Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. China rallied better than 3%; Hong Kong and Australia moved up more than 1%. Taiwan fell 0.9%. Europe is currently mostly up. Greece is up 2.4%, followed by London, Amsterdam and Norway, which are up more than 1%. There are no big losers. Futures here in the States point towards an up open for the cash market.

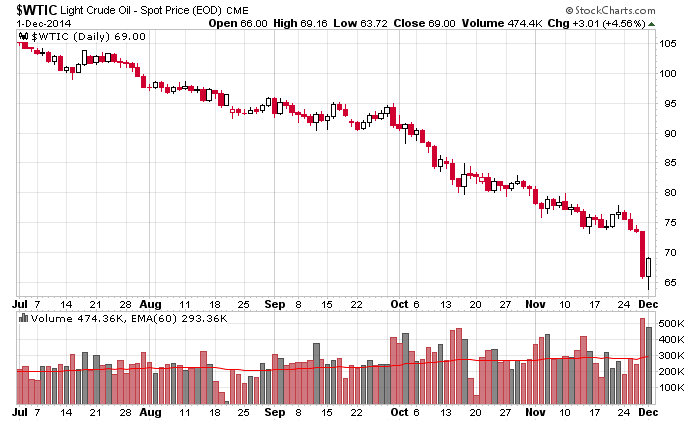

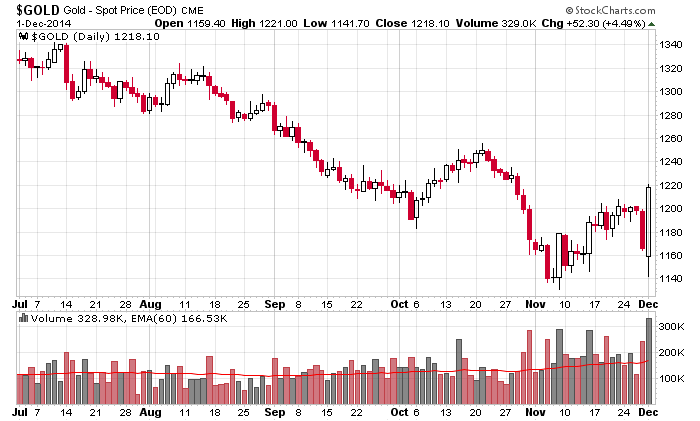

The dollar is up. Oil and copper are down. Gold and silver are down.

Heading into yesterday, we wondered about…

Oil…it was weak early but then staged an extremely impressive turnaround.

Gold…it too posted an early loss but then rallied huge.

Retail numbers…they were weaker than expected, but with so many retailers offering deals early in the week, we don’t have an apples-to-apples comparison. Yesterday’s Cyber Monday numbers were also weaker than expected for the same reason.

Things Wall St. was worried about turned out to not be so bad, but the market still suffered either its biggest or second-biggest drop since the the October bottom, and it dropped on consecutive days for the first time since early October. By itself it’s not a big deal, but considering the gains in place and the warnings we’re getting from some breadth indicators, we can conclude that for now, the easy money has been made and we need to be careful on the long side. That means we can’t sit back and relax with loose stops. We need to be more aggressive taking profits. There’s a time to let the charts play out and a time to be happy taking quick and small profits. The latter is the current situation.

Heading into today, China fills the top spot. Speculation more stimulus may be in the pipeline sent the Chinese market up 3.1%. It’s a race to the bottom with virtually everyone around the world employing some sort of QE to help their economies. When this plays out – and it likely will take years – it will be fascinating to watch. More after the open.

Stock headlines from barchart.com…

Stryker (SYK +0.05%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman Sachs.

Travelers (TRV -0.01%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Apache (APA -0.44%) was downgraded to ‘Neutral’ from ‘Buy’ at Mizuho.

Parker-Hannifin (PH -1.06%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Citigroup keeps a ‘Buy’ rating on FedEx (FDX -0.27%) as it raises ts price target on the stock to $210 from $190.

Walmart (WMT -1.51%) announced that Cyber Monday was the biggest online day in its history for orders.

Piper Jaffray reiterates an ‘Overweight’ rating on Electronic Arts (EA -1.78%) as it raises its price target on the stock to $47 from $44.

Xcel Energy (XEL +0.97%) was upgraded to ‘Neutral’ from ‘Underweight’ at JPMorgan Chase.

Cubic (CUB +2.70%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Avanir (AVNR +0.54%) will be acquired by Otsuka Pharmaceutical for $3.5 billion.

Royal Caribbean (RCL -1.97%) will replace Bemis (BMS +0.33%) in the S&P 500 as of the close of trading this Thursday.

Thor Industries (THO -1.58%) reported Q1 EPS of 73 cents, less than consensus of 81 cents.

Glenview Capital reported a 7.59% passive stake in PHH Corp. (PHH unch).

Mattress Firm (MFRM -1.99%) reported Q3 EPS ex-items of 70 cents, right on consensus, although Q3 revenue of $464.3 million was better than consensus of $431.01 million.

Shoe Carnival (SCVL -3.16%) reported Q3 EPS of 54 cents, better than consensus of 48 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:45 ICSC Retail Store Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Construction Spending

Notable earnings before today’s open: BMO, GWPH, ISLE, VNCE

Notable earnings after today’s close: ASNA, BOBE, BV, GWRE, OVTI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 2)”

Leave a Reply

You must be logged in to post a comment.

Fear and self Loathing are holding things back on investing why? International events in the EU Draghi is wild man -fear him.. Or is it Ferguson, the CR due from Congress this month? Maybe, but I think it is the run up from 13 Oct. Such witchcraft is shameful. Buy the SPY and the QQQs and a few of Jason’s specials. I think up starts todays trading.

But watch out for the plan to down 5 airliners by the Islam states, or the plan to twist the codes in our utilities dispatch systems. That will ruin the curls in your hair. My weather short wave and the Internet long range radar come from land stations, say they are being hacked by the Chinese. Bad for a old man on a sailing ship at sea. Sharpening the sabers to repel boarders.

We have an ABC down on gold, and another in crude, But the usd is suggesting UP. Hold on for Friday’s employment.