Good morning. Happy Wednesday.

The Asian/Pacific markets lean to the upside. China fell 3%, but Singapore, Australia, Indonesia, New Zealand and South Korea did well. Europe currently leans to the upside, but there aren’t any big winners. Italy, Denmark, Prague, Norway and Belgium are up; Sweden and Russia are down. Futures here in the States point towards a flat-to-up open for the cash market.

My public list at stockcharts.com has been updated with a new format. Check it out.

The dollar is up slightly. Oil is down, copper is up. Gold is flat, silver is down. Bonds are up.

The S&P has posted four consecutive gains for the first time since January and is now about 65 points off last week’s low. The tide turns quickly. Yes there have been lots of ups and downs this year, but the character of the movement is that reversals happen quickly and suddenly and if you wait for all your signals to line up, you miss it. In fact by the time all your signals line up, it’s too late, the market is already at the other extreme.

Janet Yellen speaks today before Congress. She’ll deliver prepared remarks and then field questions. Be aware. Given how sensitive the market is to news headlines, it’s entirely possible we get some abnormal movement.

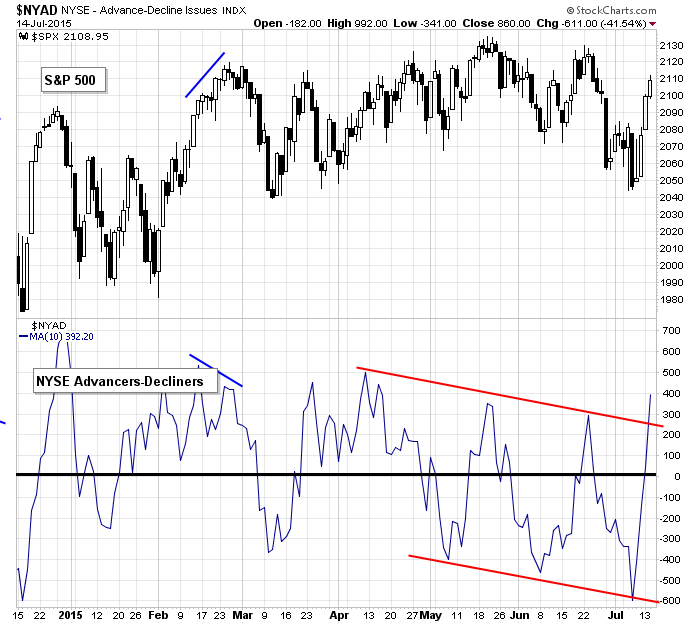

Over the weekend and then again in the video I sent out Monday I stated the path of least resistance was up and my bias was to the upside. I highlighted several indicators that were supportive of a rally – at least in the near term – and also laid out criteria that would support a continuation of the rally. For example, the 10-day of the AD line needed to break out of its down-sloping channel, take out its two previous highs and print a relatively high number. So far, so good. The AD line has done very well, and if it continues, the stage will be set for the market to not only rally to a new high, but to build on it.

Be open-minded. Be flexible. More after the open.

Stock headlines from barchart.com…

Bank of America (BAC +0.65%) reported Q2 EPS of 45 cents, better than consensus of 36 cents.

BlackRock (BLK -0.44%) reported Q2 EPS of $4.96, higher than consensus of $4.79.

PNC Financial Services Group (PNC +0.59%) reported Q2 EPS of $1.75, less than consensus of $1.76.

Delta Air Lines (DAL +0.67%) reported Q2 EPS of $1.27, above consensus of $1.21.

Eli Lilly (LLY -0.07%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Health Care REIT (HCN -0.48%) was initiated with a ‘Buy’ at SunTrust with a price target of $76.

Seagate (STX +2.87%) was upgraded to ‘Buy’ from ‘Hold’ at Craig-Hallum.

Avis Budget (CAR +0.76%) and Hertz (HTZ +0.71%) were both upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Vodafone (VOD +1.12%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

PayPal (PYPLV +0.41%) will replace Noble Corp. (NE +0.34%) in the S&P 500 as of the close of trading on Friday, July 17.

Celgene (CELG +1.62%) climbed 5% and Receptos (RCPT +5.11%) jumped 10% in after-hours trading after Celgene said it will acquire Receptos for $232 per share in cash, or about $7.2 billion.

Gabelli reported a 5.43% stake in DealerTrack (TRAK -0.11%) .

Yum! Brands (YUM +0.97%) reported Q2 adjusted EPS of 69 cents, better than consensus of 63 cents, although it reported its Q2 China Division same-store-sales were down 10%.

CSX (CSX +0.53%) reported Q2 EPS of 56 cents, higher than consensus of 53 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Producer Price Index

8:30 Empire State Mfg Survey

9:15 Industrial Production

9:15 Yellen delivers semi-annual monetary policy

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

12:25 PM Fed’s Loretta: Economic Outlook

2:00 PM Fed’s Beige Book

3:00 PM Fed’s Williams: Economic Outlook

Notable earnings before today’s open: ASML, BAC, BLK, DAL, PNC, USB

Notable earnings after today’s close: CNS, EWBC, INTC, KMI, NFLX, UMPQ, WTFC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers