Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China rallied 4.3%; Japan, Hong Kong, Australia and South Korea also did well. Malaysia dropped 0.7%. Europe currently leans to the upside, but movement is small. France, Greece, Switzerland and Amsterdam are leading; Russia and Norway are lagging. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is up slightly. Oil is down, copper is up. Gold is down, silver up.

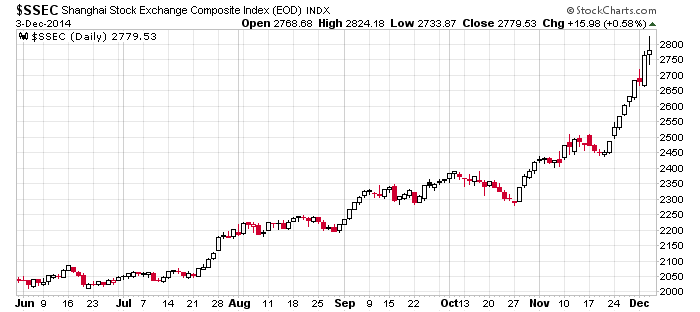

The big news is China. The recent strength coincides with their rate cut and opening up trading in mainland stocks to the rest of the world. Here’s $SSEC as of yesterday’s close. Add another 4.3% to this chart.

Here in the US, the S&P 500 hit a new high, the Dow hit a new high and closed at a new high and although the Russell has lagged overall, it’s led the last two days.

A quick look at the group charts reveal everything is on board with the market strength except energy. Financials, tech, transports, retail and several other consumer groups – they’re all at or near their highs, so unless energy is a proverbial “canary-in-a-coal-mine” there are no warnings here.

A quick look at the breadth indicators does reveal some divergences, suggesting declining support for the uptrend. We need to keep an eye on these. They aren’t extremely sensitive, meaning there often is a delay between when the divergences form and when the market reacts.

Overall things look good. The steadiness of the advance isn’t sustainable and isn’t normal, but it is what it is, and we’d be wise not to guess a top. Manage positions wisely. Don’t give profits back. Oh, and tomorrow we get the latest employment figures. More after the open.

Stock headlines from barchart.com…

CSX (CSX +2.19%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Wal-Mart (WMT -1.69%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Gentex (GNTX +2.26%) was upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Sears Holdings (SHLD +0.91%) reported a Q3 EPS loss of -$5.15, a much bigger loss than one estimate of -$3.31.

Royal Caribbean (RCL +1.39%) will replace Bemis (BMS +0.27%) in the S&P 500 as of today’s close.

Costco (COST -0.26%) reported net sales of $9.43 billion for the month of November up +7% y/y.

Dollar General (DG -0.86%) reported Q3 EPS of 79 cents, below consensus of 80 cents.

Pfizer (PFE +0.57%) reported positive results from PROFILE 1014 study of anaplastic lymphoma kinase inhibitor XALKORI in previously untreated patients with ALK-positive advanced non-small cell lung cancer.

Synopsys (SNPS -0.30%) reported Q4 EPS of 64 cents, higher than consensus of 61 cents.

Avago (AVGO +3.18%) climbed over 5% in after-hours trading after it reported Q4 EPS of $1.99, well above consensus of $1.68.

Disney (DIS -0.39%) increased its annual dividend by 29 cents or 34% to $1.15 per share.

PVH Corp. (PVH +2.12%) slid nearly 2% in after-hours trading after it reported Q3 EPS of $2.56, better than consensus of $2.48, but then lowered guidance on fiscal 2014 EPs view to $7.25-$7.30 from $7.30-$7.40, below consensus of $7.37.

Guess (GES +1.28%) reported Q3 EPS of 24 cents, higher than consensus of 18 cents, but then lowered guidance on fiscal 2015 EPS view to $1.00-$1.10 from $1.05-$1.20, at the lower end of consensus of $1.10.

Aeropostale (ARO +3.91%) fell over 7% in after-hours trading after it reported a Q3 adjusted EPS loss of -45 cents, right on consensus, but then lowered guidance on Q4 EPS to a loss of -37 cents to -44 cents, a larger loss than consensus of -36 cents.

BHP Billiton (BHP +1.37%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Rio Tinto (RIO +2.25%) was downgraded to ‘Underperform’ from ‘Buy’ at BofA/Merrill Lynch.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup US Payroll to Population

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: BKS, DG, EXPR, GIL, KR, SHLD, TTC, TD, UNFI

Notable earnings after today’s close: AMBA, AEO, CBK, COO, FNSR, FIVE, RALY, SD, SWHC, ULTA, ZUMZ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 4)”

Leave a Reply

You must be logged in to post a comment.

Saudi say they will lower prices, Draghi to QE ECB. Long the market to year end. best to all but….. don’t be out of market, The large players are bullish. Long term bullish gold miners. Bought BIOTEH yesterday. Timing matters.

cheif bear says hum bug to all

buy far the most important index is the nas 100 and that has put in a island top reversal

its nearest counterpart the german dax has a retest of 100000 and failed again

divergences everywhere and the markets are sick and need medicare

now until the nas 100 takes out the island reversal and thus invalidates it,

then the end of the world has arrived

thank goodness for complacent bulls

they are fat and ugly

Fat yes, Ugly? always

http://www.finviz.com/chart.ashx?t=MDIV&ty=c&ta=1&p=d&s=l

Don phoned to asked about core asset. here is example of what I hold in lieu of cash. Mdiv multi asset fund.

WHO did what to the market today???????