Good morning. Happy Thursday.

The Asian/Pacific markets closed up across the board (except for China which dropped 2.4%). Japan, Singapore, India, Malaysia, South Korea and Taiwan rallied more than 1%. Europe is currently mostly up. Russia is up 5.2%; France, Italy and Spain are up more than 2%; London, Germany, Prague, Switzerland, Stockholm, Norway, Amsterdam and Belgium are up more than 1%. Greece is down 1.6%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

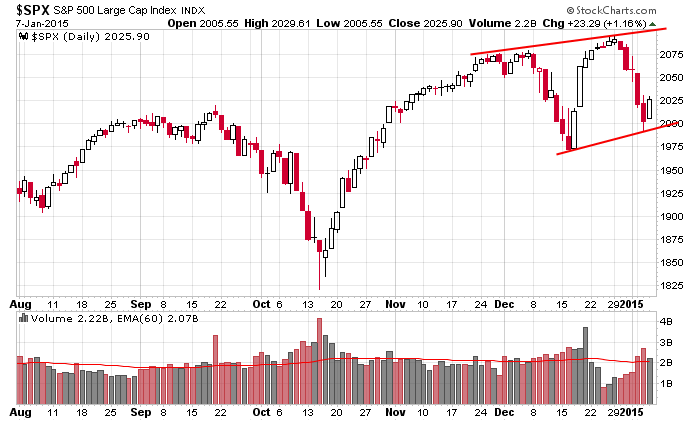

The S&P 500 fell about 100 points in six days and as of today’s open will be 50 off its Tuesday low. Volatility has been huge. I warned yesterday during the day to not get too bearish because as bad as things seemed to have gotten, counting the bulls out would not be wise. Every dip going back several years had gotten bought, so why should we assume the party is going to suddenly come to an end? You only have to look back to last month and October to find examples of the market moving off a low…and then continuing to move up…and continuing further…and before you knew it, the market was back at its high and the bears were once again totally frustrated.

Last week the indicators told us to be careful.

The lack of good set-ups to play kept us close to the sidelines.

There hasn’t been much for a swing trader to do lately, and that’s perfectly fine. Forcing trades leads to frustration, exhaustion and churning one’s account. Sometimes you gotta wait for something to get established before getting aggressive. As Jesse Livermore said: “It was the waiting that made me the money.”

Here’s the S&P 500 daily chart. It’s notable the December rally was smaller than the October/November rally and the late December/early January drop was smaller than the early-December drop. The moves are tightening up. Pressure is building.

Stock headlines from barchart.com…

Advance Auto Parts (AAP +2.15%) and Tractor Supply (TSCO +3.24%) were both upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Global Payments (GPN +1.17%) reported Q2 cash EPS of $1.27, better than consensus of $1.20, and then raised guidance on fiscal 2015 cash EPS view to $4.75-$4.83 from $4.65-$4.75, higher than consensus of $4.73.

Ralph Lauren (RL +2.51%) was downgraded to ‘Hold’ from ‘Buy’ at Maxim.

Staples (SPLS +2.02%) was added to the short-term buy list at Deutsche Bank.

Eli Lilly (LLY -0.70%) wsa downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Priceline (PCLN -0.96%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Constellation Brands (STZ +2.58%) reported Q3 EPS of $1.10, less than consensus of $1.14.

Family Dollar Stores (FDO +0.24%) reported Q1 EPS of 44 cents, well below consensus of 62 cents.

Bank of America (BAC +0.47%) was initiated with an ‘Outperform’ at Credit Suisse with a price target of $21.

Marathon Oil (MRO +1.23%) and Oasis Petroleum (OAS unch) were both downgraded to ‘Sell’ from ‘Neutral’ at Citigroup.

Anadarko (APC +1.59%) , Chesapeake (CHK -0.33%) , Whiting Petroleum (WLL -0.10%) , Pioneer Natural (PXD -1.10%) , Noble Energy (NBL -0.38%) and Cabot Oil & Gas (COG +0.86%) wwre all downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Goldman Sachs (GS +1.49%) was initiated with an ‘Outperform’ at Credit Suisse with a price target of $225.

JPMorgan Chase (JPM +0.15%) was initiated with an ‘Outperform’ at Credit Suisse with a price target of $75.

Zumiez (ZUMZ +4.73%) rose 3% in after-hours trading after it reported December same-store-sales were up 8% y/y and then raised guidance on Q4 EPS to 75 cents-77 cents from 69 cents-72 cents, higher than consensus of 73 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Gallup US Payroll to Population

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

3:00 PM Consumer Credit

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: APOL, FDO, GPN, SCHN,STZ

Notable earnings after today’s close: ANGO, BBBY, CUDA, EOPN, HELE, PSMT, RT, TCS, VOXX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 8)”

Leave a Reply

You must be logged in to post a comment.

Jesse Livermore.. Love the quote.

I got a buy signal on Tuesdays close. I really do not expect too much upside this time. I suspect Jason is right we are going to bounce a bit.

“Pressure is building”. . . Does this mean for higher oil prices ?

I’m not making any near-term predictions with oil. “Pressure is building” was in reference to the daily SPX chart.

April 25 the EU goess QE to cure its recession — maybe. Long big time. Look a the pharmacy stocks like IBB, since worldwide they are leaders.