Good morning. Happy Monday. Hope you had great weekend.

The Asian/Pacific markets closed mixed. China dropped 1.75%, followed by Australia (down 0.75%), Indonesia (down 0.55%) and Taiwan (down 0.4%). Hong Kong, India and New Zealand each rallied 0.45%. Europe is currently mostly up. Greece is up 3.1%, followed by Germany and France (up 1.2% each) and Italy, Spain, Amsterdam and Stockholm (up ~ 0.9% each). Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up.

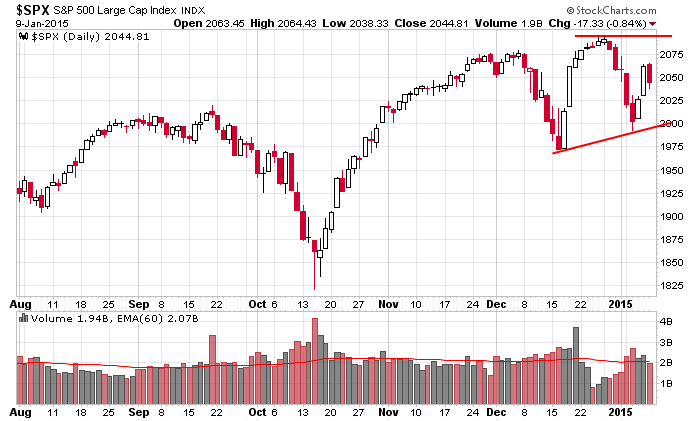

I don’t have anything new to add to my comments made over the weekend in the Weekly Report. The two big takeaways were: 1) Gold and silver are my favorite groups right now. The stocks have been trending and many are poised to break out of consolidation patterns and begin the next legs up of their current moves. I’ve highlighted many stocks from the groups a couple times the last couple weeks. 2) The indexes are in no-man’s land between their most recent reaction highs and lows. Nobody’s back in against the wall. Nobody has to dig in and defend their turf. The market can move a couple days in either direction before we approach a key level. Here’s the S&P daily.

The indicators are mixed right now…some are in good shape, others don’t have much room for error if they wish to signal “pullback in an uptrend.”

Other than gold and silver stocks, we don’t have many good set-ups to play. Swings in both directions wrecked most of the charts, so ideally the market would move sideways for a few weeks – inside the trendlines drawn above – and allow some patterns to form.

Oil is down 3.72% right now, so it’ll open at another new low. Some oil stocks haven’t done too badly lately, but they won’t go far with crude also bouncing.

More after the open.

Stock headlines from barchart.com…

Alcoa (AA +1.32%) was upgraded to Buy from Neutral at Nomura.

Bristol-Myers Squibb (BMY -0.66%) climbed nearly 6% in pre-market trading after it said its Opdivo treatmet showed better overall survival rates compared with docetaxel, a form of chemotherapy, in a study of patients with a type of lung cancer.

NPS Pharmaceuticals (NPSP -2.35%) jumped nearly 9% in pre-market trading after Shire Plc agreed to buy the drug maker for about $5.2 billion.

D.R. Horton (DHI +0.50%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Barron’s says that Regeneron (REGN +1.93%) has 25% upside potential.

Select Medical (SEM +7.65%) fell 4% in after-hours trading after it lowered guidance on fiscal 2015 diluted EPS to 84 cents-90 cents, well below consensus of 98 cents.

BlackRock reported a 12.3% passive stake in Symmetry Surgical (SSRG -2.45%) .

BlackRock reported a 10.2% passive stake in Orbitz (OWW +0.92%) .

Brown Brothers Harriman reported a 5.05% passive stake in Southwestern Energy (SWN -1.56%) .

Baupost Group reported a 10.01% passive stake in Cheniere Energy (LNG +1.49%) .

Fitch Ratings downgraded Russia’s long-term foreign and local currency Issuer Default Ratings to ‘BBB-‘ from ‘BBB’ with a negative outlook.

Ameriprise Financial reported a 10.6% passive stake in Mattson (MTSN unch) .

Burlington Stores (BURL -1.52%) rose 4% in after-hours trading after it raised guidance on Q4 adjusted EPS to $1.30-$1.32 from $1.25-$1.28, higher than consensus of $1.28, and also raised guidance on full year fiscal 2014 EPS view to $1.70-$1.72 from $1.65-$1.67, better than consensus of $1.68.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

12:40 PM Fed’s Lockhart: Monetary Policy

1:00 PM Results of $24B, 3-Year Note Auction

Notable earnings before today’s open: none

Notable earnings after today’s close: AA, SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 12)”

Leave a Reply

You must be logged in to post a comment.

http://www.advisorperspectives.com/dshort/charts/indicators/INDPRO-log.gif

Manufacturing jobs are below expectations. Be aware of jobs falling particularly manufacturing which is below its current projection.

Energy savings can not be trusted to boost consumer spending. Jobs in shale projection are falling.

Be aware of global demand falling in EU, China and Japan.