Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board. Indonesia fell more than 3%, Hong Kong and Singapore more than 2%, Japan, China, Australia, India, Malaysia, New Zealand and Taiwan more than 1%. Europe is also extremely weak. Belgium is down more than 3%, Germany, France, Netherlands, Finland and Italy more than 2%, London, Austria, Sweden, Switzerland, Greece, Turkey, Denmark and Spain more than 1%. Futures here in the States point towards a relatively big gap down for the cash market.

VIDEO overview of the Leavitt Brothers service…here

The dollar is down. Oil is up, copper is flat. Gold and silver are up. Bonds are up.

China has further devalued their currency. The assumption is if they need to do this to make their exports more attractive their economy must not be doing very well. They are genuinely scared. Markets around the world are down a bunch. Will this spark a global currency war – everyone trying to devalue more than the next? I have no idea how that ends. I’m not sure central bankers around the world know either.

What I do know, and what I’ve been saying for weeks, is my bias is to the downside…that the weak internals would cap every attempt to move up…that every rally is shortable until that proves to be unwise…that longs are short term only.

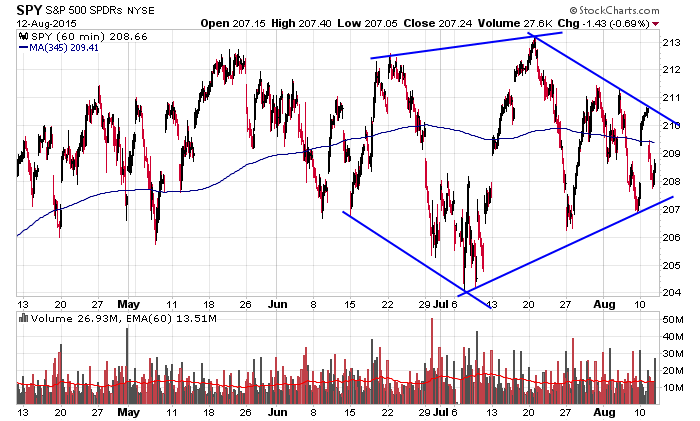

Here’s the 60-min SPY chart. First the range expanded, now it’s contracting. Pressure has been building. The ups and downs have dampened. We used to get a week or two in one direction, then a week or two in the other. Now we’re only get a day or two.

Who will flinch first? You know my answer. My bias remains to the downside. More after the open.

Stock headlines from barchart.com…

Alibaba (BABA -3.89%) slid over 5% in pre-market trading after it reported Q1 EPS of 59 cents, better than consensus of 58 cents, but Q1 revenue of $3.27 billion was below consensus of $3.39 billion.

Aramark (ARMK -0.62%) reported Q3 adjusted EPS of 29 cents, above consensus of 28 cents.

Cash America (CSH -3.26%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee CRT.

L Brands (LB -1.08%) was downgraded to ‘Market Perform’ from ‘Outperform’ at BMO Capital.

Johnson Controls (JCI -3.59%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Tenneco (TEN -2.79%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

Applied Industrial (AIT -0.10%) reported Q4 EPS of 70 cents, below consensus of 73 cents.

The WSJ reports that Credit Suisse (CS -2.09%) and Barclays (BCS -1.42%) are in settlement talks with the SEC and the New York Attorney General over allegations of wrongdoing at their “dark pools.”

CDK Global (CDK -3.23%) rose over 9% in after-hours trading after Bloomberg reported that the company is said to be working with bankers to explore a sale.

CSC (CSC -1.77%) reported Q1 adjusted EPS of $1.11, higher than consensus of $1.01, and then was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Gabelli reported a 6.47% stake in Southwest Gas (SWX +1.27%) .

Viavi (VIAV -5.80%) reported Q4 EPS of 13 cents, better than consensus of 8 cents.

Fossil (FOSL -3.74%) reported Q2 EPS of $1.12, above consensus of 82 cents, and then raised guidance on fiscal 2015 EPS to $6.20-$7.00, well above consensus of $5.57.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 Job Openings and Labor Turnover Survey

10:30 EIA Petroleum Inventories

1:00 PM Results of $24B, 10-Year Note Auction

2:00 PM Treasury Budget

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 12)”

Leave a Reply

You must be logged in to post a comment.

the jaws of death expanding broading pattern is a trend terminial pattern

there is a larger death pattern going back to 1970 also which is complete

indicating the dow and spx have finished a long term bull and are now dead

spx big boy index has been resistive and must hold 2063 support or break 2044

which one will it be

instos pushed the cash futures index down to 2059 earlier to steel the bulls stops

so as they can do a run to the up side

long long ago before high frequency machines instos at open used to try to go for the closing price gap fill

now the machines use it to steel stops on the light opening volume,before daytraders take a possition

the casino goes on

this has been a loverly short on the china devalue

look at the german dax for the last 2 days

dax also has a effect on nas 100

dax eats apples