Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. Hong Kong (down 0.9%), Japan (down 0.7%) and China and India (down 0.5%) dropped the most. Europe is posting relatively big losses. Russia is down 2.7%, followed by Austria and Norway (down 1.4%), London (down 1.3%), Italy (down 1.2%) and Stockholm (down 1%). Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil is down, copper is down. Gold and silver are down. Bonds are up.

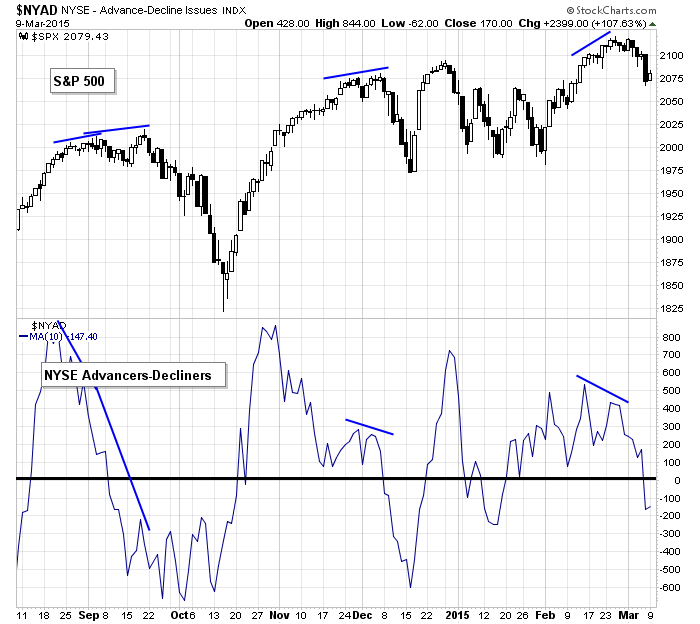

The correction we started anticipating 1-1/2 weeks ago is playing out nicely. Several breadth indicators diverged from the indexes, and now they’re heading straight down. When such happens, you never know if a pullback will start right away, a couple days later or a week later, but you do know the upside is limited in terms of both time and price.

Now prices are falling, and the indicators still have room to move down before being considering over-sold. So far I’d consider the action to be pretty typical. That doesn’t mean I’m holding – it just means what I see is fairly normal price action for a market which is pulling back within an uptrend.

Here’s the S&P 500 vs. the 10-day MA of the NYSE AD line as an example of what I was looking at two weeks ago.

If you can go short, go for it. If not, that’s fine. Be patient. You’ll get some good charts to trade in the next week or two…or who knows, maybe a little longer. Whatever you do, don’t force your trading style on a market that has changed. That’s death for any trader – to trade in a vacuum without recognition of context. More after the open.

Stock headlines from barchart.com…

Peabody Coal (BTU -0.78%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

AutoZone (AZO +0.88%) was upgraded to ‘Buy’ from ‘Hold’ at Argus.

NVIDIA (NVDA +0.27%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Hewlett-Packard (HPQ -0.69%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Qihoo 360 (QIHU -1.88%) reported Q4 adjusted EPS of 75 cents, better than consensus of 71 cents.

Skyworks (SWKS +1.50%) will replace PetSmart (PETM +0.06%) in the S&P 500 as of the close of trading on Wednesday.

Mindray Medical (MR -1.90%) reported Q4 non-GAAP EPS of 49 cents, less than consensus of 52 cents.

Guggenheim Partners reported a 10.9% stake in Merge Healthcare (MRGE -9.19%).

Illumina (ILMN -0.04%) was initiated with a ‘Buy’ at UBS with a price target of $240.

OrbiMed reported a 13.57% passive stake in Synergy Pharmaceuticals (SGYP +2.57%).

Titan Machinery (TITN -5.90%) slid over 8% in after-hours trading after it reported preliminary a Q4 ex-items EPS loss of -18 cents to -23 cents, well below consensus of 9 cents. The company also said it will reduce its workforce by 14%.

United Natural Foods (UNFI +2.18%) reported Q2 adjusted EPS of 65 cents, below consensus of 67 cents, and then lowered guidance on fiscal 2015 revenue to $8.19 billion-$8.29 billion, less than consensus of $8.33 billion.

Casey’s General Stores (CASY +3.72%) reported Q3 EPS of $1.01, well above consensus of 82 cents.

Qualcomm (QCOM +1.69%) authorized a repurchase of $15 billion in common stock.

Urban Outfitters (URBN +1.59%) reported Q4 EPS of 60 cents, better than consensus of 58 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

9:00 NFIB Small Business Optimism Index

10:00 Job Openings and Labor Turnover Survey

10:00 Wholesale Trade

1:00 PM Results of $24B, 3-Year Note Auction

Notable earnings before today’s open: BKS, BPI, JW.A, LINC, LMIA, MVIS, SUP, TCPC, YORW

Notable earnings after today’s close: EOX, FCEL, HABT, HRZN, HTHT, MPO, NCS, ONTY, PAY, SINA, SUPN, SURG, TCRD, WB, ZGNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 10)”

Leave a Reply

You must be logged in to post a comment.

Short is out of the barn. For now. I covered mine in the Premarket. If your a day trader I think we will recover from this gap down. If so short again. If you have a lot of guts go long on the open just don’t plan on a long trade.

My models telling me.

http://www.advisorperspectives.com/dshort/charts/index.html?employment/AHETPI-3MA-pch.gif

WAges to working people are at about the lowest point in history. The Debt/GDP ratio is 100%. Is it not feasible to fear for the currency and the credit in the US? Yes, Maybe 10% in a portfolio is not unreasonable as an investment.

I meant 10% gold, not yet, but soon. In the mean while may short some bonds. Are you sure this is spring?