Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. China rallied 1.4%; Malaysia also closed up. Australia, India and New Zealand closed down. Europe is currently mostly up. Italy, Spain, Germany, Belgium and Prague are up 0.85% or more. Norway and Greece are down. Futures here in the States point towards an up open for the cash market.

The dollar is up a small amount. Oil and copper are up. Gold and silver are up.

The market closed up yesterday. The S&P rallied out of the block but then settled into a range for the rest of the day. The Russell rallied, rested and the rallied again. It completely recovered the drop off Friday’s high. Trading felt slow. It felt like pre-holiday trading…even though it was a little early for that type of trading to take place.

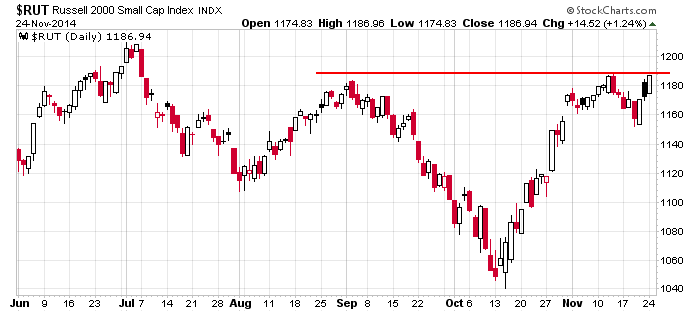

Here’s the daily Russell 2000 chart. Last week the index lagged but then caught up some Thursday and Friday. Yesterday it recovered Friday’s intraday drop and is now sitting just below a multi-month high. Not bad. It hasn’t matched the movement of the large caps, but there’s nothing horribly wrong with this chart. A breakout first measures to about 1215…which happens to be very close to the July high. After that, well, we’ll see. I don’t want everyone to get excited about a move that matches the rally off the October low.

The market continues to do well, and as long as the bears keep trying to pick tops, the Energizer Bunny character will remain in place. But given this, the easy money has been made, and at this time, we don’t have very many good set ups to play. Most good stocks have already broken out and run. Time is needed to allow them to reform patterns. I like the market, but we need to be more selective chasing stocks higher here. More after the open.

Stock headlines from barchart.com…

Valspar (VAL -0.11%) reported Q4 EPS of $1.38, well above consensus of $1.15.

Campbell Soup (CPB -0.54%) reported Q1 EPS of 74 cents, stronger than consensus of 72 cents.

Pall Corp. (PLL -0.40%) reported Q1 EPS of 89 cents, higher than consensus of 80 cents.

Netflix (NFLX -1.06%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Tiffany & Co. (TIF +1.06%) reported Q3 EPS of 76 cents, weaker than consensus of 77 cents.

Hormel Foods (HRL -0.37%) reported Q4 EPS of 63 cents, below consensus of 64 cents.

According to the Wall Street Journal, Honda (HMC -0.19%) said that over an an 11-year period beginning in 2003, it did not report 1,729 death and injury incidents to U.S. regulators.

Post Holdings (POST +0.87%) reported Q4 adjusted EPS of 13 cents, nearly double consensus of 7 cents.

Dycom (DY +0.92%) jumped over 5% in after-hours trading after it reported Q1 EPS of 59 cents, well above consensus of 50 cents.

Ceridian reported an 8.3% stake in FleetCor (FLT +0.04%) .

Aegean Marine (ANW -0.43%) reported Q3 EPS of 20 cents, less than consensus of 21 cents.

Casey’s General Stores (CASY +0.75%) announced that it will revise its financial statements for fiscal years 2012, 2013 and 2014 and Q1 of fiscal 2015 for an accounting error and pay the I.R.S. $30.4 million in taxes due as well as $1.1 million in interest to resolve this matter.

Brocade (BRCD +1.65%) reported Q4 EPS of 24 cents, higher than consensus of 23 cents.

Nuance (NUAN +0.53%) rose over 4% in pre-market trading after it reported Q4 EPS of 33 cents, better than consensus of 27 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 GDP Q3

8:30 Corporate Profits

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

1:00 PM Results of $13B, 2-Year FRN Auction

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: BECN, BWS, CBRL, CHS, CPB, DAKT, DANG, DSW, DSX, EV, FRED, HRL, LG, MOV, NJR, PLL, SIG, TECD, TIF, VAL, XCRA, YGE

Notable earnings after today’s close: ADI, AVAV, BLOX, CTRP, CUB, HPQ, NMBL, PWRD, TIVO, VEEV, VNET, XNET

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 25)”

Leave a Reply

You must be logged in to post a comment.

Going short looks tempting here.. But not worth the risk.

ES>price toped out at 2073. Area of short term support would be 2054 (or 2050). Wont be suprised if we see a down day for tuesday for the SP index by the time merkets close. Overall, still shooting for the stars.

mixed bag of nuts..dow leading now…

decliners are getting stronger and price action is slow and methodical

they bought infront of support..

adv are adding.