Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 2%, and Australia and Malaysia did better than 1%. Indonesia, South Korea, Taiwan and Hong Kong also did well. China dropped 1%. Europe is currently mostly down. Greece and Switzerland are up about 1.6%. Norway (down 1.7%), Stockholm (down 0.9%), Amsterdam (down 0.8%) and London (down 0.6%) are down. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up. Bonds are down.

So what’s going on out there?

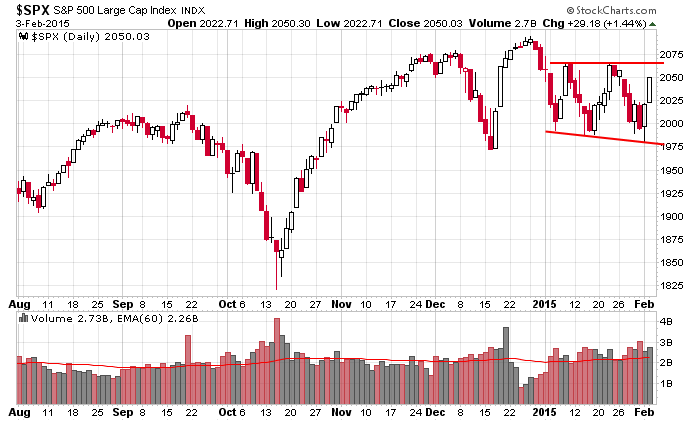

The market took out support on Monday but then quickly reversed and put in two strong up days on above-average volume. Now the S&P 500 is in the upper half of its range that goes back to the beginning of November. The bulls no longer have their backs against the wall. Not only do they have a lot of wiggle room, the odds of the indexes visiting the highs are just as good as them visiting the lows.

Oil has rallied huge the last three days – easily the biggest 3-day move since the top was established last summer. But between after-hours selling yesterday and pre-market selling today, it’s almost 3 bucks off its high. The first move off a low is the easy move – lots of short covering. Given how many market participants were looking for a sub-$40 print, there were no doubt a lot of traders looking the wrong direction the last couple days. Some oil stocks look very good – they bottomed in December – but crude has some proving to do. It takes more than short covering for an uptrend to last.

For now the song remains the same. Rallies get sold, dips get bought. The range remains in place. Resist having a strong opinion here, and no big bets. More after the open.

Stock headlines from barchart.com…

Humana (HUM +1.78%) reported Q4 EPS of $1.09, below consensus of $1.16.

Massachusetts Financial reported a 5.9% passive stake in Franklin Resources (BEN +2.39%) .

FDA approved Pfizer’s (PFE +1.17%) Ibrance drug for postmenopausal women with breast cancer.

Wabash (WNC +6.19%) reported Q4 EPS of 27 cents, highe than consensus of 24 cents.

Silgan Holdings (SLGN +1.27%) reported Q4 adjusted EPS of 58 cents, above consensus of 56 cents.

C.H. Robinson (CHRW +2.44%) reported Q4 EPS of 77 cents, higher than consensus of 76 cents.

Franklin Mutual reported a 5.7% passive stake in Symantec (SYMC +2.13%) , a 5.9% passive stake in Hospira (HSP +0.47%) , and a 5.3% passive stake in CIT Group (CIT +2.90%) .

Arthur J. Gallagher (AJG +1.04%) reported Q4 adjusted EPS of 56 cents, more than consensus of 54 cents.

Disney (DIS +2.36%) rose over 4% in after-hours trading after it reported Q1 EPS of $1.27, much better than consensus of $1.07.

Edwards Lifesciences (EW +1.21%) jumped 4% in after–hours trading after it reported Q4 EPS pf $1.06, better than consensus of 95 cents.

Take-Two (TTWO -0.50%) climbed over 5% in after-hours trading after it reported Q3 EPS of $1.87, well above consensus of $1.52, and hen raised guidance on fiscal 2015 EPS $1.65-$1.75, higher than consensus of $1.38.

Wynn Resorts (WYNN +4.05%) slid 5% in after-hours trading after it reported Q4 adjusted EPS of $1.20, below consensus of $1.43.

Gilead (GILD +0.93%) reported Q4 EPS of $2.43, more than consensus of $2.22, and then announced a 43 cent dividend and a $15 billion share buyback program.

Aflac (AFL +1.58%) reported Q1 operating EPS of $1.29, right on consensus, with Q1 revenue of $5.51 billion, above consensus of $5.48 billion.

Unum Group (UNM +2.94%) reported Q4 adjusted EPS of 90 cents, higher than consensus of 88 cents.

Chipotle (CMG +1.98%) reported Q4 EPS of $3.84, better than consensus of $3.79.

Fiserv (FISV +1.43%) reported Q4 adjusted EPS of 89 cents, right on consensus, although Q4 adjusted revenue of $1.23 billion was below consensus of $1.32 billion.

Macy’s M raised guidance on fiscal 2014 EPS outlook to $4.35-$4.37 from $4.25-$4.35, higher than consensus of $4.35.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:30 Treasury Refunding Quarterly Announcement

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

11:00 Global Composite PMI

11:00 Global Services PMI

Notable earnings before today’s open: ABG, ADP, ARCB, BSX, CKSW, CLX, CTSH, EVR, GM, GWPH, HAIN, HUM, LFUS, LG, LVLT, MOD, MPC, MPLX, MRK, MSI, NJR, RL, SE, SLAB, SMG, SNE, SO, STE, TMHC, WHR

Notable earnings after today’s close: ACXM, ADEP, AFFX, AFOP, ALL, APU, ATML, AWH, BDN, BGC, BKD, BMR, CATM, CBG, CDNS, CEB, CINF, CLW, CMRE, CNW, DATA, ENS, EPM, ESS, EXAR, FBHS, FEIC, FMC, FORM, FOXA, G, GEOS, GIL, GLUU, GMCR, GPRE, HI, HUBG, ININ, IRBT, LCI, LNC, MAA, MAC, MTGE, MTRX, MUSA, NE, NXPI, ORLY, OSUR, PAA, PAGP, PMT, PNNT, PRE, PRU, PSEC, QUIK, RE, RRTS, RXN, SPB, SU, SYA, THG, TTMI, TWO, TYL, UA, UGI, UHAL, WFT, WGL, WSTL, YUM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 4)”

Leave a Reply

You must be logged in to post a comment.

“the odds of the indexes visiting the highs are just as good as them visiting the lows. ”

Agree