Good morning. Happy Friday.

Most of the Asian/Pacific markets were closed today. Malaysia dropped 1.3%; the others (Japan, Australia, New Zealand) posted small gains. London posted a small gain; the rest of Europe was closed. Futures here in the States point towards an up open for the cash market.

List of ETFs –> here

The dollar is up a small amount. Oil is down, copper is up. Gold and silver are down. Bonds are down.

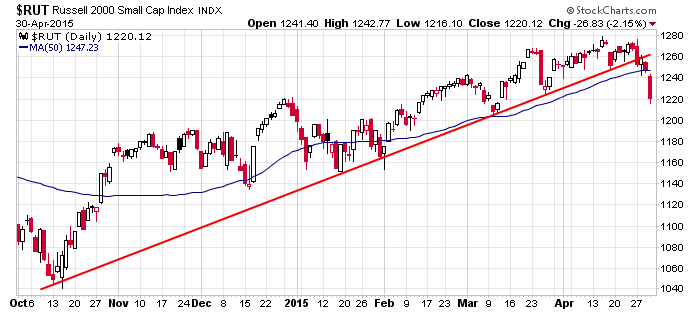

The market got crushed yesterday. Here’s the daily Russell chart. It broke a trendline that went back to the October low, and it has penetrated its 50-day by the greatest amount in six months.

Twitter and Yelp have already taken big post-earnings hits. Today LinkedIn will join the party and drop 20% at today’s open. What’s going on with Web 2.0? Web 1.0 (AMZN, NFLX, EBAY) are doing okay.

Several other groups have turned down recently. Health care plans, biotech, aerospace & defense, retail – these groups had done great for a long time but their uptrends are not over. It forces us to ask the question: If the market is going to move up, what groups are going to take a leadership role? Coal? Industrial metals? Nonferrous metals? These groups have done well lately, but they are hardly the types of groups capable of leading the market up.

Here’s a chart from Chart of the Day that shows the gains during November-April (blue line) significantly out-performs the May-October period (green).

Overall the trend remains up, but in the near term I don’t trust this market. More after the open.

Stock headlines from barchart.com…

AON Plc (AON -1.69%) reported Q1 EPS of $1.37, better than consensus of $1.28.

Leggett & Platt (LEG -1.76%) reported Q1 EPS of 50 cents, above consensus of 46 cents.

Enbridge Energy (EEP -2.21%) reported Q1 EPS of 26 cents, higher than consensus of 22 cents.

YRC Worldwide (YRCW -2.07%) reported a Q1 EPS loss of -70 cents, a bigger loss than consensus of -49 cents.

Baidu (BIDU -8.55%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Fluor (FLR -1.36%) reported Q1 EPS of 96 cents, below consensus of 98 cents.

Bloomberg reported that Monsanto (MON -0.90%) approached Syngenta (SYT -3.36%) regarding a takeover.

AIG (AIG -0.64%) reported Q1 EPS of $1.22, higher than consensus of $1.19.

Reuters reports that Intel talked about offering $58 per share for Altera (ALTR +2.36%) .

Expedia (EXPE -2.11%) climbed over 6% in after-hours trading after it unexpectedly reported a Q1 adjusted EPS loss of -3 cents, below consensus of a 9 cent profit, although Q1 revenue of $1.37 billion was above consensus of $1.35 billion.

Fortune Brands (FBHS -2.73%) reported Q1 EPS ex-items of 28 cents, weaker than consensus of 32 cents.

Visa (V -1.92%) reported Q2 EPS of 63 cents, above consensus of 62 cents.

Western Union (WU -0.54%) reported Q1 EPS of 39 cents, better than consensus of 38 cents.

Century Aluminum (CENX -1.60%) reported Q1 EPS of 76 cents, higher than consensus of 63 cents.

LinkedIn (LNKD -1.95%) plunged over 20% in after-hours trading after it reported Q1 EPS of 57 cents, better than consensus of 56 cents, but then lowered guidance on fiscal 2015 EPS to $1.90, well below consensus of $3.03.

Columbia Sportswear (COLM -1.55%) reported Q1 EPS of 37 cents, above consensus of 36 cents.

Gilead (GILD -1.77%) is up over 2% in pre-market trading after it reported Q1 adjusted EPS of $2.94, well above consensus of $2.32.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:00 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: AON, AXL, BCO, BERY, BPL, CBM, CBOE, CHTR, CLX, CPN, CTB, CVS, CVX, DUK, FE, GWR, HPY, ITT, KCG, LM, LPNT, MCO, MGI, MNTA, MOG.A, MOSY, MSG, NSP, NTLS, NWL, PEG, PNM, PNW, RUTH, RYAM, TDS, TRP, USM, VFC, WETF, WY, ZEUS

Notable earnings after today’s close: AEC, BRK.B, VNR

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers