Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across-the-board. China rallied better than 5%, and Hong Kong and Singapore moved up more than 1%. Japan, Australia, India, Indonesia, Malaysia, South Korea and Taiwan also did well. Europe is currently mixed and little changed. London, Germany, France, Finland and Norway are down; Poland, Spain and Italy are up. Futures here in the States point towards a moderate gap up open for the cash market.

Leavitt Brothers video overview

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are down.

The market got spanked yesterday. There’s no way to sugar-coat it. It was a good, old-fashioned bloodbath. Nowhere to run, nowhere to hide. Everything closed down.

The internals had already told us the path of least resistance was down, so worst case scenario is you had a small amount of long exposure which could have been squared off at yesterday’s open.

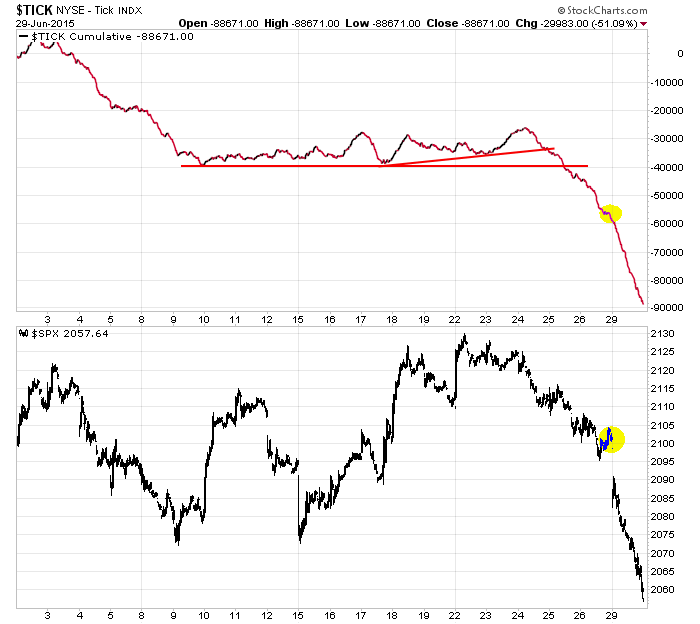

One of those internals was the cumulative TICK (chart below). Over the previous month, the S&P was flat, but the cumulative TICK had broken down and was trading at a new low. If the market gaps up and then slowly grinds down all day, the market may close flat while the TICK closes with a sizable loss. I value what takes place during regular trading hours much more than what takes place overnight (which results in a gap), so when there’s a discrepancy, I play close attention.

Yesterday was all about Greece and the possible domino effect that could take place if Greece was voted out of the euro. Don’t get too convinced the market is going to crash. You never know when a white knight (Russia, China) will step in.

Stock headlines from barchart.com…

Qualcomm (QCOM -0.90%) was downgraded to ‘Sell’ from ‘Hold’ at Drexel Hamilton.

JPMorgan Chase (JPM +0.44%) downgraded to Perform from Outperform at Oppenheimer.

Ternium (TX -1.08%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Tesla shares (TSLA -0.63%) have ‘substantially’ more upside, says Credit Suisse.

Synaptics (SYNA -3.90%) was upgraded to ‘Outperform’ from ‘Perform’ at Oppenheimer.

Chesapeake (CHK +0.45%) was upgraded to ‘Buy’ from ‘Underperform’ at Sterne Agee CRT.

Ryder (R -0.67%) and Old Dominion (ODFL -0.23%) were both upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Macy’s(M +0.98%) was downgraded to ‘Sell’ from ‘Buy’ at Deutsche Bank.

LifePoint (LPNT +0.59%) was upgraded to ‘Buy’ from ‘Neutral’ at Mizuho.

LinkedIn (LNKD -0.90%) filed to sell 3.57 million shares of Class A common stock for holders.

First Light Asset reported a 5.16% passive stake in Streamline Health (STRM +6.93%) .

J.B. Hunt (JBHT -0.12%) will replace Integrys Energy (TEG +0.70%) in the S&P 500 as of the close of trading on Tuesday, June 30.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

9:45 Chicago PMI

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

Notable earnings before today’s open: CAG, OMN, SCHN

Notable earnings after today’s close: AVAV, CAMP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers