ACIW, ACOR, ADP, AGI, ALKS, ALU, AMRC, APA, ASEI, ATK, AVP, AYR, AZN, BDX, BG, BGCP, BKCC, BLL, BUD, BWA, BZH, CCJ, CDW, CEVA, CHTR, CI, CL, CME, CNSL, COMM, COP, COT, CRCM, CRR, CTCM, CVI, CVRR, DDD, DISCA, DLPH, DTV, ENDP, EPD, EXC, FCH, FCN, FIG, FLY, FRM, GEL, GG, GIL, GLOP, GMT, GNRC, GTLS, H, HGG, HL, HP, HST, IDA, IMN, INCY, IRDM, IRM, ITT, IVZ, K, KMT, LKQ, LLL, LM, MA, MCK, MD, MDP, MNTA, MOD, MOS, MPC, MPLX, MSCI, MTOR, MWIV, NGD, NI, NJR, NWL, OAK, OCN, ODFL, OXY, PCG, PCRX, PES, PNR, PNW, PPL, PRFT, PWR, Q, RFP, RYL, SBH, SC, SCG, SFY, SHOO, SNAK, SNMX, STC, STRA, STRZA, SUP, SWC, TE, TEVA, TKR, TRP, TWC, UAN, UPL, USAK, VG, VICL, VNTV, VRX, WLT, WWE, XEL, XOM, XRAY

Notable earnings after today’s close: ABCO, ABTL, ACGL, ADNC, ADUS, AFFX, AHS, AIV, ARRS, ASH, AVD, AXTI, BAGL, BBG, BBRG, BEAT, BRKS, BYD, CALD, CERS, CPSI, CPT, CTRL, CYH, DATA, DCT, DGI, DVA, DXPE, EEP, EGO, EIX, ELLI, ESIO, EXEL, EXPE, FLDM, FLR, FLT, FNGN, G, GDOT, GFIG, GPRO, HME, HNSN, IMMR, IMPV, JIVE, JLL, KEYW, KOG, KRG, LNKD, LOPE, LRE, LYV, MATX, MCHP, MHK, MRC, MXL, MXWL, NGVC, NKTR, NU, OIS, OMCL, ONNN, OUTR, PCCC, PCYC, PKI, PMCS, PSA, PXLW, RMD, RMTI, SGEN, SKUL, SPF, SPWR, SREV, SSNC, STAA, SWIR, SWN, SYNA, THG, TNAV, TRLA, TSLA, TSYS, VCRA, WU, WWWW, YRCW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 31)”

Leave a Reply

You must be logged in to post a comment.

We have the answer to yesterday’s question. The FOMC announcement provided a big hint.

As Jason indicates, path of least resistance is down.

There is a layer of support at 1953 extending 1947.

Another layer begins at 1945 extending to 1944. Your guess as good as mine as to the odds of these holding.

There will be bounces, just as was seen in the second leg after the FOMC announcement when we moved up 13 SPX points in 15 minutes. The work of bears drawing in bulls.

From that high to the overnight low was 24 SPX points (roughly 240 Dow Jones points).

So, beware of bounces. We could see one today that takes us up to 1965 even to 1970.

Do not get bullish if that occurs.

Test the bullishness, watch the pullback that occurs. Rough numbers for now, but it needs to

hold 1960 on the pullback. Very rough estimate, and note that is 10 SPX pts below Wed’s close.

Futures were -17 at the low overnight. At 910: -14

Bonds, interestingly, are bullish.

NASDAQ futures (-30) indicate that NAS will be in sync with the Dow and SPX today.

Big day tomorrow: non-farm payroll numbers/unemployment rate. Released an hour before the bell.

The next two days are going to be interesting.

correction: the layer starting at 1945 extends to 1934, not 1944.

zaner support levels

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_16Jul310953_zps5cadfbdf.jpg

Starting the day at S2. For ES

es has to stay close to this 1947.50 area..ic the vix forming wave 5 up and wave 6 to 12.80 area(bottom of upward fork)

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_18Jul311017_zps5fe560a0.jpg

yea, i was one of those sucker bulls. had a small position, didnt like the pull back…thx for your insightful analysis..much appreciated…good hunting today..i love volatility…

Jim, nothing wrong with riding the long. Or a short. Once you’re up $ in the position, get your stop to B/even as soon as you can. Especially with futures. At the first sign of hesitation in the move, advance the stop for at least a small profit. (That’s advice learned by my own pain.)

vix double top area…

At some point all moves reverse. We are in that lower layer of support spx 1945-1934. Looking for some positive ticks

Positive ticks holding

i notice that also…

yeah, well that lasted like the proverbial snowball.

setup for tomorrows numbers before the open?

noticing some call options being bought here on dia

pc rising to .98

interesting here

es hour chart bottom forming candle

ES can’t go much lower than this if this budding up leg is to survive. Back after lunch.

Assuming the bottom holds, here’s some resistance that will get in the way of this up leg.

All numbers ES: 1942 (a moving avg, declining slightly).

Then 47.75, 52.75 and 58.

As for set up for tomorrow, Jim, my WAG (and I assume you know that acronym), it does look like they’re setting up for a jump at the payroll report, followed by a pullback. (I’ve studied more than 2 years of payroll numbers vs the Wed ADP report — there is no correlation between the two numbers. Since Friday’s is compiled by the BLS, now you know why I refer to it as the “BS from the BLS.”)

Back to today: They did respond to the lower half of that layer 1945-1934, which questions if it will be revisited. In other words, you want a definite snap reversal off the top of the layer. This subdued climb does not inspire confidence IMHO.

The 1934 SPX layer is technically broken

spx 1925 is bottom of the downward fork…brutal day

i guess they know something…no covering

The July account statements are not going to be pretty.

ru flat?

Sht 37.25 ES

nice…

There are two more layers below, first at 1911, second at 1891 (ES). However, I still do expect a bounce (whether dead cat or real) tomorrow. They’ve stretched this move pretty far. Anybody can see that.

yes, i will hold a few calls for the bounce.

“the path of least resistance will be down.”

Look for a washout.

has there been any war news out or is this a seasonal end month dump the junk to buy better junk next month or with the euro dropping the carry trade closing their positions

who cares –to busy trading the lovely volatility topping process

now Europe is closed we have started up –will it last

my tick indicator is showing a lessining of the tick extremes below 1000 and a intraday bullish divergence on the 5 and 2 minute time frames