Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong rallied almost 3%; Japan, China and Indonesia gained more than 1%. India dropped 0.8%. Europe is currently mostly up. Greece is down 3.3%. Russia, Switzerland, Stockholm, Amsterdam, Germany and Austria are doing well. Futures here in the States point towards a relatively big gap up open for the cash market (again).

Thanks for your votes on my public list at stockcharts.com. Keep ’em coming.

The dollar is up. Oil and copper are down. Gold and silver are up. Bonds are up.

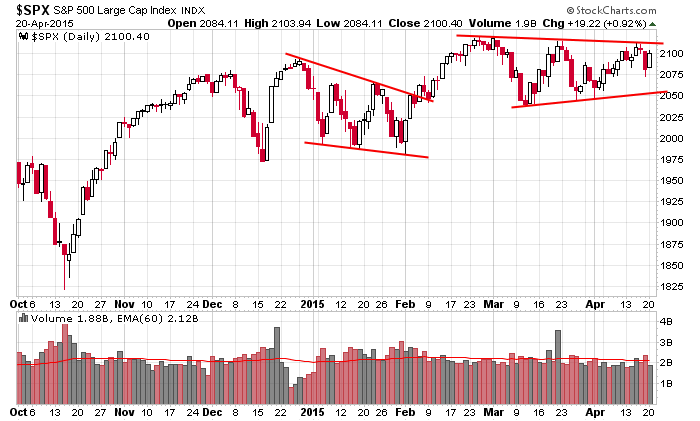

The S&P may once again attempt to breakout today. It moved down big Friday and then recovered most of the losses yesterday. With today’s expected gap up, it’ll open just a couple points below last week’s high. If successful, the index will still have lots of work to do. Besides needing to clear itself from resistance to confirm the breakout (this is always the case), there may be more sellers sitting at the March and February highs.

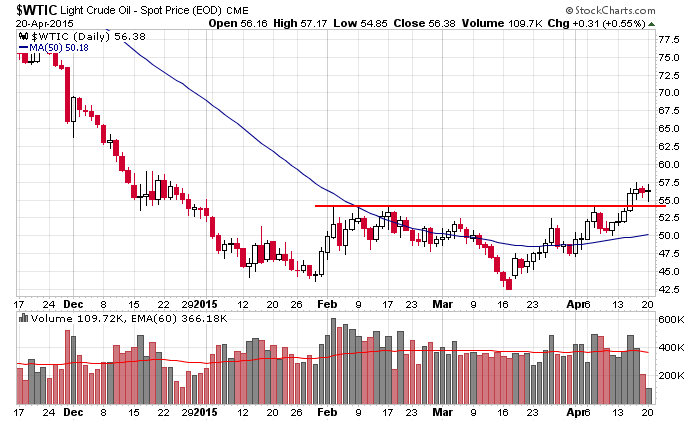

In my opinion, oil remains the market’s most interesting group (yeah I know I sound like a broken record). The group is huge and very liquid. Crude can rally 10-20% from the current level (stocks will move much more) or drop 20% back into its base. Right now I lean to the upside. Here’s the daily chart. It broke out last week and is now resting. Some sideways consolidation would be fine; a drop to the now up-trending 50-day MA would be fine too. This chart could be in the beginning stages of an uptrend. Have a plan. Have a contingency plan.

Stock headlines from barchart.com…

Travelers (TRV +0.70%) reported Q1 EPS of $2.53, above consensus of $2.52.

United Technologies (UTX +1.22%) reported Q1 EPS of $1.51, higher than conensus of $1.46.

Kimberly-Clark (KMB +0.54%) reported Q1 EPS of $1.42, better than consensus of $1.33.

Under Armour (UA +3.08%) reported Q1 EPS of 7 cents, stronger than consensus of 5 cents.

Harley-Davidson (HOG +1.93%) reported Q1 EPS of $1.27, better than consensus of $1.24.

Steel Dynamics (STLD +2.15%) reported Q1 adjusted EPS of 17 cents, above consensus of 15 cents.

Luxor Capital reported a 5% passive stake in GrubHub (GRUB +0.55%) .

Packaging Corp. (PKG +0.34%) reported Q1 adjusted EPS of $1.01, below consensus of $1.08.

Coach (COH +0.33%) was initiated with a ‘Sell’ and a $32 price target at Cantor.

Sanmina (SANM +0.95%) fell nearly 10% in after-hours tradign after it lowered guidance on fiscal Q3 EPS to 48 cents-52 cents, below consensus of 56 cents, and said it sees Q3 revenue of $1.5 billion-$1.55 billion, below consensus of $1.64 billion.

Bed Bath & Beyond (BBBY +1.19%) was initiated with a ‘Buy’ at Cantor with a price target of $83.

IDEX Corp. (IEX +1.55%) reported Q1 EPS of 84 cents, above consensus of 83 cents.

Dollar Tree (DLTR +0.72%) was initiated with a ‘Buy’ at Cantor with a price target of $96.

Lam Research (LRCX +1.88%) jumped nearly 10% in after-hours trading after it reported Q3 EPS of $1.40, higher than consensus of $1.30.

International Business Machines (IBM +3.42%) reported Q1 EPS of $2.91, better than consensus of $2.82.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

Notable earnings before today’s open: ABG, ACI, AMTD, ARMH, ATI, BHI, CLS, CP, CS, DD, DOV, EAT, EDU, FITB, GCI, GPC, HOG, ITW, JAKK, KMB, KSU, LECO, LMT, LPT, MAN, MLNX, MTG, NTRS, NVR, OMC, PCAR, PNR, RF, SAH, SAP, SBNY, SNV, TCB, TRV, TTS, UA, UTX, VZ, WIT

Notable earnings after today’s close: ACE, ADTN, AMGN, BRCM, CAMP, CMG, CREE, DFS, DLB, EWBC, FTI, FULT, HTS, IBKR, ILMN, INFN, IRBT, ISRG, MANH, NBR, PFPT, SMCI, SYK, URI, VASC, VMW, YHOO, YUM, ZIXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 21)”

Leave a Reply

You must be logged in to post a comment.

“The S&P may once again attempt to breakout today.” Agree but it may also hit resistance and begin a down leg. I am waiting for this one to play out.