Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. China rallied another 3.6%, but Singapore dropped 1.3%, and Hong Kong, Malaysia and South Korea also dropped noticeably. Europe is currently mostly down. Russia is up 2.6%, but Greece is down 4.5% and Spain, Italy, Austria and Norway are down more than 1%. Futures here in the States point toward a down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up.

After two holiday-shortened weeks, we finally get a full week of trading, and unlike other times of the year where it takes some time for things to get back to normal, I’d expect things the ramp up pretty quickly. Volume, volatility, activity level, intraday ranges – they should quickly recover.

The big story heading into the new year remains oil. It’s been cut in half since topping last summer, and so far it’s showing no sign of a bottom. There will be losses in the oil sector – layoffs, bankruptcies, etc – but the bigger risk is political destabilization due to entire countries not being able to pay their bills. If Greece, a small country with a small GDP, can scare the whole world with thoughts of leaving the Euro, Venezuela can do the same. And Russia…well it’s in a different league with regards to destabilizing the world.

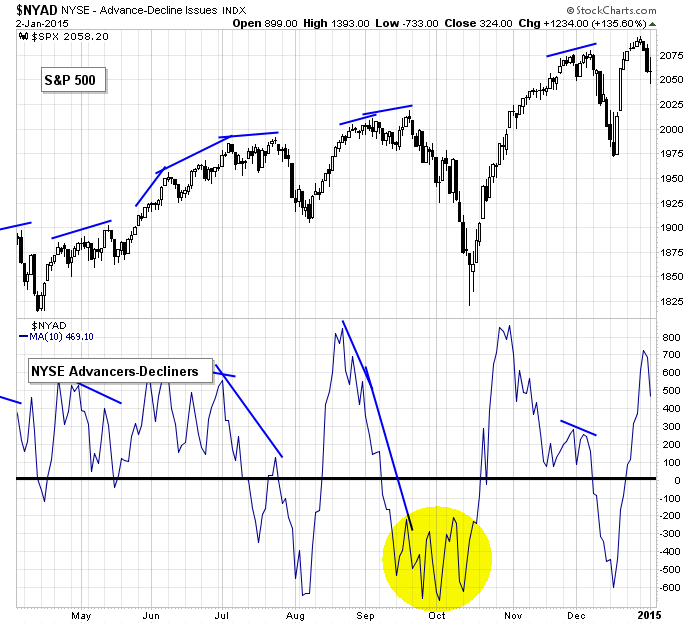

Otherwise the indicators are in good shape. They’ve moved as bulls would want them to and are now starting to cycle back. If the indicators are a strong guide for you, you toned things down last week because a rest is needed. Here’s an example. The 10-day of the NYSE AD Line. It moved to a high level and is now moving down. A little time is needed for the indicator to cycle down and support the bulls in the near term again.

Trading ideas…there aren’t many good ones to be had right now. A vertical move down the first half of December followed by a vertical move up the second half has wrecked havoc on the charts of individual stocks. Regardless of what your overall view of the market is, there simply aren’t many good set-ups to be had right now. That’s just the way it is, but considering my comment above about the indicators needing to cycle, the lack of set-ups isn’t an issue because we don’t want to be aggressive right now anyways.

Be patient. January will be an active month, but it’s unclear exactly where things are heading. More after the open.

Stock headlines from barchart.com…

Caterpillar (CAT +0.38%) and GlaxoSmithKline (GSK -0.87%) were both downgraded to ‘Underweight’ from ‘Neutral’ at JPMorgan Chase.

Starbucks (SBUX -0.74%) was downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

Macy’s (M -0.09%) was downgraded to ‘Neutral’ from ‘Buy’ at Buckingham.

Domino’s Pizza (DPZ +0.13%) was upgraded to ‘Buy’ from ‘Neutral’ at Janney Capital.

Ford (F -0.90%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Coca-Cola Enterprises (CCE -0.77%) was upgraded to ‘Neutral’ from ‘Underperform’ at BofA/Merrill Lynch.

General Mills (GIS -0.41%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill Lynch.

Xylem (XYL +0.03%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

CF Industries (CF +1.97%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

PPL Corp. (PPL +0.08%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Cognizant (CTSH +0.02%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

BorgWarner (BWA -0.38%) could rise 23% to $67 on higher returns and better growth prospects, according to a weekend article by Barron’s.

Alamo Group (ALG +1.30%) raised its dividend by 14% to 8 cents from 7 cents per share.

Wet Seal (WTSL +16.67%) defaulted on a $27 million senior convertible note.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

8:30 Gallup US Consumer Spending Measure

12:30 PM TD Ameritrade IMX

Notable earnings before today’s open: CVGW, CMC, LNN

Notable earnings after today’s close: SHLM, LNDC, MU, SONC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 5)”

Leave a Reply

You must be logged in to post a comment.

Look at bonds EU is rate sensitive. speeches:FOMC Member Williams Speaks at 8 AM EST. A short term bottom is trying to form. Volume may come back today. Stay close, the dow/nas maybe on ABC move up. currency: euro weak, dollar strength slowing. Watching only today.