Good morning. Happy Friday.

The Asian/Pacific markets closed down across-the-board. Australia dropped more than 2%; India, South Korea, Japan, Hong Kong and Singapore dropped more than 1%. Europe is currently down across-the board. Belgium and Greece are down more than 2%. London, Germany, France, Austria, Amsterdam, Norway, Stockholm, Switzerland and Russia are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold is up, silver is down.

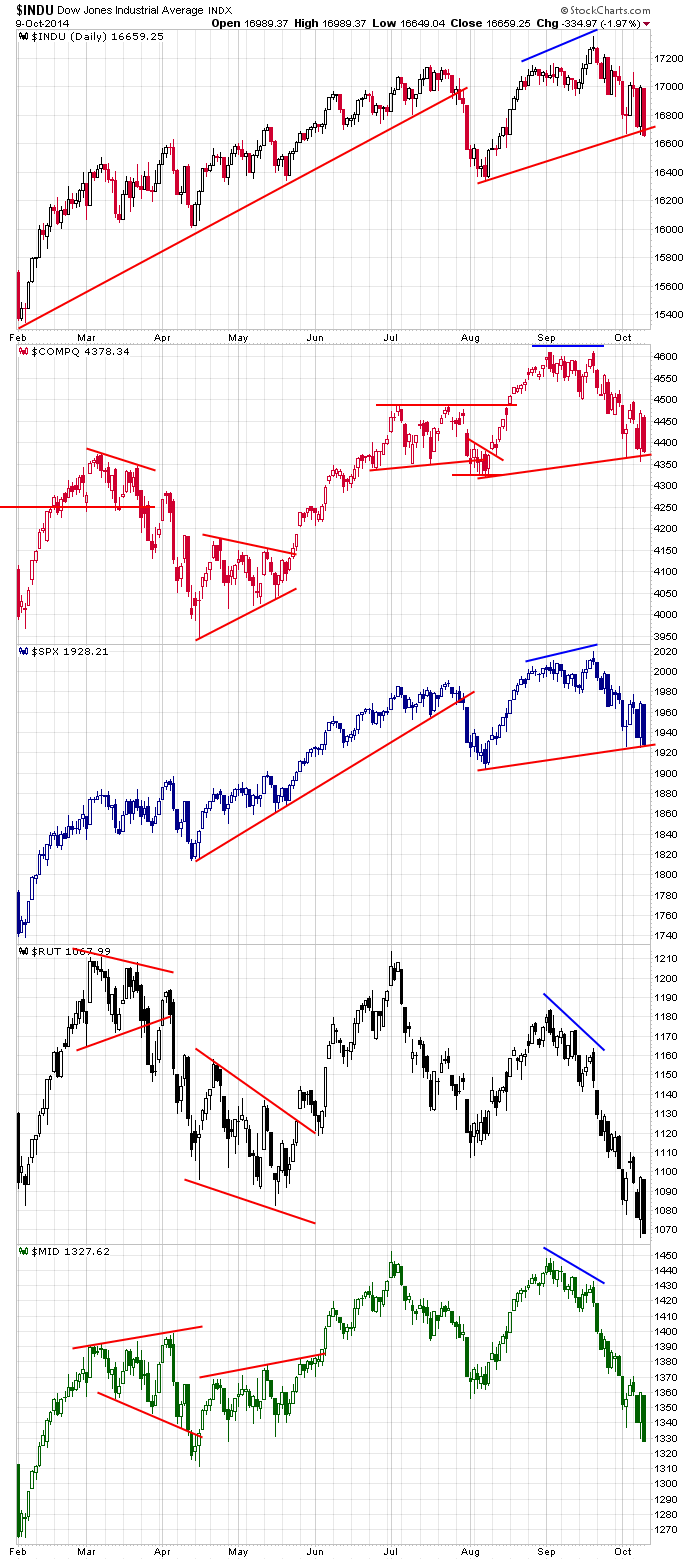

I was wrong. I thought two V-bottoms in a 5-day period would shift Wall St’s bias to the upside…at least in the near term. It didn’t happen. The market got crushed yesterday…the second time in three days and the forth time in eleven days the market succumbed to intense selling pressure that led to stiff, across-the-board losses and a close at the lows. Nowhere to run, nowhere to hide. Despite a couple of “false hope” days, the trend down, which started in mid-September, remains in place.

Here are the daily charts. Massive volatility and intraday ranges lately. If the amount of margin Wall St has taken on the last year really is extremely high, having back-to-back “SPX down 50” days is not out of the question in the near future…especially when you considering all the momentum computers running on autopilot that can sense selling pressure and pile on.

Is is too late to go short? I don’t know. The floor can get pulled out here, and the S&P can quickly move down to 1800. But as we know, big bounces occur within downtrends, so have a plan. If you trade short term, you gotta exit when those bounces materialize and then re-enter. If you swing trade, a big stop is needed…not always easy and comfortable. More after the open.

Stock headlines from barchart.com…

Tesla (TSLA -0.88%) announced the all-wheel-drive version of its Model S with dual motors that can propel the car to 60 mph in 3.2 seconds.

Fastenal (FAST -2.44%) reported July sales growth at +14.7% and Aug sales growth up +15%. FAST reported in-line fiscal Q3 EPS of 45 cents.

Apple (AAPL +0.22%) will have only 3 days to review and block information in the GT Technology (GTAT +17.27%) bankruptcy case.

Citigroup removed Liberty Interactive (QVCA -1.90%) from its Focus List but added adding HSN, Inc (HSNI -1.62%).

PointState Capital reported a 6.0% passive stake in L-3 Communications (LLL -3.52%).

Highland Capital Management reported a 9.9% passive stake in Loral Space (LORL -3.32%).

Juniper (JNPR -1.23%) slipped 5% in after-hours trading after it lowered guidance on Q3 adjusted EPS to 34 cents-36 cents, below consensus of 38 cents, and lowered its Q3 revenue outlook to $1.11 billion-$1.12 billion, less than consensus of $1.18 billion.

Family Dollar (FDO +0.05%) reported Q4 adjusted EPS of 73 cents, below consensus of 77 cents.

Microchip (MCHP -1.43%) lowered Q2 revenue guidance to $546.2 million from $560.0 million-$575.9 million, below consensus of $567.91 million.

Eminence Capital reported a 5.4% passive stake in TIBCO (TIBX -0.13%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Import/Export Prices

9:00 Fed’s Plosser: Monetary Policy

1:00 PM Fed’s George: Economic Outlook

2:00 PM Treasury Budget

Notable earnings before today’s open: FAST, INFY, PGR

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 10)”

Leave a Reply

You must be logged in to post a comment.

I love to get a swing traders perspective.