Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China rallied 1%, followed by Hong Kong (up 0.55%) and Japan (up 0.43%). Taiwan dropped 1.28%, followed by Australia (down 0.93%) and Malaysia (down 0.49%). Europe is currently down across-the-board. Spain is down more than 2%; Italy, Prague, Germany and France are down more than 1%; the losses of Belgium, Stockholm and Greece are also notable. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold is up, silver down.

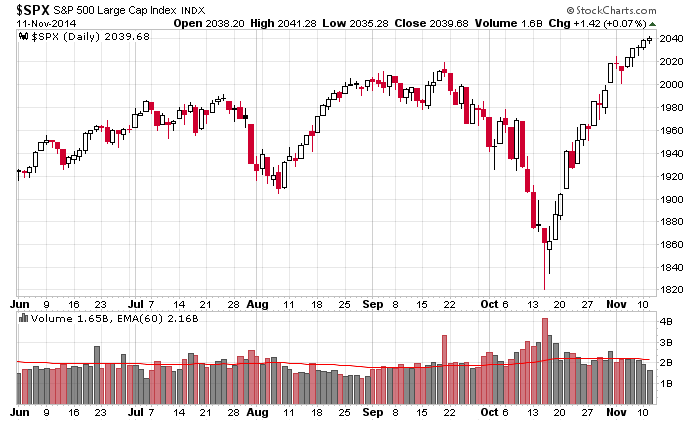

The S&P has moved up five straight days…the last three on declining volume…and volatility has all but disappeared. We went through a period where the S&P would move 25 points in a day; it has taken the last week to trace the same ground.

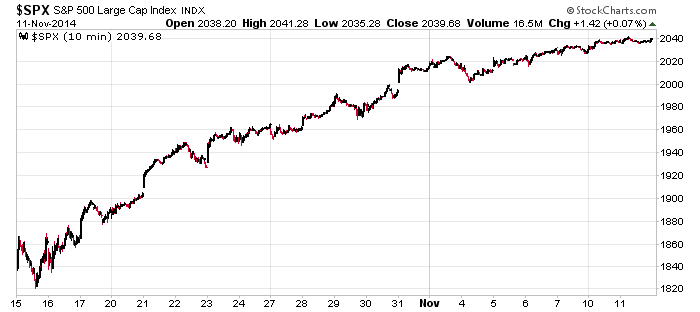

Here’s the S&P over the last 19 days…slow, steady, consistent, methodical. There’s barely a noticeable pullback in there.

This daily offers a better perspective on the relentlessness of the buying pressure. No way this is sustainable. 220 points in less than four weeks is one thing…only four down days and 18 of the 19 days the S&P put in a low that was higher than the day before is another. Unsustainable.

My bias is to the upside, but I’ve hesitate to put new money to work the last week. I’d like to see the market let out some air before beginning an end-of-year run. More after the open.

Stock headlines from barchart.com…

Citigroup (C -0.15%) fell 1% in pre-market trading after the bank, along with four others, was fined $668 million to settle a probe into the rigging of foreign-exchange rates.

BB&T (BBT -0.29%) to acquire Susquehanna Bancshares (SUSQ -0.80%) for approximately $2.5 billion.

Beazer Homes (BZH +1.37%) reported Q4 EPS of $1.88, well above consensus of $1.08.

Flowers Foods (FLO -2.34%) reported Q3 adjusted EPS of 21 cents, better than consensus of 20 cents, but then lowered guidance on fiscal 2014 EPS view to 86 cents-90 cents from 92 cents-98 cents, below consensus of 93 cents.

JetBlue (JBLU -1.07%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

CBOE Holdings (CBOE +0.82%) were downgraded to ‘Sell’ from ‘Hold’ at Evercore ISI.

Goldman Sachs reported a 13% passive stake in PBF Logistics (PBFX -0.59%) .

JPMorgan Chase (JPM -0.90%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

Rockwell Automation (ROK +0.10%) reported Q4 EPS of $1.86, higher than consensus of $1.83.

ADT Corp. (ADT -3.23%) reported Q4 EPS of 55 cents, better than consensus of 48 cents.

Discovery (DISCA -0.84%) and Viacom (VIAB -0.80%) were both downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

VeriFone (PAY -0.11%) was initiated with a ‘Buy’ at Topeka with a price target of $43.

Fossil (FOSL +0.51%) surged over 8% in after-hours trading after it reported Q3 EPS of $1.96, higher than consensus of $1.82.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

3:00 Fed’s Plosser Speech

7:00 MBA Mortgage Applications

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 Wholesale Trade

1:00 PM Results of $24B, 10-Year Note Auction

1:30 PM Fed’s Kocherlakota Speech

Notable earnings before today’s open: ADT, AG, ARMK, BZH, CAE, CNCE, CSIQ, DWSN, ECA, ELOS, ENR, EZCH, FLO, M, MGAM, MRKT, MTLS, MTOR, PF, PLUG, RICE, ROK, SEAS, SLW, WUBA

Notable earnings after today’s close: APU, BRKS, CHMI, CNAT, CSCO, CYBR, FTD, FUEL, HTHT, IAG, JCP, NTAP, NTES, PLKI, PNNT, TCX, TTEK, UGI, WGL, WX, XONE

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 12)”

Leave a Reply

You must be logged in to post a comment.

The indicators seem reluctant to support a move up. http://stockcharts.com/c-sc/sc?r=272124&chart=SCIN,uu%5B305,a%5Ddacayaci%5Bpb20!b50%5D%5Bdg%5D%5BilG%5D

Maybe a set back this week cheers

50% retrace from yesterdays morning high..if that means anything…probably not

We could see some air out of the tires on todays gap down.

quoting the sicilian in “princess bride”….”Inconceivable” another positive day…