Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mostly down. China rallied 0.85%, and New Zealand moved up 0.5% while Australia dropped 0.6%, and Korea dropped 0.3%. Europe is currently mostly down. Stockholm is down 0.8%, Switzerland 0.7%, London and Norway 0.6% and France 0.5%. Russia and Greece are up 0.6%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is flat. Oil is down slightly, copper is up. Gold and silver are up.

Here are the employment numbers…

unemployment rate: 6.1% (was 6.2% last month)

nonfarm payrolls: +142K (smallest gain since December) (+228K was expected)

private payrolls:

average workweek: unchanged 34.5 hours

hourly wages: up 0.2% cents to $24.53

labor participation rate drops to 62.9% (was 62.8% last month)

July number revised from 209K to 212K.

June number revised from 298K to 267K.

S&P 500 futures jumped 6 points on the news, so instead of suggesting a moderate gap down, they now point towards a flat open.

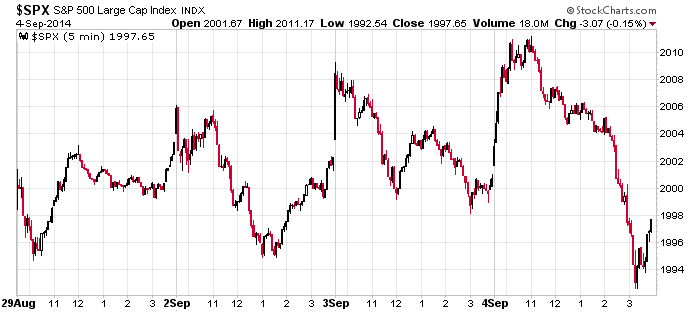

Here’s the 5-min S&P chart for this week (plus last Friday). Each day the market was strong early (and put in a new all-time high), but each time the gains were given back. No doubt the invisible hand of the market is trying to shake the tree a little and make sure as few traders as possible participate in the next move. For the week the index is down about 6 points – not bad coming off four consecutive up weeks.

The near term remains iffy. The risk/reward for new trades is only ok…there are some lagging indicators…and now there hasn’t been much follow through on upward movement. There’s a time to be all in and a time to lay low and let the market show its cards before committing much new capital. The latter is the current situation. There’s nothing wrong with sitting tight and waiting right now. More after the open.

Stock headlines from barchart.com…

Wynn Resorts (WYNN -0.26%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Credit Suisse (CS -1.05%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Google (GOOG +0.70%) was added to the ‘Conviction Buy List’ at Evercore who raised their price target on the stock to $750 from $725.

British Petroleum (BP -5.91%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

The Gap (GPS +0.58%) fell over 6% in pre-market trading after it reported Aug same-store-sales unexpectedly fell -2.0% in Aug, weaker than expectations for a +1.7% increase.

Parker-Hannifin (PH +1.41%) was initiated with a ‘Buy’ at Buckingham with a price target of $135.

Celgene (CELG -1.06%) was initiated with a ‘Buy’ at SunTrust with a price target of $121.

Allergan (AGN -0.44%) was initiated with a ‘Buy’ at ISI Group with a price target of $207.

Steelhead Partners reported a 6.8% passive stake in Endeavour (END -1.75%) .

Stone Point Capital reported a 7.4% stake in Yadkin Financial (YDKN +0.48%) .

Cooper Companies (COO -0.21%) reported Q3 EPS $of 1.90, right on consensus, but then raised guidance on 2014 EPS view to $7.34-$7.44 from $6.80-$7.00, well above consensus of $6.84.

NVIDIA (NVDA +1.78%) filed a patent infringement complaint against Qualcomm (QCOM +0.29%) and Samsung (SSNLF -2.54%) that alleges the companies are both infringing NVIDIA GPU patents covering technology including programmable shading, unified shaders and multithreaded parallel processing.

Esterline (ESL +0.04%) reported Q3 EPS ex-items $1.38, less than consensus of $1.40, although Q3 revenue of $531.1 million was higher than consensus of $516.57 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Non-farm payrolls

10:15 Fed’s Plosser: Economic Outlook

Notable earnings before today’s open: none

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 5)”

Leave a Reply

You must be logged in to post a comment.

“There’s nothing wrong with sitting tight and waiting right now.”

Great advice Jason!