Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed with a lean to the upside. China rallied 2.3%, India 1.9% and Hong Kong 1.1%. Europe is currently mostly up. London, France, Belgium, Amsterdam, Italy, Spain and Switzerland are all up 0.9% or better. Futures here in the States point towards an up open for the cash market.

Thanks for your votes on my public list at stockcharts.com. Keep ’em coming.

The dollar is up. Oil is up, copper is down. Gold and silver are up. Bonds are down.

Here are the employment numbers…

unemployment rate: 5.4% (was 5.5% last month)

nonfarm payrolls: +223K (was +126K last month) –

private payrolls:

average workweek: unchanged at 34.5 hours

hourly wages: up 3 cents or 0.1% to $24.87

labor participation rate: up to 62.8% (was 62.7%)

March job gain cut from 126K to 85K

February job gain raised from 264K to 266K

At first glance these seem like decent numbers – not great, just decent. S&P futures jumped about 10 points on the news and continue to climb as of this post.

There’s a belief that good news is bad and bad news is good…that bad employment numbers would result in a longer delay before rates are raised and good numbers would force the Fed to raise rates sooner. But these numbers seem decent on the surface, and the market is jumping.

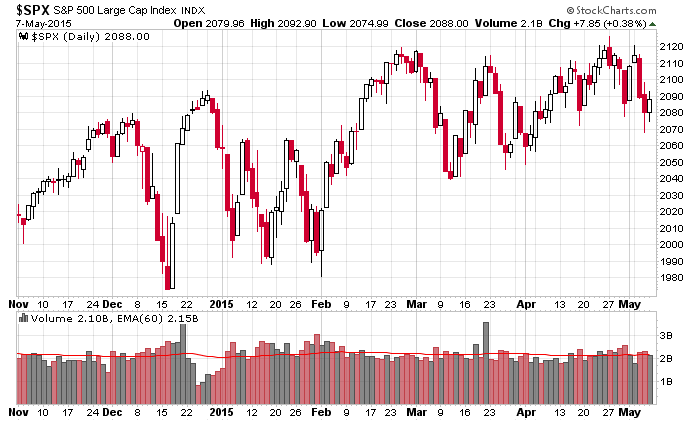

Here’s the S&P daily going back to November – a big sloppy mess, a complete lack of smooth movement. Rallies get sold, dips get bought…lots of gaps…lots of long tails on the candles…lots of overlapping candles…no move lasts long or goes far. Just a mess, and not a fun environment for trend traders.

Don’t over-trade…don’t churn your account. If you trade short term, keep doing your thing. If you’re more a trend trader that likes to hold for a few weeks or longer, pick your spots wisely. More after the open.

Stock headlines from barchart.com…

Ericsson (ERIC +1.56%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch and at UBS.

Biogen (BIIB -0.07%) announced a $5 billion share repurchase program of the company’s common stock.

Sucampo (SCMP -19.71%) rose 3% in after-hours trading after it announced that the FDA has granted Fast Track Designation for its drug cobiprostone that helps in the prevention of oral mucositis.

CST Brands (CST +0.24%) reported Q1 EPS of 20 cents ex-items, weaker than consensus of 23 cents.

Molina Healthcare (MOH -0.19%) reported Q1 adjusted EPS of 71 cents, well above consensus of 49 cents.

NVIDIA (NVDA +1.76%) reported Q1 EPS of 33 cents, better than consensus of 26 cents.

Cerner (CERN +0.56%) reported Q1 EPS of 45 cents, right on consensus, although Q1 revenue of $996.1 million was less than consensus of $1.09 billion.

Sprouts Farmers Markets (SFM -2.74%) reported Q1 adjusted EPS of 25 cents, below consensus of 26 cents, and then lowered guidance on fiscal 2015 adjusted EPS to 84 cents-87 cents, below consensus of 88 cents.

Mohawk (MHK +2.12%) reported Q1 adjusted EPS of $1.70, higher than consensus of $1.60.

Scientific Games (SGMS +4.93%) reported a Q1 EPS loss of -$1.01, a smaller loss than consensus of -$1.26.

Mettler-Toledo ({=MTD reported Q1 adjusted EPS of $2.25, above consensus of $2.17.

Nuance (NUAN -0.26%) reported Q2 non-GAAP EPS of 30 cents, higher than consensus of 24 cents.

Kemper (KMPR -0.47%) repored Q1 EPS of 42 cents, well below consensus of 57 cents.

CA Technologies (CA -0.16%) lowered guidance on fiscal 2016 EPS to $2.38-$2.45, below consensus of $2.47, and said it sees fiscal 2016 revenue of $3.95 billion-$3.99 billion, below consensus of $4.18 billion.

CBS (CBS +0.16%) reported Q1 EPS of 78 cents, better than consensus of 75 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Gallup US Payroll to Population

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

3:00 PM Consumer Credit

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAON, ACHN, ACRE, AEE, AGIO, AKRX, ALE, ALU, AMRC, APA, APO, ARCP, ARIA, AXAS, BABA, BDBD, BDX, CBB, CCC, CCOI, CDW, CECE, CHD, CNK, CNQ, CNSL, CONE, COT, COTY, CRIS, CSIQ, DFT, DNOW, DWRE, ENZY, FIG, FSYS, GLP, GOGO, GOLD, GSM, HII, HILL, HL, HPT, INSY, INXN, IRC, IT, KATE, LEAF, LIOX, LPI, LQDT, LXP, MFC, MGA, MITL, MMS, MPEL, MPW, MT, MWW, MZOR, NCLH, NICE, NJR, NRP, NXST, OGE, ONE, OWW, PCLN, PDCE, PGEM, PMC, PPL, PRFT, RDEN, REGN, RESI, REV, RFP, RGEN, RICE, RRD, RSTI, RWLK, SATS, SEAS, SFY, SNAK, SNI, SPH, SRPT, SSTK, STE, SUNE, TA, TAP, TDC, THS, TIME, TLM, TLP, TU, USAC, VC, VTG, WAC, WIN, WPG, WPP, WRES

Notable earnings after today’s close: ABTL, ACAD, ACET, ADVS, AGO, AHS, AHT, AIRM, AL, ALIM, ALJ, ALNY, ALSK, AMBR, AMH, ASYS, AVNW, BCEI, BEBE, BIOS, BKD, CA, CBS, CDXS, CERN, CNAT, CORT, CROX, CUTR, CYBR, DATA, DIOD, DXPE, EBS, ECPG, ECYT, ED, EGY, ENOC, ENV, ERII, ESPR, EVC, EZPW, FLDM, FRT, FTD, FUEL, GALE, GDOT, GEOS, GST, GXP, HTGC, IMPV, INWK, JAZZ, JCOM, JMBA, KEYW, KTOS, LBTYA, MAIN, MCHP, MDRX, MDVN, MED, MHK, MNST, MOH, MTD, MTRX, NGVC, NHI, NOG, NUAN, NVAX, NVDA, OLED, OMED, OUTR, PCTY, PETX, PLNR, POST, PRO, PSIX, RBA, RBCN, RIGL, RJET, RMAX, RMTI, RPTP, RRMS, SAAS, SEMG, SFM, SGMS, SLW, SPPI, SRC, SREV, SSNI, STMP, SWIR, TCX, TEAR, TGI, THOR, TLLP, TNGO, TPC, TRMR, TRUE, TWOU, UBNT, UEPS, WAIR, WIFI, XOMA, XOXO, YUME, ZNGA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers