Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Taiwan (up 1%), New Zealand (up 0.9%), Malaysia (up 0.6%) and Singapore (up 0.6%) led the way; Hong Kong (down 0.6%) was the sole down market. Europe leans to the upside, but not a single market has moved more than 0.5% from its unchanged level. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are up.

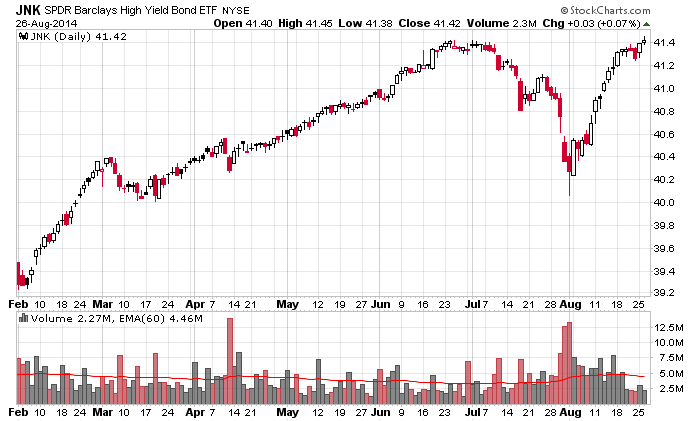

The S&P 500 (up 10 of 13 days) and Nas (up 11 of 13 days) hit new highs again yesterday. The Russell 2000, which has been lagging overall, led the way. This is the biggest technical warning we’re getting right now…and it shouldn’t be ignored. The small caps tend to lead the market up and down…their movement is an indication as to what Wall St’s appetite is for risk. When investors are feeling good, they take a chance on smaller, less-proven companies that have much more upside. When they’re not feeling confident, they stick with bigger, well-established companies. The lagging small caps is a warning, but their movement isn’t the only indication for risk appetite. The junk bond market also sends off clues, and right now that market is doing well. Here’s JNK, a junk bond ETF. It sold off hard in July but has since rallied all the way back.

So maybe the lagging small caps is not a sign investors don’t have the stomach for risk. Maybe it’s signalling something else.

In any case I still like the market, but with the lagging small caps and lack of upside movement of the bullish percent charts and new highs, we need to be selective with new trades right now. More after the open.

Stock headlines from barchart.com…

Tiffany & Co. (TIF +0.54%) reported Q2 EPS of 96 cents, better than consensus of 85 cents.

Brown Shoe (BWS +0.51%) reported Q2 EPS of 41 cents, higher than consensus of 35 cents.

Eli Lilly (LLY +0.13%) was initiated with a ‘Buy’ at Deutsche Bank with a price target of $71 and Pfizer (PFE +1.04%) was also initiated with a ‘Buy’ at Deutsche Bank with a price target of $34.

Waste Management (WM +0.17%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Facebook (FB +1.25%) was downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

Donaldson (DCI -0.15%) reported Q4 EPS of 50 cents, higher than consensus of 47 cents.

Rent-A-Center (RCII +0.95%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord.

Bristol-Myers (BMY +0.08%) announced that the European Commission has approved Daklinza for use in combination with other medicinal products across genotypes 1, 2, 3 and 4 for the treatment of chronic hepatitis C virus infection in adults.

Smith & Wesson (SWHC -0.08%) slumped over 10% in after-hours trading after it said its sees Q2 EPS of 4 cents-8 cents, well below consensus of 28 cents, and lowered guidance on fiscal 2015 EPS to 89 cents-94 cents, much weaker than consensus of $1.36.

FJ Capital reported a 5.87% passive stake in Sun Bancorp (SNBC +0.52%) .

Dycom (DY +1.20%) reported Q4 EPS of 48 cents, better than consensus of 47 cents.

Bob Evans (BOBE -2.73%) reported Q1 adjusted EPS of 10 cents, right on consensus, although Q1 revenue of $326.3 million was slightly below consensus of $328.61 million.

Analog Devices (ADI +0.54%) reported Q3 EPS of 63 cents, right on consensus, although Q3 revenue of $728 million was higher than consensus of $716.69 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: BF.B, BRLI, BWS, CHS, DCI, EXPR, ISLE, SDRL, TIF, YGE

Notable earnings after today’s close: BYI, CWST, GEF, GES, GMAN, LCI, TLYS, VMEM, VNET, WDAY, WSM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 27)”

Leave a Reply

You must be logged in to post a comment.

Jason

I like your junk bond comments.

My calculation is we have about 8 trading days to the top. Tops are very hard to calculate. Heard mentality is very hard to quantify as opposed to bottoms which are often more logically based.

We observed resistance at 2005 yesterday and have generated a lower level at 2002-2004.

Overnight, futures stabilized at 2000 SPX equivalent which if holds projects a target 2007, maybe a tad higher.

There are multiple layers of support below, so any pullback is likely to find a bounce.

A fresh 14 year high on NASDAQ yesterday, harkening back to Mar 2000. And, of course, a new all-time high for SPX.

The SPX target remains 2030 and if Daddy Paul is right with 8 trading days til the top, that is plenty of time to get there. We’ll find out in less than 2 weeks.

Futures were mild overnight, are +.75 at 920

gm mike, holy crap its a negative day…

yeah, can you believe it? I like it.

This area of bounce is one that I’ve been watching. Lots of resistance, however. Won’t be an easy climb. Can be done, but it’ll be a “labored” climb.

bkx 15m 100ma at 71.56

vix 15m 200ma at 11.95

es 93.5 i’ve got as support

i own T, it seems in most cases when T is up, market is down…

it always amazes me that a small amount of buy volume can move the price significantly.

If you can display your ES volume in 5 minute candles, take a look at the 1015 candle. That type of large volume is part of what I look for in a reversal. My IB feed says it was over 24K contracts.

es sept contract. ive at 10:15 a red volume at 17.5k…something is amiss with my ib data. or i that set up incorrectly/

here is the image of that chart..”x” marks the spot (10:15)

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_28Aug271111_zps79c48b32.jpg

For now, ignore the value, look at the 1015 candle and compare it to the 1010 and 1005: does it show a larger value than those two? (I display the volume as a bar below each candle — I pay more attention to the size of the bar than the actual value — I want to see relative volume for each 5 min candle. That make sense?)

ok, so im hung up on the color…actually the next 4 candle shows a level of support…

Let me add this: Once you’re in the direction of the trend, it is easy to keep it going on lower amounts/volume.

bkx not doing much

Definitely not helping.

Did you see my reply regarding volume at 10:09?

yes, i posted an image of the es chart

Rog, ok. Just wanted to point out the relative size of the candle. Not always, but often, a huge volume like that indicates a climax. Selling in this case and buying at a top. As you said on the other comment, you have to ignore the color, and I think you know what I mean about that. If it’s a selling climax, it will be red, but it can have bullish implications. Especially if it’s at a level of support. BTW, this didn’t get all the way to the level of support I was watching, they front-ran it by half a point, a bunch of eager beavers.

ok, thx very good lesson out the final climax and the reversal.

Roger that. Now that you know about it, you’ll see it happening more often. Another cue / clue as to what “da boyz” are doing.

feels like the boyz going to make a end of the day run up..

vix sold off and so didnt es, ym

Remember earlier I said they front ran the support level? That down draft penetrated it, so we’ll see if that holds thru the night until tomorrow.

yes ic es made new low..ym didnt

es 50% retrace 1996.5

Well, they got another close in the 2000s. A whole .10 higher than Tuesday. Golf clap in appreciation for their skill.

have a great evening..

You too. Tomorrow.