Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India dropped 1.6%, followed by Indonesia (down 0.6%) and Korea, Taiwan and Hong Kong (down 0.5%). China and Australia each moved up about 0.9%. Europe is currently suffering big across-the-board losses. Austria is down 2.6%, followed by France (down 1.9%), Greece (down 1.6%), London and Italy (down 1.5%), Spain (down 1.4%), Germany (down 1.3%), Prague (down 1.2%) and Norway (down 1%). Russia is up 0.4%.

The dollar is down. Oil and copper are up. Gold and silver are up.

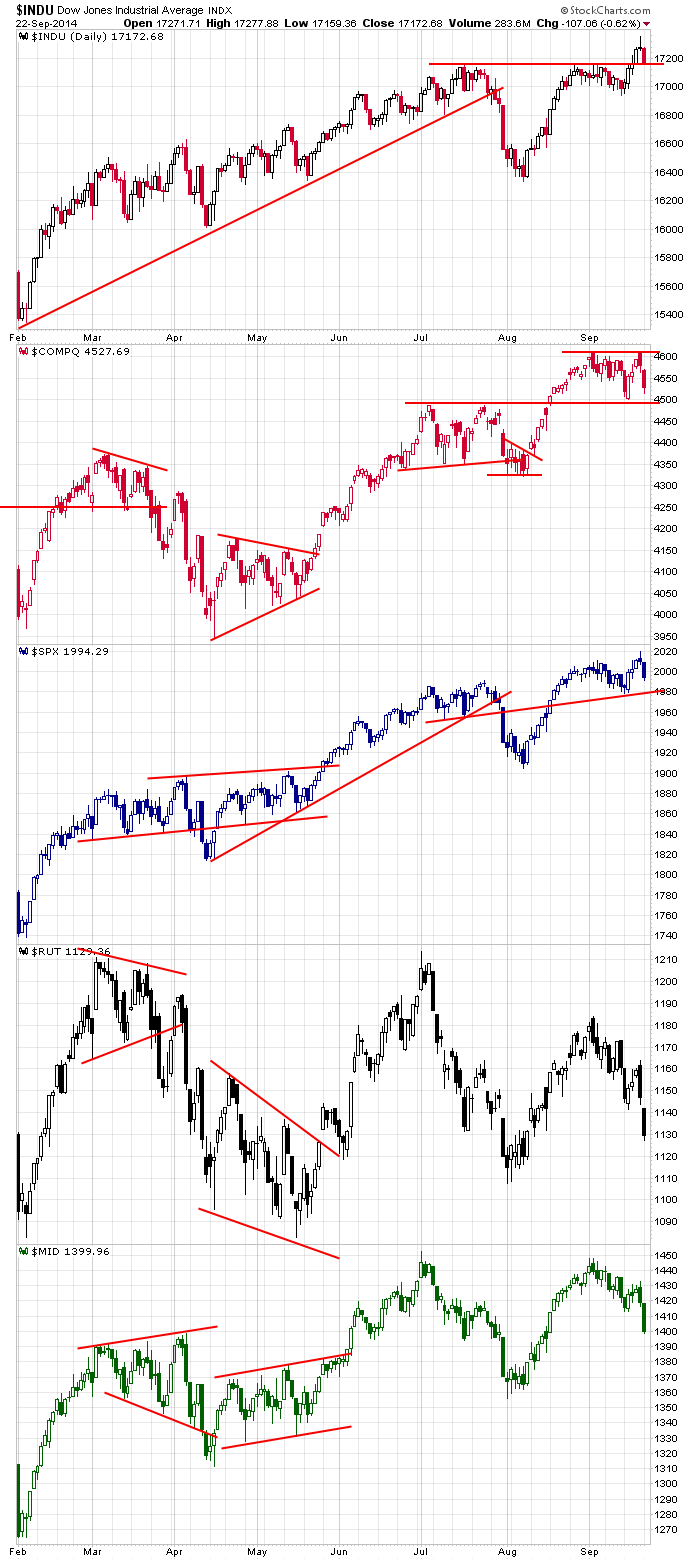

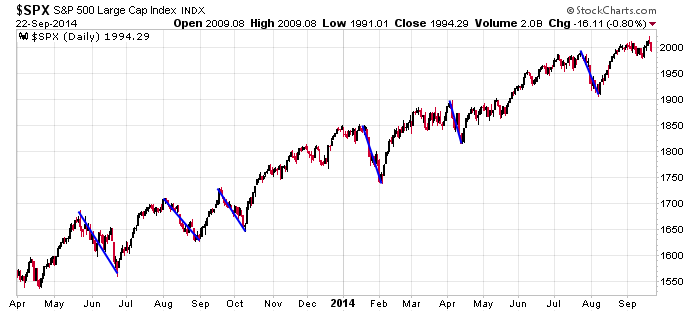

The market got hit hard yesterday – one of its biggest down days since bottoming in early August. Here are the daily index charts. The Dow and S&P 500 remain in good shape – at least from a longer term swing trading standpoint. The Nas has neutralized and is now trading in a rectangle pattern that has bullish implications because it’s forming within an uptrend, but there’s no telling when will resolve. The small caps and mid caps look terrible. A slow drift down has indeed hit an air-pocket, and in both cases, I don’t think anyone could argue support is close.

I could certainly argue a relief bounce will play out soon, but I don’t think it will mark a bottom. More selling is needed to washout the longs. Instead of trying to reverse now, ideally the AD line would plunge, new lows would surge, the bullish percent charts would fall hard, etc. If you’re bullish, you root for more weakness because it’d be easier to rally off a legit correction than from the current level. Plus a bigger move down gives you an opportunity to buy at lower prices.

Don’t fight a correction. Since April 2013 there have been 6 pullbacks that lasted a couple weeks and covered 75-100 points.

Stock headlines from barchart.com…

CarMax (KMX -1.42%) reported Q2 EPS of 70 cents, better than consensus of 67 cents.

Dresser-Rand (DRC +2.58%) was downgraded to ‘Hold’ from ‘Buy’ at KeyBanc.

Clorox (CLX +7.35%) was downgraded to ‘Sell’ from ‘Neutral’ at B. Riley.

Bed Bath & Beyond (BBBY -0.25%) was downgraded to ‘Market Perform’ from ‘Outperform’ at William Blair.

Fluor (FLR -2.46%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo.

Cree (CREE -1.92%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Stephens.

Siemens (SIEGY -0.85%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

Dick’s Sporting Goods (DKS -1.61%) was downgraded to ‘Market Perform’ from ‘Outperform’ at William Blair.

Herbalife (HLF -10.31%) rose nearly 3% in after-hours trading after sources close to the matter said that billionaire activist investor Carl Icahn has not sold out of his stake in the company

AEGON (AEG unch) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Ascena Retail (ASNA -2.36%) slumped over 10% in after-hours trading after it reported Q4 adjusted EPS of 13 cents, well below consensus of 18 cents, and then lowered guidance on fiscal 2015 adjusted EPS to 90 cents-$1.00, weaker than consensus of $1.25.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:45 PMI Manufacturing Index Flash

10:00 Richmond Fed Mfg.

1:00 PM Results of $29B, 2-Year Note Auction

Notable earnings before today’s open: KMX, CCL

Notable earnings after today’s close: AIR, BBBY, CPRT, SCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 23)”

Leave a Reply

You must be logged in to post a comment.

“If you’re bullish, you root for more weakness because it’d be easier to rally off a legit correction than from the current level.” The waiting is the hardest part. One always wants to capture every nice bounce.. You can’t do them all.

Side note my small cap model will show buy upon a 1% down close today. The NASDAQ model shows zip.

My gut tells me we are going to get a bounce before a nice pullback.

The yield curve is steep, stocks are not over priced, interest rates are low and inflation is low. No time to be short.

ym 5th wave complete..6th wave to 17100 area

rut firming up

not really…hvy weight on market

long some dia calls for the 6th wave up…

nice tank at the eod…