Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Japan, Australia and South Korea led to the upside; Singapore and India dropped. Europe is currently mostly up. Belgium is up almost 2%; Italy, Amsterdam, Switzerland, Germany and Prague are also doing well. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil is down, copper is down. Gold is down, silver is up. Bonds are up.

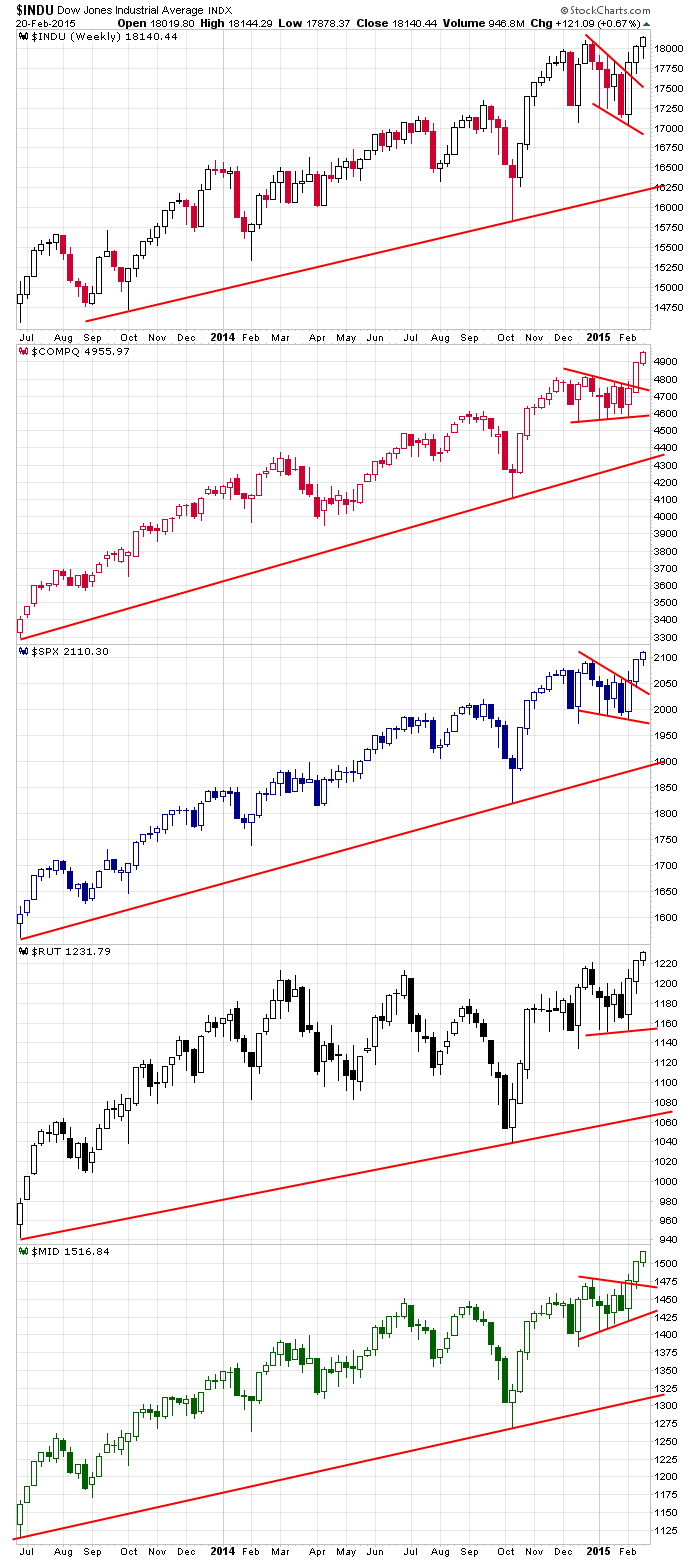

We begin the week with across-the-board new highs in place. Most of the indexes are at their all-time highs. Only the Nas and Nas 100 have a little work to do. Here are the weeklies. Three consecutive up weeks, and I guess if you want to be a pessimist, you’d argue the candles are getting progressively smaller. That alone is not a reason the market “has” to fall. That market seems and feels like it wants to go up, so fighting it would not be wise. A blow-off, parabolic move is certainly possible.

Oil remains a big concern for some and a blessing for others. Oil companies have to deal with low prices…countries that depend on oil revenue have to pump like crazy to pay their debts…shippers make less money…and banks that loan to oil companies are at risk of being on the wrong side of some bad loans. But we as consumers benefit with lower gas prices…and companies benefit too with lower energy prices. In fact no one on the street is going to complain about saving money at the pump, and no one will sympathize with oil companies suffering. Here’s the 15-min oil chart going back 20 days. A move off the low followed by a 2+ week range. Today’s open will be down near $49.

Don’t fight the trend. But don’t get complacent either. More after the open.

Stock headlines from barchart.com…

Precision Castparts (PCP +2.53%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Boeing (BA +2.97%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Raytheon (RTN +0.75%) was upgraded to ‘Buy’ from ‘Neutral’ at Buckingham.

AerCap (AER +1.42%) reported Q4 adjusted EPS of $1.40, higher than consensus of $1.30.

Colgate-Palmolive (CL +0.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

CSX (CSX +0.06%) was initiated with an ‘Overweight’ at JPMorgan Chase with a price target of $41.

Penn National (PENN -1.80%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Honda (HMC +0.42%) announced that Takanobu Ito is stepping down as president and CEO of Honda and Takahiro Hachigo, Honda’s managing officer, will take over as president and CEO in June.

CyberArk (CYBR +9.44%) was downgraded to ‘Underweight’ from ‘Neutral’ at JPMorgan Chase.

LabCorp (LH +3.36%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

Antofagasta (ANFGY +2.00%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

DirecTV (DTV +0.06%) was downgraded to ‘Hold’ from ‘Buy’ at Brean Capital.

Rio Tinto (RIO +0.67%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Exxon Mobil (XOM +0.54%) was awarded a $1.01 billion government contract for aviation turbine fuel.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Chicago Fed National Activity Index

9:45 PMI Services Index Flash

10:00 Existing Home Sales

10:30 Dallas Fed Manufacturing Outlook

Notable earnings before today’s open: AER, AWI, AXL, CIE, CTB, DISH, DNOW, EDR, KOS, PACD, STAG

Notable earnings after today’s close: AGU, ATRC, AXTI, CHGG, DEPO, DK, EIGI, ESRX, FIVN, IVR, KAMN, LNT, NLS, OHI, OKE, OKS, PDLI, QUAD, ROSE, RWT, SF, SNHY, SSW, THC, TRAK, TXRH

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 23)”

Leave a Reply

You must be logged in to post a comment.

“Don’t fight the trend. ”

Agreed on has to think that the market will trade lower than Friday.. Still I don’t think it is worth shorting.