Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Singapore and Japan dropped more than 2%; India, Indonesia and Malaysia dropped more than 1%. China rallied 2.3%. Europe is currently mostly down. Spain is down more than 2%; Italy, Austria, Amsterdam, Norway, Switzerland, Prague, Stockholm and France are down more than 1%. Russia is up almost 2%. Futures here in the States point towards a moderate gap down for the cash market, but this doesn’t tell the whole story. S&P futures dropped from 1994 to 1961.5 and have now rallied back to 1977 – massive overnight movement.

VIDEO: The Indicators Which Helped Me Pick a Short Term Top

The dollar is down. Oil is getting hit hard again; copper is down. Gold and silver are up.

As stated above, there’s been a huge amount of movement in the futures market overnight…actually just the last three hours. The overnight session is typically on the quieter side – maybe the S&P moves 10 points. Not today.

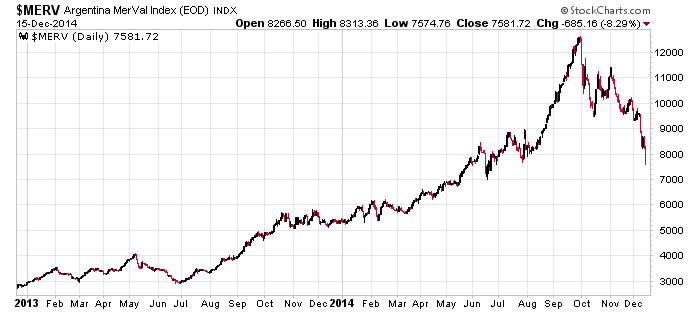

The cause, or at least the main cause, is the desperate measures Russia is taking to stop the slide in its currency. Their central bank raised its key interest rate from 10.5% to 17% in hopes of halting its inflationary slide. The Russian market plunged almost 100 points from 1415 to 1320 but has since rallied up 1460 – crazy movement that is only possible when a country’s currency is unstable. Remember Argentina when its currency was be devalued? Here’s a chart of the country going back two years. That looks like an incredible run – quadrupling from 3000 to 12000 – but actually it was entirely due to its currency getting crushed.

Crude oil is down 2.15 and is printing a 53 handle. Including today oil has dropped 14 of 16 days and has been cut in half since topping in June. It’s been a bottomless pit.

My bias remains to the downside. Enough damage has been done for me to want a complete washout before attempting to rally again. I don’t like reversals from no-man’s land. I’d prefer lots of pain to signal capitulation. Then the market can stabilize and move up.

Don’t get lazy. More after the open.

Stock headlines from barchart.com…

Microsoft (MSFT -0.60%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill Lynch.

Hess Corp. (HES -1.62%) and EOG Resources (EOG -1.19%) were both downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

According to The New York Times, the Royal Bank of Scotland (RBS -2.75%) and Lloyds (LYG -1.28%) failed a stress test performed by the Bank of England.

Dollar Tree (DLTR +0.68%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Macerich (MAC -0.37%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Autodesk (ADSK -1.14%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill Lynch.

Bloomberg reported that Olam (OLMIY -1.98%) will acquire Archer Daniel’s (ADM -0.04%) cocoa business for $1.3 billion.

Boeing (BA +1.08%) climbed 2.7% in pre-market trading after it raised its dividend 25% and authorized a $12 billion share repurchase plan.

Goldman Sachs (GS -1.74%) was initiated with a ‘Buy’ at Guggenheim with a price target of $215.

Bank of America (BAC -1.63%) was initiated with a ‘Buy’ at Guggenheim with a price target of $20.

VeriFone (PAY +0.15%) reported Q4 EPS of 44 cents, higher than consensus of 41 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index Flash

Notable earnings before today’s open: DRI, FDS, NAV

Notable earnings after today’s close: HEI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 16)”

Leave a Reply

You must be logged in to post a comment.

Jason

Could not agree more.. We need a washout.

why should we get a wash out

we have had megaphone broadening pattern jaws of death tops in just about all markets,that go back many years–the broaderning pattern does not need a distribution after it as that is the distribution

other markets like nas 100 have had island reversal tops

currently all markets are going to plan

a impulsive sub wave one down that may be finished except nas 100 ,with a target of 4100,then a xmas rally sub wave 2 for a lower top,then impulsive sub 3 down on jan 28th interest rate hike

and there we go we have had a trend change

or perhaps the markets go up forever ..?????

and their is no end of the universe

If you’re looking at charts that go back many years, your time frame is much longer than mine.

Hi Aussie, nice to hear from you..i think you mentioned the oe is providing most of the churning and rally will probably take affect after that 3rd wk..