Good morning. Happy Friday.

A few Asian/Pacific markets are still closed. Japan and New Zealand moved up today; Australia and India moved down. Europe is currently mixed, but gains and losses are small. France, Italy, Amsterdam and Stockholm are down; Austria, Prague and London are up. Futures in the States point towards a down open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are up. Bonds are up.

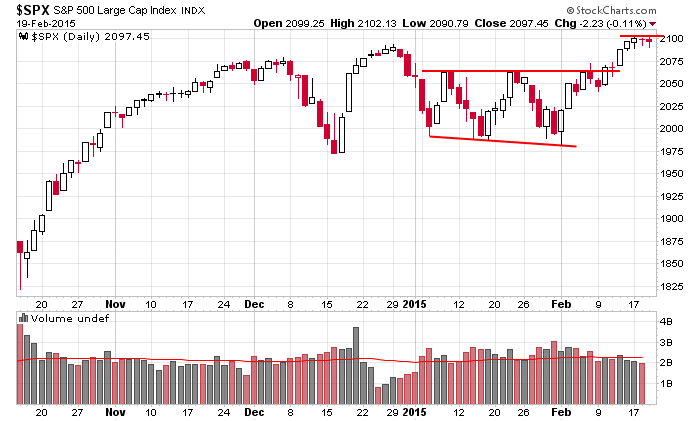

It’s been mostly a quiet week. The market moved up Monday and then followed through Tuesday, but since midday Tuesday, the indexes have mostly traded in a small range. In fact the S&P’s range for the entire week has been less than 13 points. Lately first-hour ranges have been 10 points and weekly ranges have been 50-60 points, so it’s been a very quiet week.

Here’s the S&P 500 . First it broke out from its January range; then it took out its December high, which was the all-time high. Now it’s resting. Nothing wrong here.

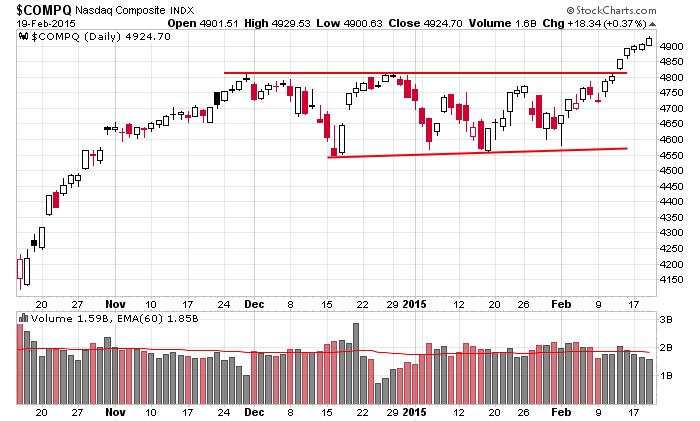

The big star lately has been the Nasdaq. Seven consecutive up days have put the index in new high territory and only about 200 points from its all-time high.

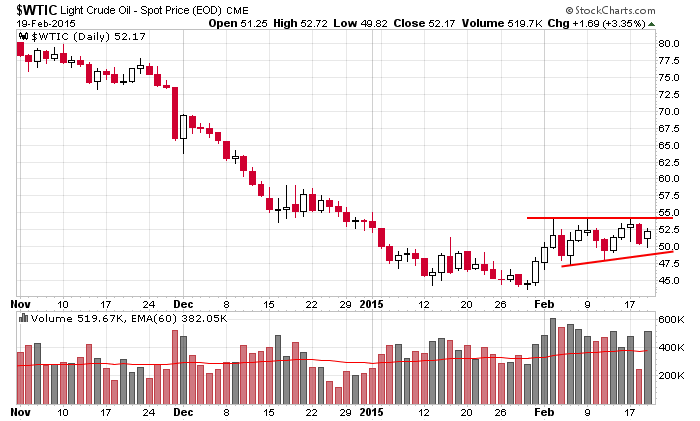

Oil remains the market’s most interesting group. It has the potential to offer us a round of breakouts…or it could fizzle and test its lows. Who knows? From a fundamental standpoint, the oversupply should prevent prices from moving up much, but if too many traders get stacked on one side, a squeeze to the upside is very possible.

Stock headlines from barchart.com…

Deere & Co. (DE -1.12%) reported Q1 EPS of $1.12, higher than consensus of 83 cents.

Laboratory Corp. of America Holdings (LH +0.12%) reported Q4 EPS of $1.44, well below consensus of $1.63.

Iron Mountatin (IRM -1.77%) reported Q4 EPS of 52 cents, below consensus of 55 cents.

Consolidated Edison (ED -0.93%) reported Q4 EPS ex-items of 58 cents, higher than consensus of 55 cents.

Superior Energy (SPN -1.17%) reported Q4 EPS of 48 cents, less than consensus of 49 cents.

Community Health (CYH +1.29%) reported Q4 EPS of $1.12, weaker than consensus of $1.19.

Marvell Technology (MRVL +1.05%) fell nearly 4% in after-hours trading after it reported Q4 EPS of 25 cents, higher than consensus of 24 cents, although Q4 revenue of $857 million was below consensus of $889.88 million.

Keysight Technologies (KEYS +2.22%) reported Q1 adjusted EPS of 56 cents, above consensus of 49 cents.

MRC Global (MRC +0.82%) reported Q4 adjusted EPS of 33 cents, well below consensus of 46 cents.

Newmont Mining (NEM -1.13%) reported Q4 adjusted EPS 17 cents, better than consensus of 10 cents.

Nordstrom (JWN -1.17%) fell 3% in after-hours trading after it reported Q4 EPS of $1.32, less than consensus of $1.35, and then lowered guidance on fiscal 2015 EPS to $3.65-$3.80, well below consensus of $4.11.

Mohawk (MHK +0.58%) gained over 2% in after-hours trading after it reported Q4 EPS ex-charges of $2.27, better than consensus of $2.21.

Brocade (BRCD -0.08%) reported Q1 EPS of 27 cents, higher than consensus of 24 cents.

Intuit (INTU +1.50%) rose nearly 4% in after-hours trading after it reported a Q2 EPS loss of -6 cents, a smaller loss than consensus of -13 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:45 PMI Manufacturing Index Flash

10:00 Atlanta Fed’s Business Inflation Expectations

Notable earnings before today’s open: B, CHH, COG, COMM, DE, ENB, ERF, GOV, HCN, IPGP, IRM, LH, PEG, PNW, SATS, SWC, TC, TFX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 20)”

Leave a Reply

You must be logged in to post a comment.

Never short a dull market but I think it wise to wait for a dip to go long.

sure looks like the todays oex is a major factor…

Slow down in the economy is coming,here now? Holding small caps VB LJT VOOG, global ETFs (VT,NEU). Avoiding bonds for a while. Some plays in the oil sector. sell puts. volume is low. Be nervous, GDP is slipping in home building car sales.

ranges are better today for opts ex

the false break i have been looking for could have been the german dax and its effect on nas 100

wouldnt trust any market longer than a quick daytrade

greece only factored into the market as a good outcome

hope next week more volitile