Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China, Hong Kong and South Korea rallied better than 1%. Europe is currently mostly up. Norway and Germany are up more than 1%. Belgium, Amsterdam and Switzerland are also doing well. Futures here in the States point towards an up open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is up. Crude is down, copper is up. Gold and silver are up. Bonds are up.

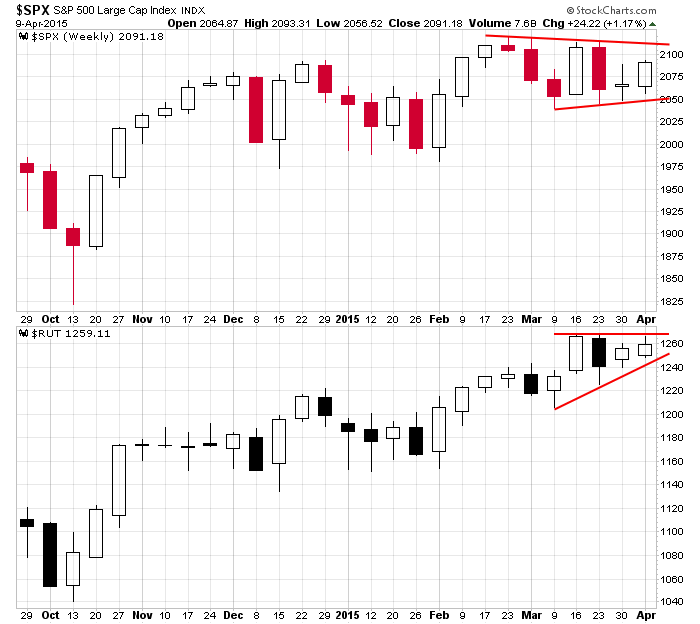

Last day of the week. As of now we have across-the-board gains from the indexes, and I’m seeing some improvement from the breadth indicators. Here are the weekly S&P and RUT charts. Overall there is nothing wrong with these charts. Both are consolidating within uptrends. Day to day and week to week it can be frustrating to trend traders, but the overall health of the market remains in place.

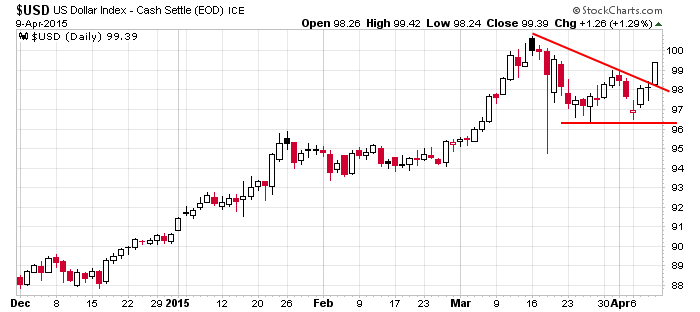

Oil has improved a bunch the last month, but the landscape won’t be any easier going forward if the dollar is going to leg up from this pattern. The dollar has been strong for a while and in all likelihood is not close to finishing its eventual overall move.

Overall I like the market. Play the best stocks from the best groups, and until the market breaks out, be content with small wins.

Trade in the direction of the trend (up)…focus on the groups and stocks that are doing the best…cut losses…when appropriate, add to winners. Oh and one more. Chill. Don’t make this harder than it inherently is.

Stock headlines from barchart.com…

GE (GE +2.88%), in a bid to boost profitability, confirmed a deal to sell $26.5 billion of real estate, authorized a new $50 billion stock buyback plan, and will work to terminate GE Capital’s designation as a Systemically Important Financial Institution (SIFI).

Netflix (NFLX -0.42%) was upgraded to Buy from Neutral at Citigroup after the recent pullback and the target was raised to $525 from $409.

GM (GM +0.50%) was adding to Citigroup’s Focus List as the analyst says the recent 6% decline provides a buying opportunity.

Ruby Tuesday (RT -1.23%) reported Q3 EPS of -1 cent, which was better than expectations of -4 cents.

Deutsche Bank (DB -0.79%) is close to a deal in its LIBOR case, according to the NY Times.

Worldwide PC shipments declined by -6.7% in Q1 to 68.5 million units, according to IDC.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:00 Fed’s Lacker: U.S. Economic Outlook

8:30 Import/Export Prices

2:00 PM Treasury Budget

Notable earnings before today’s open: DCO

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 10)”

Leave a Reply

You must be logged in to post a comment.

shorter term the charts do not look that good and today could be a little faults break high

most turns have a doji somewhere and on the weekly above it become overwellming,magnificent impressive

compelling

Interestingly, the VIX has penetrated the weekly equilibrium support level of 14.25 and the next area of support would be 11.65 low point and likely to trade within that range from here on out, not unless some unexpected event unfolds. Ironically, the American stock market is the world’s worst this year. The SP500 is up just 1.6% through Thursday’s close, making the worst among major market indices for 2015.

In Asia, India’s BSE Sensex is up 5 percent, Japan’s Nikkei (CBOE: .NKXQ) is up 14 percent, and Hong Kong’s Hang Seng (Hong Kong Stock Exchange: .HSI) is also up 14 percent.

In Europe, the UK’s FTSE 100 (FTSE International: .FTSE) is up 6 percent, France’s CAC 40 (Euronext Paris: .FCHI) is up 22 percent, Germany’s DAX (XETRA: .GDAXI) is up 24 percent, and Russia’s RTS (Exchange: .SPRTSTR) is up 27 percent. In fact, the only European indices that are underperforming the US can be found in Romania, Croatia, and Greece.