Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up, but gains were not outstanding. Europe is currently mostly down, but losses are not extreme. Futures there in the States suggest a small gap down open – barely noticeable.

Last week was a good one. All the indexes made a new swing high, and many key groups confirmed the move. It’s noteworthy the Nas and semis started to lag late in the week – something to keep an eye on …

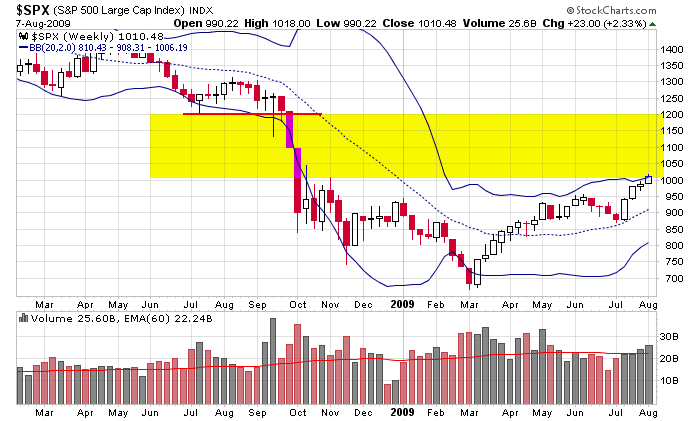

Here’s the SPX weekly. The index closed at its highest level since last October and into its thin trading area. It’s also right at its upper Bollinger Band. I think this is an important level…a level that could produce an hysterical squeeze or some stiff selling.

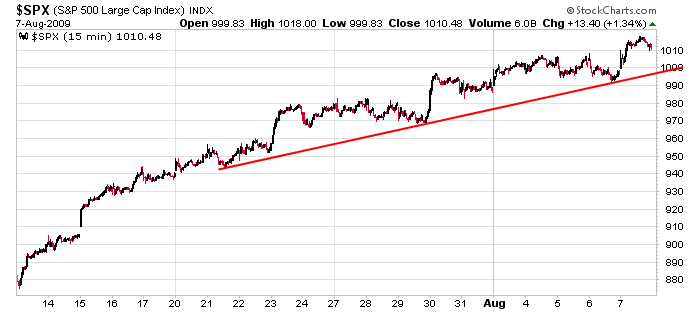

Here’s the 15-min chart. This rally has been as steady as possible. There’ll be some support around 1000 (from the trendline and psychology), and after that there should be many layers of support should the bears decide to press the issue.

The trend is up; there’s no point fighting it. But I remain in a defensive posture.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers