Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. China dropped an incredible 7.4%; Hong Kong, Australia and Singapore dropped more than 0.9%. There were no big winners. Europe is currently mixed, and there are no big movers. The UK, Poland and Switzerland are down the most; France, Hungary, Spain and Russia are up the most. Futures here in the States point towards a small up open for the cash market.

Leavitt Brothers video overview

The dollar is flat. Oil is down, copper is up. Gold and silver are down. Bonds are down.

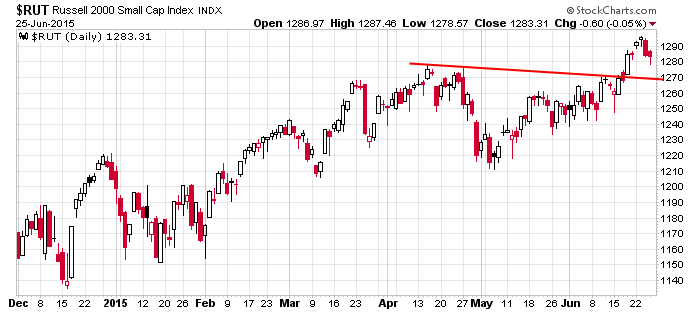

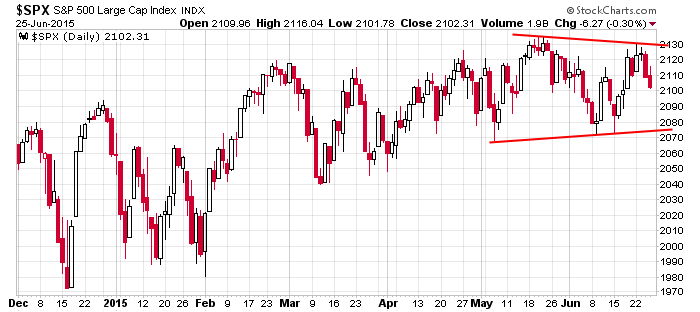

Tale of two markets right now. The Russell small caps have broken out and are now doing some backing and filling. The S&P 500 large caps have put in a lower high and are unchanged since late-February. Here are both charts.

Yesterday I said oil was one of the most interesting groups because it was getting squeezed by resistance at $62 and support at its 50-day MA. Today crude is set to open right at the moving average. Small penetrations are fine, but given how its held all month, I’m sure a few stops will be triggered. Next support level is $56 – not a big move down, just a couple points and enough to cause some damage among oil stocks.

Bias is neutral right now. The index charts are mixed. Charts of individual stocks are so-so. Most indicators are pointing down. If you trade the easy and obvious ones that jump off the screen at you, there isn’t much to do right now. More after the open.

Stock headlines from barchart.com…

UnitedHealth (UNH +2.65%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee CRT.

Target (TGT +0.19%) was downgraded to ‘Market Perform’ from ‘Outperform’ at BMO Capital.

Jefferies lowered its Street-high estimates for Intel (INTC +0.25%) after Micron noted weaker near-term PC trends during its May quarter earnings report.

Restoration Hardware (RH -0.39%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T.

Community Health (CYH +12.97%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Cal-Maine Foods (CALM -0.13%) was initiated with a ‘Buy’ at DA Davidson with a price target of $65.

Facebook (FB -0.99%) was initiated with a ‘Buy’ at Mizuho with a price target of $104.

Yahoo (YHOO +0.29%) was initiated with a ‘Buy’ at Mizuho with a price target of $51.

Electronic Arts (EA -0.34%) was initiated with a ‘Buy’ at Mizuho with a price target of $75.

Amazon.com (AMZN -0.17%) was initiated with a ‘Buy’ at Mizuho with a price target of $498.

Activision Blizzard (ATVI -0.16%) was initiated with a ‘Buy’ at Mizuho with a price target of $29.

Glenview Capital Management reported a 7.24% passive stake in Manpower (MAN +0.82%) .

Nike (NKE -0.94%) gained 3% in after-hours trading after it reported Q4 EPS of 98 cents, well above consensus of 83 cents.

SYNNEX (SNX -1.12%) reported Q2 EPS of $1.55, better than consensus of $1.53, although Q2 revenue of $3.25 billion was less than consensus of $3.42 billion.

Micron (MU -0.17%) tumbled 13% in after-hours trading after it reported Q3 EPS of 54 cents, less than consensus of 56 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: FINL

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers